In my past two articles, I talked about the British and European data from Tuesday. These reports had a limited impact on both instruments on Wednesday morning, but in the afternoon, movements became much stronger, and market activity increased. This happened because the U.S. released its inflation report for August, and market participants were puzzled by its value. The reaction that everyone saw at the end of the day was not exactly logical. However, there is an explanation for everything.

The Consumer Price Index rose to 3.7% in August from a year earlier, while the most pessimistic forecasts were talking about a rise to 3.6%. Core inflation fell to 4.3% YoY, which generally corresponds to market expectations. The first question is which of these indicators is more important for the market right now? In my opinion, both are important. It's a good thing that core inflation continues to decline. The fact that headline inflation continues to rise is bad. It's a mutual offset, but the demand for the U.S. dollar decreased after the report. Why?

If demand for the dollar is decreasing, it means the market has taken the information negatively. And there can be many explanations for this. Perhaps the market is not that interested in core inflation. Perhaps the market does not believe that the FOMC will raise interest rates next week. Or perhaps sellers were prepared for a decline, but the infamous level of 1.2444 for the British pound prevented both the euro and the pound from falling.

If the market believed in an FOMC rate hike next week (which would be logical given the rise in inflation), the dollar would have risen. If it did not rise, it means that the market doesn't believe in it, and that the current sentiment is not very bearish. I want to remind you that, according to wave analysis, the construction of corrective waves is quite likely for both instruments right now. So, personally, I think it's all about the waves, not the information background and its interpretation. Either the bears are waiting for the outcomes of the European Central Bank, Federal Reserve, and Bank of England meetings, and then they will decide whether to build a corrective wave now or wait for some time, or maybe they were simply not impressed with the latest inflation report, and are not ready to make important decisions based on it.

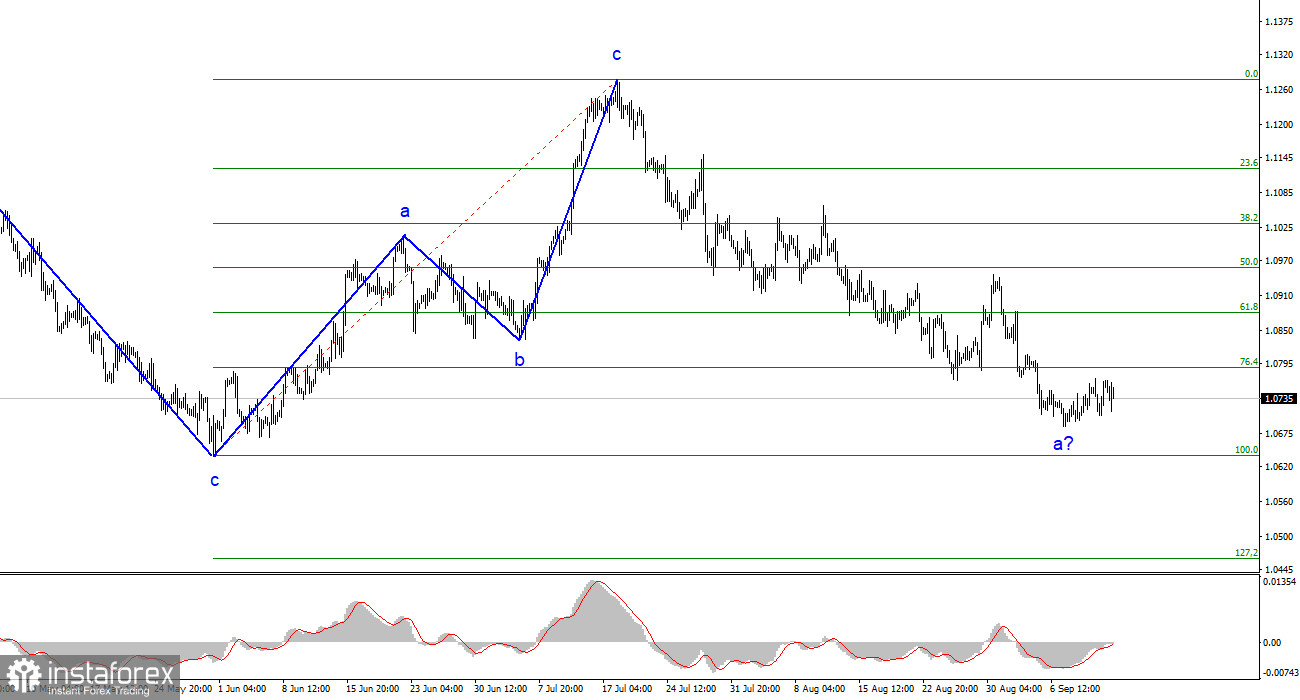

Based on the conducted analysis, I came to the conclusion that the upward wave pattern is complete. I still believe that targets in the 1.0500-1.0600 range are quite feasible. Therefore, I will continue to sell the instrument with targets located near the levels of 1.0636 and 1.0483. A successful attempt to break through the 1.0788 level will indicate the market's readiness to sell further, and then we can expect to reach the targets I've been discussing for several weeks and months.

The wave pattern of the GBP/USD pair suggests a decline within the downtrend. There is a risk of completing the current downward wave if it is d, and not wave 1. In this case, the construction of wave 5 might start from the current marks. But in my opinion, we are currently witnessing the first wave of a new segment. Therefore, the most that we can expect from this is the construction of wave "2" or "b". An unsuccessful attempt to break the 1.2444 level, corresponding to 100.0% on the Fibonacci scale, may indicate the market's readiness to build an upward wave.