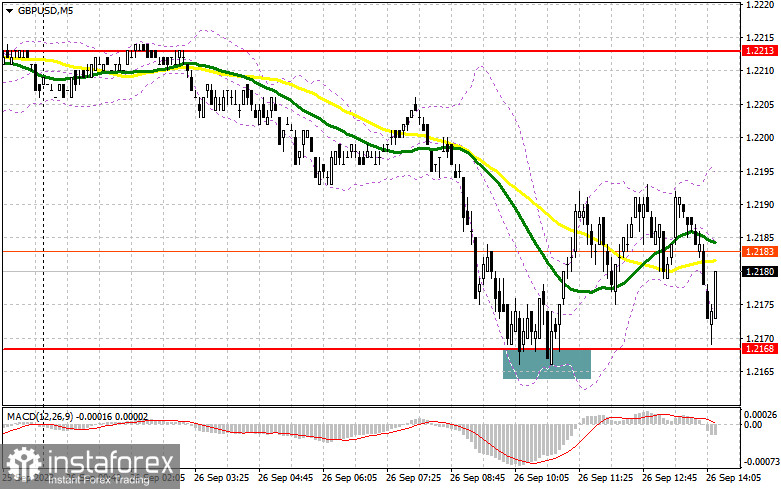

In my morning forecast, I pointed out the level of 1.2168 and recommended making trading decisions based on it. Let's look at the 5-minute chart and analyze what happened there. The decline and the formation of a false breakout around the support level of 1.2168 resulted in a buying signal, which led to a 25-point upward movement in the pair. However, judging by the chart, bulls face challenges with further growth. The technical picture has changed slightly in the second half of the day.

To open long positions on GBP/USD, the following is required:

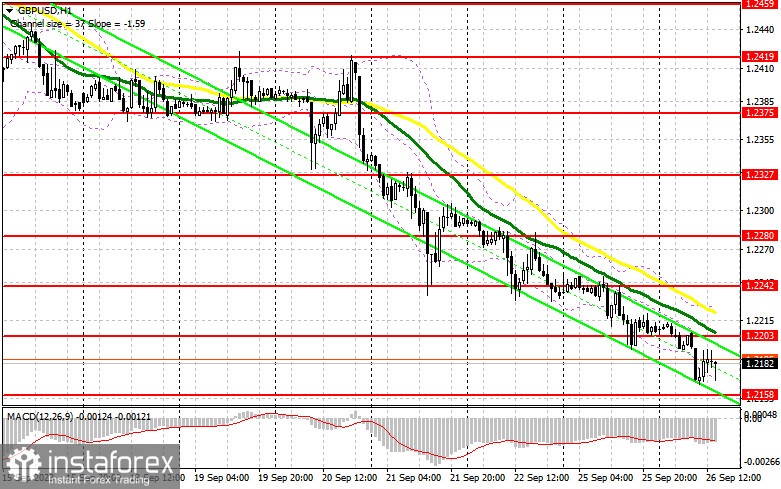

The further direction of the pound depends on the reaction to American statistics. Ahead of us are the Consumer Confidence Index and the volume of home sales in the primary market in the USA. A decrease in these indicators will lead to a surge in the pound. If the data turns out to be better than expected, and FOMC member Michelle Bowman reminds traders of high-interest rates in the USA, pressure on the pair may return. Regarding a decline in the pair, I rely on protecting the new local minimum of 1.2158. The formation of a false breakout at this level will provide an entry point for long positions, anticipating a correction to 1.2203 - a new resistance level where moving averages play on the bearish side. Breaking and settling above 1.2203 will restore buyers' confidence at the beginning of the week, signaling the opening of long positions with an exit at 1.2242, where I expect the presence of larger sellers. The ultimate target will be the area of 1.2280, where I will take profit. In the scenario of a decline to 1.2158 and the absence of activity from buyers in the second half of the day, pressure on the pound will only increase. In this case, only protecting 1.2115 and a false breakout there will signal the opening of long positions. I plan to buy GBP/USD immediately on the bounce from the minimum of 1.2072, with a 30-35 point intraday correction target.

To open short positions on GBP/USD, the following is required:

If GBP/USD rises in the second half of the day, short positions around the new resistance of 1.2203 formed after the first half of the day will be the optimal scenario. In this case, the target will be the new local minimum of 1.2158. Breaking and testing this range from below upwards against strong US data, especially Consumer Confidence, will deal another serious blow to the bullish positions, providing an opportunity for a drop to support at 1.2115. The more distant target remains the area of 1.2072, where I will take profit. Buyers will have an excellent chance to build an upward correction in the scenario of GBP/USD rising during the American session and the absence of activity at 1.2203 in the second half of the day. In this case, I will postpone sales until a false breakout at 1.2242. If there is no downward movement from there, I will sell the pound immediately on the rebound from 1.2280, but only counting on a pair correction down by 30-35 points.

Indicator Signals:

Moving Averages

Trading is conducted below the 30 and 50-day moving averages, indicating further decline in the pair.

Note: The period and prices of the moving averages considered by the author are on the hourly chart (H1) and differ from the general definition of classic daily moving averages on the daily chart (D1).

Bollinger Bands

In case of a decrease, the lower boundary of the indicator, around 1.2160, will serve as support.

Description of Indicators:

• Moving average (determines the current trend by smoothing volatility and noise). Period 50. Marked in yellow on the chart.

• Moving average (determines the current trend by smoothing volatility and noise). Period 30. Marked in green on the chart.

• MACD Indicator (Moving Average Convergence/Divergence) - Fast EMA period 12, Slow EMA period 26, SMA period 9.

• Bollinger Bands - Period 20.

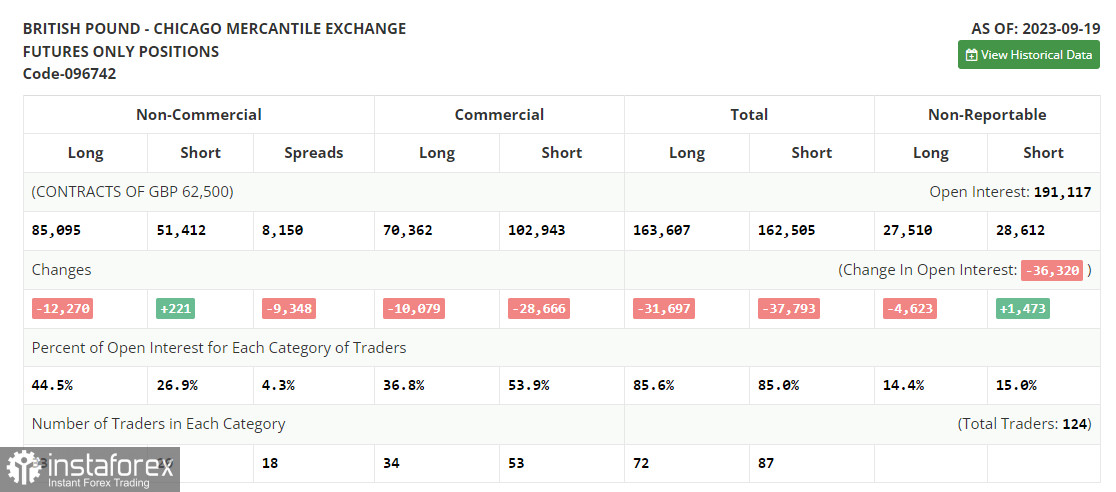

• Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions, using the futures market for speculative purposes and meeting specific requirements.

• Long non-commercial positions represent the total long open positions of non-commercial traders.

• Short non-commercial positions represent the total short open positions of non-commercial traders.

• The net non-commercial position is the difference between non-commercial traders' short and long positions.