On Monday, the EUR/USD pair secured below the Fibonacci retracement level of 161.8% (1.0561), reversed in favor of the US currency, and dropped below the 1.0489 level. Thus, the process of the quotes' decline may now continue towards the next Fibonacci level of 200.0% (1.0392). The pair's price staying above the 1.0489 level would work in favor of the euro and could lead to some growth towards the 1.0561 level.

Yesterday's trading allowed us to expect the formation of the first sign of the end of the "bearish" trend. I remind you that this would have been a breakthrough at the peak of Friday, September 29th. In this case, a second upward wave would have formed, and this wave combination could have been considered the "beginning of a bullish trend." However, instead, we witnessed a new drop and a breakthrough of the lows on September 27th. Thus, a new downward wave has formed, and the "bearish" trend remains intact. In the coming days, it will be extremely difficult to expect even one sign of the "bearish" trend's end, as this would require a rise to 1.0630 or the formation of multiple waves.

Yesterday in the European Union, business activity indices in the manufacturing sectors were released, showing no significant changes. There might not have been any changes, but trader activity was very high. The reason might lie in the business activity indices for the US manufacturing sector. The ISM index rose from 47.6 points to 49.0, surpassing traders' lower expectations. The standard business activity index rose from 47.9 to 49.8 points. Thus, both indices have practically returned to the 50.0 level, above which it can be considered that the situation in the industrial sector has improved. The dollar maintains high chances of further growth.

On the 4-hour chart, the pair dropped to the 127.2% Fibonacci retracement level at 1.0466. A rebound from this level would allow us to expect a reversal in favor of the European currency and a new rise towards the upper boundary of the descending trend corridor. I still recommend considering a strong euro rally only after closing above the corridor. If the pair's price settles below the 1.0466 level, it would increase the likelihood of further decline towards the next 161.8% Fibonacci retracement level at 1.0245.

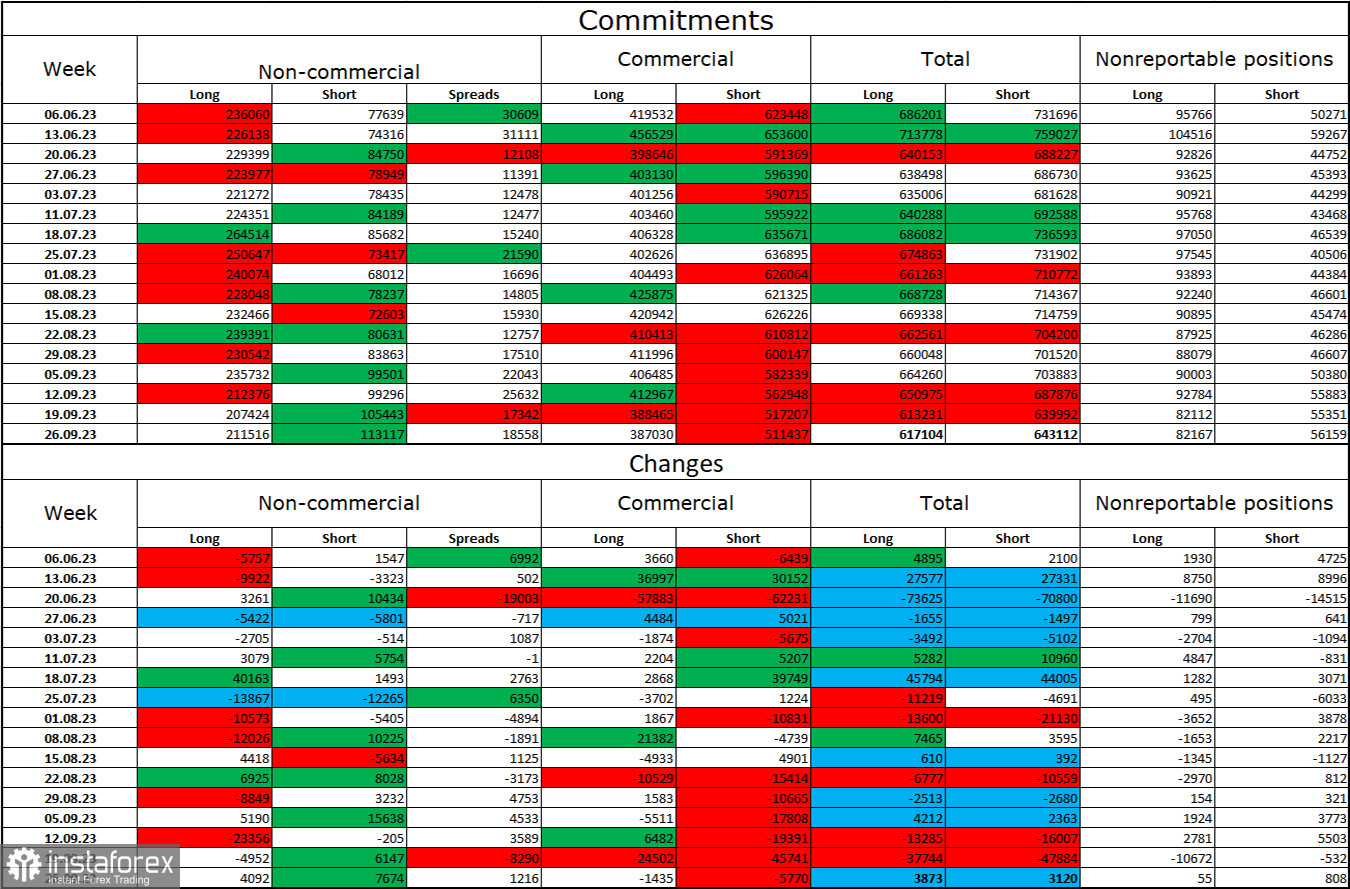

Commitments of Traders (COT) report:

In the last reporting week, speculators opened 4,092 long contracts and 7,674 short contracts. The sentiment of large traders remains bullish but has noticeably weakened in recent weeks and months. The total number of long contracts concentrated in speculators' hands now amounts to 211,000, while short contracts stand at 113,000. The difference is now only twofold, whereas a few months ago, the gap was threefold. I believe that the situation will continue to shift toward the bears over time. Bulls have dominated the market for too long, and now they need a strong information background to sustain the bullish trend. Such a backdrop is currently lacking. The high value of open long contracts suggests that professional traders may continue to close them in the near future. I believe that the current figures allow for a continuation of the euro's decline in the coming months.

Economic Calendar for the US and the European Union:

US - JOLTS Job Openings (14:00 UTC).

On October 3rd, the economic calendar contains only one entry, but it is quite important. The impact of the information background on traders' sentiment today may be weak.

Forecast for EUR/USD and Trader Advice:

Sales of the pair were possible upon securing below the 1.0561 level on the hourly chart, with a target of 1.0489. The first target has been reached and surpassed; sales can be held with a target of 1.0392. There's no need to rush into buying today; you can open small long positions upon a rebound from the 1.0466 level on the 4-hour chart with a target of 1.0570.