At the start of Wednesday's US session, the Consumer Price Index was released. The report was quite mixed. Despite the ongoing rise in inflation, the core index still demonstrates a downtrend. Judging by the market's reaction, traders are perplexed by such results. Most market participants don't understand how to interpret the August figures – in favor of the dollar or against it.

The situation is further complicated by the fact that there is currently a so-called "quiet period" during which Federal Reserve members are not allowed to express their views in public. There are less than 10 days left until the next Fed meeting, so traders are forced to act without hints from the US central bank.

Current price fluctuations reflect how indecisive the bulls and the bears are – contrary to the expectations of many experts, the inflation data did not play a decisive role in determining the direction. Sellers were unable to resume the downtrend, and buyers were unable to organize a significant correction. Although both sides made attempts: initially, the EUR/USD price fell to the 1.07 level, but then reversed and returned to the 1.0750 mark, where it drifted. Everyone lost in the moment – both bears and bulls. However, when it comes to broader timeframes, the winner will be determined by the Fed, which will comment on the latest figures next week.

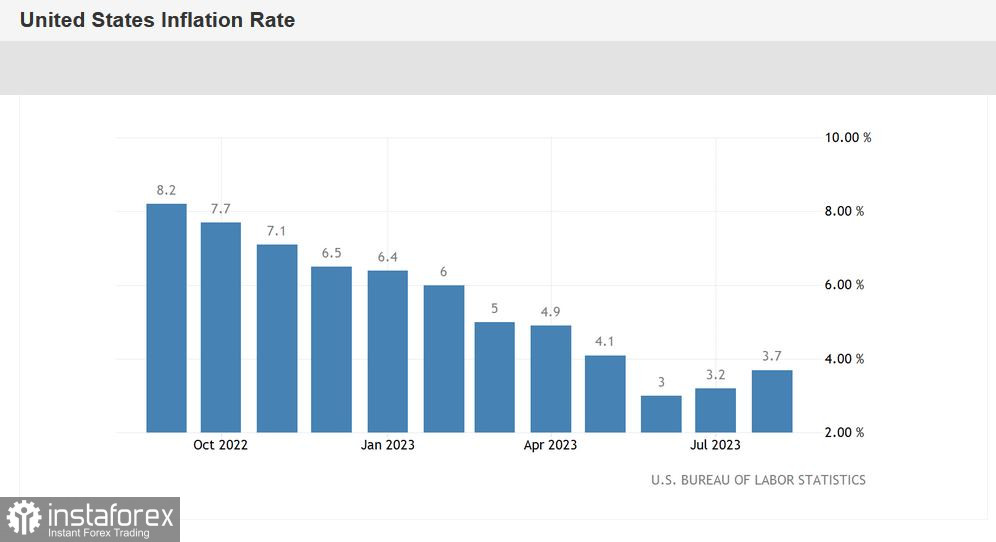

The US CPI, on a yearly basis, rose to 3.7% against expectations of 3.6%. This indicator has been rising for the second consecutive month after a 12-month (!) downward cycle. The monthly reading came in at 0.6%, the highest growth rate since June 2022.

However, the core CPI continues to steadily decline. The annual reading met expectations by easing to 4.3%, the slowest growth rate since October 2021.

The Core CPI figure, which excludes volatile food and energy prices, rose by 4.3% in the same period after a sharper increase (4.9%) in July. The cost of clothing increased by 3.1% (in July, this component rose by 3.2%), used cars decreased in price by 6.6% (after a 5.6% decline in the previous month), new cars became more expensive by 2.9% (3.5%), and the cost of transportation services increased by 10.3% (in July, the growth was 9%).

The largest contribution to the monthly CPI growth came from the gasoline price index, accounting for more than half of the increase. The energy component index increased by 5.6% over the month, as virtually all major energy component indices rose.

Considering recent events in the oil market, it can be assumed that such trends will continue to develop. Oil prices have reached a 10-month high due to supply cuts. Brent crude oil reached $92 a barrel for the first time since November 2022. US WTI crude oil also increased, hitting $89.05 per barrel. As you may know, Saudi Arabia and Russia extended their decision to cut supplies last week, totaling 1.3 million barrels per day. Adding to the oil price surge this week, Libya closed 4 eastern oil export terminals due to severe weather and flooding.

Therefore, the US CPI left more questions than answers, especially in the context of the Fed's reaction. On one hand, inflation has been accelerating for the second consecutive month. More than half of the monthly increase in the CPI was driven by a spike in gasoline prices. Given the ongoing rise in the oil market, this suggests that this indicator will continue to rise. On the other hand, the core index on an annual basis hit a multi-month low, dropping to 4.3%. Judging by the EUR/USD dynamics, traders have not formed a consolidated opinion on the Fed's possible response to the August CPI.

It is noteworthy that immediately after the release, the probability of a Fed interest rate hike in September dropped from 10% to 3% (according to the CME FedWatch Tool). This means that traders are confident that the central bank will maintain the status quo this month. However, they were already confident in this outcome even before the report. Meanwhile, the probability of a rate hike in November edged down (from 45% to 39%). In general, the situation has not fundamentally changed after the report: the prospects for September remain negligible, while those for November are roughly 50/50.

All of this suggests that EUR/USD traders still need a "hint from the Fed," i.e., an explanation/commentary. The U.S. central bank will act as an arbiter in the current situation: following the September meeting, the Fed will either confirm its intention to maintain a wait-and-see position or hint at a possible rate hike at one of the subsequent meetings (in November or December). Therefore, if the European Central Bank does not present a "hawkish surprise" by unexpectedly raising rates, the EUR/USD pair will likely trade in the same range (between 1.0680 and 1.0800) in the foreseeable future (i.e., until September 20, when the results of the September Fed meeting are announced), awaiting the U.S. central bank's verdict.