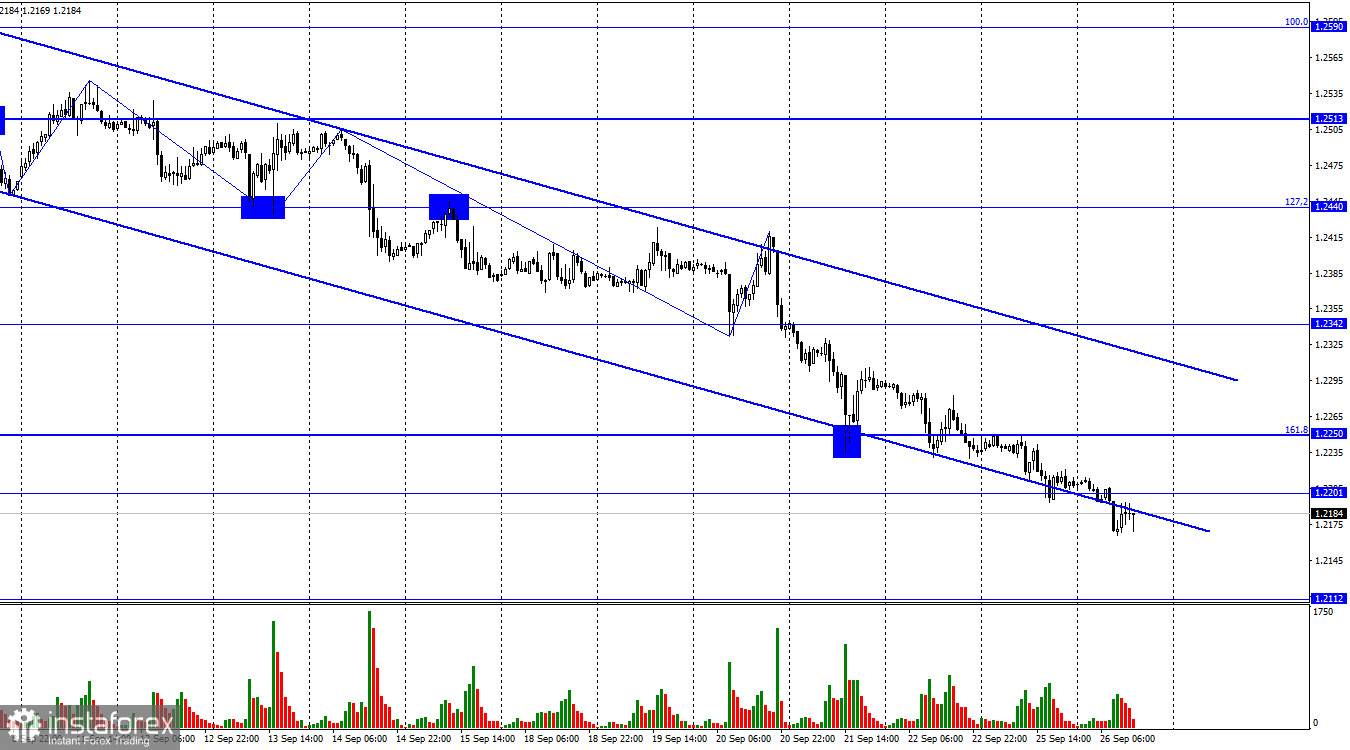

On the hourly chart, the GBP/USD pair continued its decline on Monday and consolidated below 1.2201. Thus, the decline in quotes can now continue toward the next level at 1.2112. The descending trend corridor still characterizes traders' sentiment as "bearish." I don't even see any potential "bullish" signals that could form soon. The "bearish" trend is very strong.

A new downward wave has been forming for five days now. The British pound has fallen for five consecutive days without significant pullbacks or corrections. Thus, there is no sign of the "bearish" trend ending. A sign of completion can only appear if an upward wave is formed and the next downward wave does not break the low of the current wave. Forming all these waves and movements may take several days or more. Therefore, it is certainly not today that we should expect the end of the trend.

The information background for the British pound at the beginning of the week is very weak. More precisely, it is absent. There has been no news in the UK at all, and in the US, several reports will be released today, which would be better to consider tomorrow as the dollar continues to rise without stopping. However, I would like to focus on the statement made by FOMC member Neel Kashkari, who said yesterday that he supports another interest rate hike by the end of the year. I don't think the Bank of England has already completed its tightening cycle (maybe it will raise rates again), but the Fed is currently more "hawkish."

This information is sufficient for bearish traders in the GBP/USD pair to continue their attacks. And what else can they do if there are no reasons to retreat?

On the 4-hour chart, the pair continues its decline and has consolidated below the 50.0% correction level at 1.2289. Thus, the decline of the British pound can continue towards the next level at 1.2008. A new "bullish" divergence is looming in the CCI indicator, which allowed for some growth to be expected, but it has not yet formed. The 1.2250 on the hourly chart has also not stopped the decline. It is already practically unrestricted.

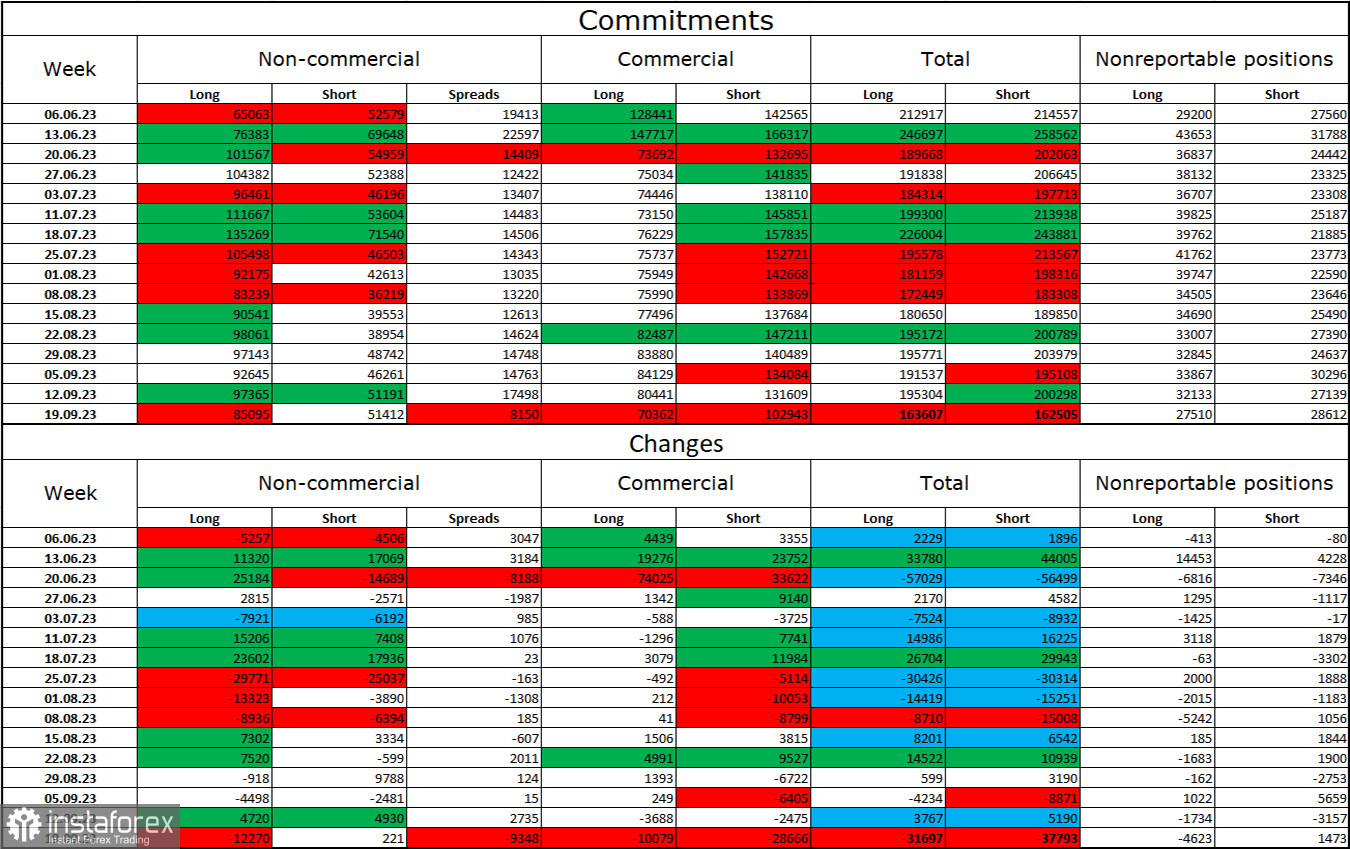

Commitments of Traders (COT) Report:

The sentiment among the "Non-commercial" category of traders for the last reporting week has become less "bullish." The number of long contracts held by speculators decreased by 12,270 units, while the number of short contracts increased by 221. The overall sentiment of major players remains bullish, and the gap between the number of long and short contracts is narrowing each week: now it's 85,000 versus 55,000. The British pound had decent prospects for further growth, but many factors have favored the US dollar. I do not expect a significant surge in the British pound soon. Over time, bulls will continue to unwind their Buy positions, as is the case with the European currency. The Bank of England can only change the market dynamics if it continues to raise interest rates for longer than planned, but the recent meeting showed that this factor should not be relied upon.

News Calendar for the US and the UK:

US - Building Permits (12:00 UTC).

US - Consumer Confidence Index CB (14:00 UTC).

US - New Home Sales (14:00 UTC).

On Tuesday, the economic events calendar includes several entries, but no truly significant ones are among them. The impact of the information background on market sentiment today will be very weak.

Forecast for GBP/USD and trader advice:

Selling the British pound was possible upon closing below 1.2201 with a target of 1.2112 on the hourly chart. I do not recommend buying in such a strong "bearish" trend; there are no "bullish" signals.