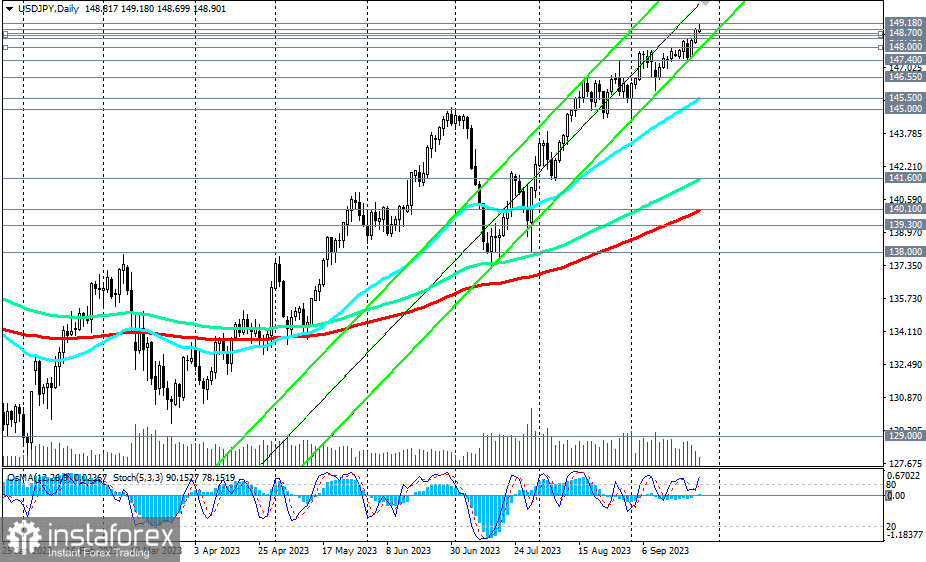

USD/JPY continues to rise. If market participants previously considered the level of 145.00 as the "protective" level at which the Bank of Japan would conduct currency intervention, then at the moment, USD/JPY is trading near the 149.00 mark, managing to update a high at the beginning of the European trading session at 149.18, a level not seen since the end of October. Now, the new assumption among investors is that the Bank of Japan will "protect" the 150.00 level.

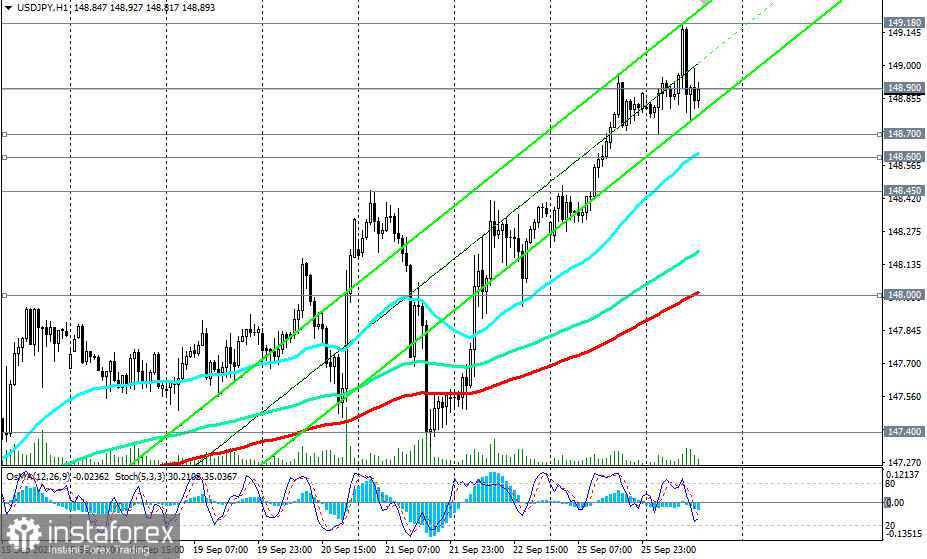

A breakout of today's high at 149.18 could serve as a signal for increasing long positions.

For now, preference remains with long positions. It is not excluded that the 150.00 level may also be comfortably breached. It's worth noting that in October last year, USD/JPY nearly reached the record multi-year level of 152.00.

However, a break of today's low at 148.70 and the short-term support level at 148.60 (200 EMA on the 15-minute chart) could initiate the implementation of an alternative scenario for a decline in the pair. If the downward correction does not stop near the support levels at 148.00 (200 EMA on the 1-hour chart), 147.40, 146.50 (200 EMA on the 4-hour chart), then after breaking the important support level at 145.50 (50 EMA on the daily chart) and the local support level at 145.00, USD/JPY may continue its decline, down to key support levels at 141.60 (144 EMA on the daily chart), 140.10 (200 EMA on the daily chart), 139.30 (50 EMA on the weekly chart), separating the medium-term bullish market from the bearish one.

Support levels: 148.70, 148.60, 148.45, 148.00, 147.40, 147.00, 146.50, 145.50, 145.00, 142.00, 141.60, 140.10, 139.30, 139.00, 138.00

Resistance levels: 149.00, 149.18, 150.00, 151.00, 152.00