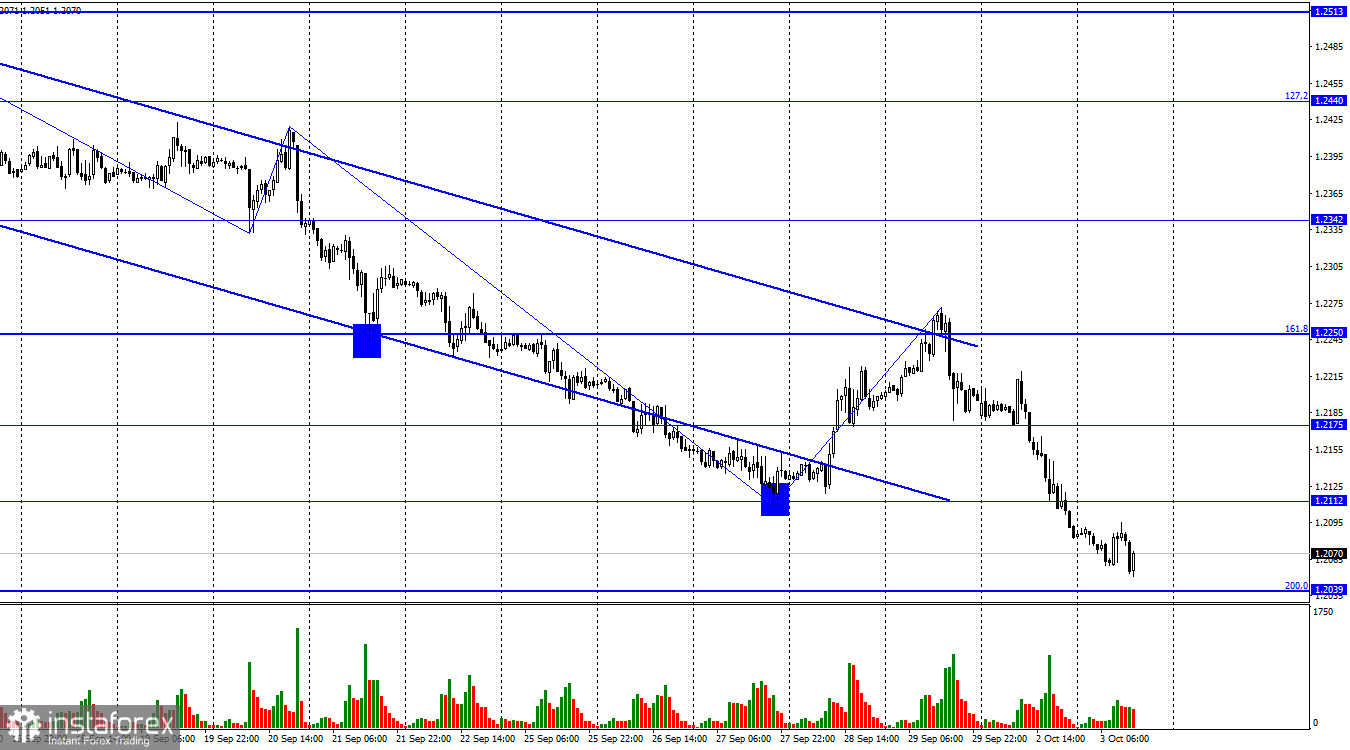

On the hourly chart, the GBP/USD pair on Monday consolidated below the level of 1.2175 and fell to the level of 1.2112. Today, it closed below the level of 1.2112, and the decline continued almost to the Fibonacci level of 200.0%–1.2039. A rebound of the pair's rate from the level of 1.2039 will favor the British pound, with some growth towards the levels of 1.2112 and 1.2175. Closing the pair's rate below the level of 1.2039 will increase the likelihood of a further decline towards the level of 1.1883.

Yesterday gave hope for the formation of one or two signs of the end of the "bearish" trend. But instead of their formation, a new wave formed, which maintained the "bearish" trend and pushed the possible end of it a few days ahead. Now, for the appearance of the corresponding signs, growth above 1.2250 is needed, or two new waves (up and down). Undoubtedly, for the formation of any of these signs, it will take at least several days.

The current week will not only be interesting but may also be a savior for the British pound, which has been falling continuously for more than 2 months. At the end of the week, an important package of statistical information will be released in the United States, including reports on the labor market and unemployment. It is precisely this data that the British pound (along with the euro) will now rely on to end its fall. Undoubtedly, the decline may end earlier, but what to expect is simpler: the end of the fall on weak data from the United States or the end of the fall for no reason?

Many economists continue to worry about the prospects of the American economy, and I believe that the labor market will continue to shrink and unemployment will rise. Perhaps these two reports will help the euro and the pound stop the collapse. But only if the key reports from the United States show weak values, and they can show strong ones too.

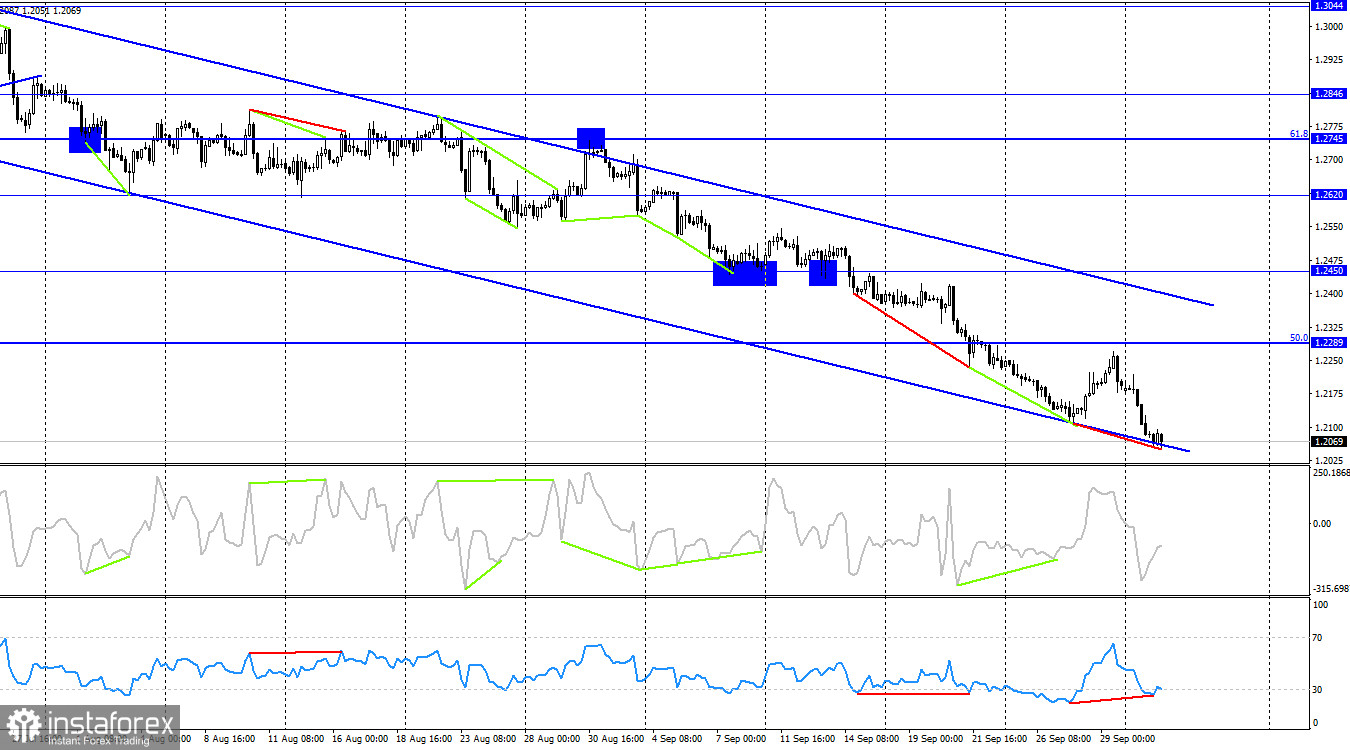

On the 4-hour chart, the pair made a new reversal in favor of the American currency and resumed the process of decline towards the level of 1.2008. At the moment, a new "bullish" divergence is looming on the RSI indicator, which once again allows us to count on some growth in the pair. A rebound of quotes from 1.2008 will also work in favor of the British pound and the start of growth. Closing below 1.2008 will increase the likelihood of a further decline towards the next corrective level of 38.2% (1.1832).

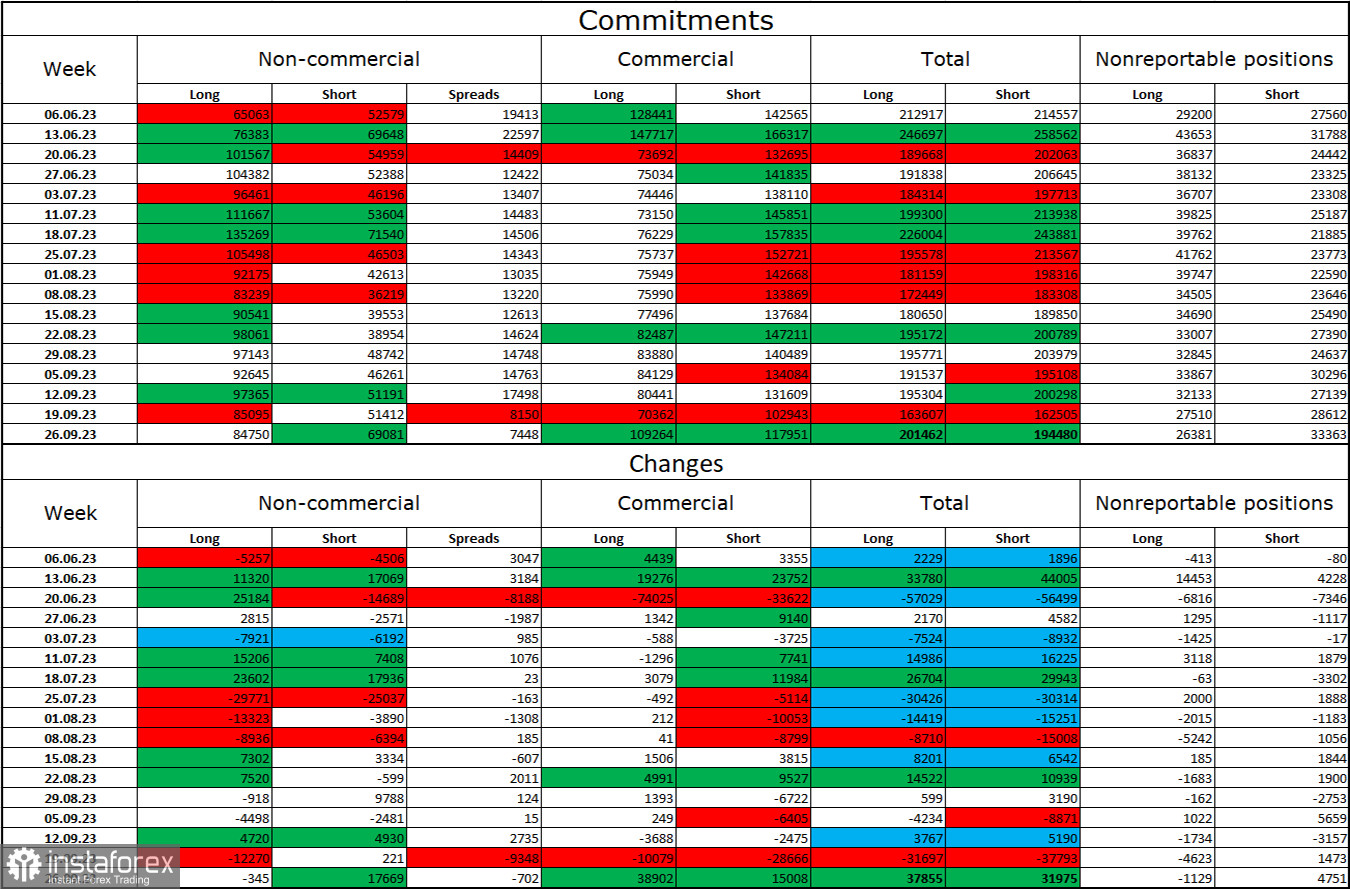

Commitments of Traders (COT) Report:

The sentiment of "non-commercial" traders in the past reporting week has become less "bullish" again. The number of long contracts held by speculators decreased by 345 units, while the number of short contracts increased by 17,669 units. The overall sentiment of major players remains bullish, and the gap between the number of long and short contracts narrows every week: now 85,000 versus 69,000. In my view, the British pound had good prospects for continued growth two months ago, but now many factors have turned in favor of the US dollar. I don't expect a strong pound sterling rally in the near future. I believe that over time, bulls will continue to unwind their buy positions, just as is the case with the European currency.

News calendar for the US and the UK:

US - Job Openings and Labor Turnover Survey (JOLTS) (14:00 UTC).

On Tuesday, the economic events calendar contains only one interesting entry. The impact of the news background on market sentiment today may be of moderate or weak strength.

Forecast for GBP/USD and trading advice:

Selling the British pound was possible on a rebound from the level of 1.2250, with targets at 1.2175 and 1.2112 on the hourly chart. All targets have been reached. You can keep selling with a target of 1.2039, and in case of a breakthrough, with a target of 1.1883. I recommend considering buying in case of a rebound from the levels of 1.2039 or 1.2008.