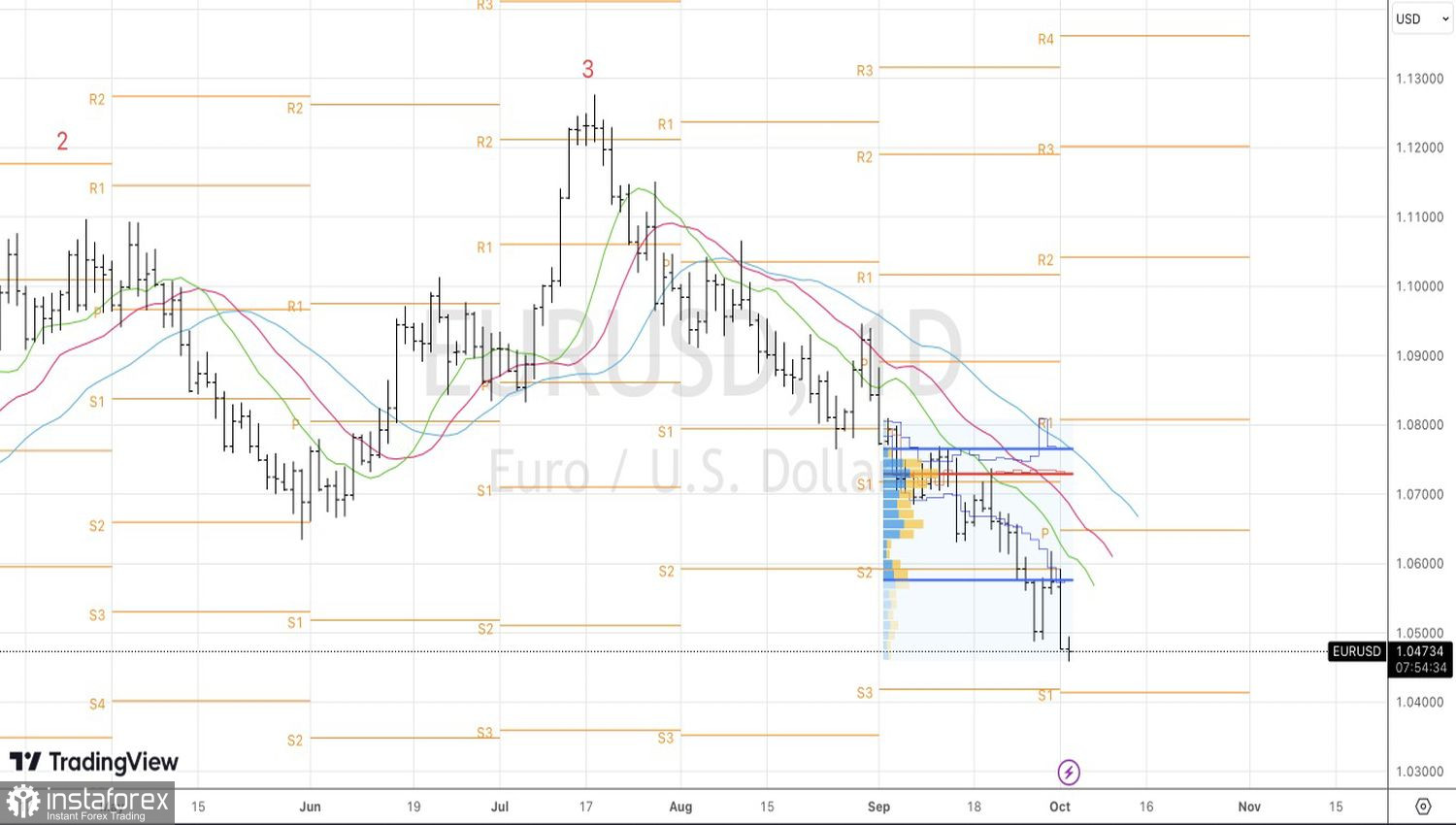

Looking at how the euro has been falling persistently and hopelessly, one can't help but be surprised by what's happening. No matter how strong the trend may be, it doesn't go without correction. However, EUR/USD has been moving down for 12 consecutive weeks, and even the slightest attempts by the "bulls" to counterattack are swiftly thwarted by their opponents. Starting from 1.127 in the middle of July, the main currency pair is plummeting like a stone. At this rate, it might reach parity by the end of October.

Many factors, including the divergence in monetary policies between the ECB and the Fed, as well as differences in economic growth between the Eurozone and the United States, are already factored into the EUR/USD quotes. The dollar is rising thanks to the rally in Treasury yields, which gained momentum after Congress prevented a government shutdown at the beginning of October. Investors are getting rid of debt obligations due to unsatisfactory fiscal policies. States and other countries are spending more, and they are forced to inflate budget deficits and increase debts.

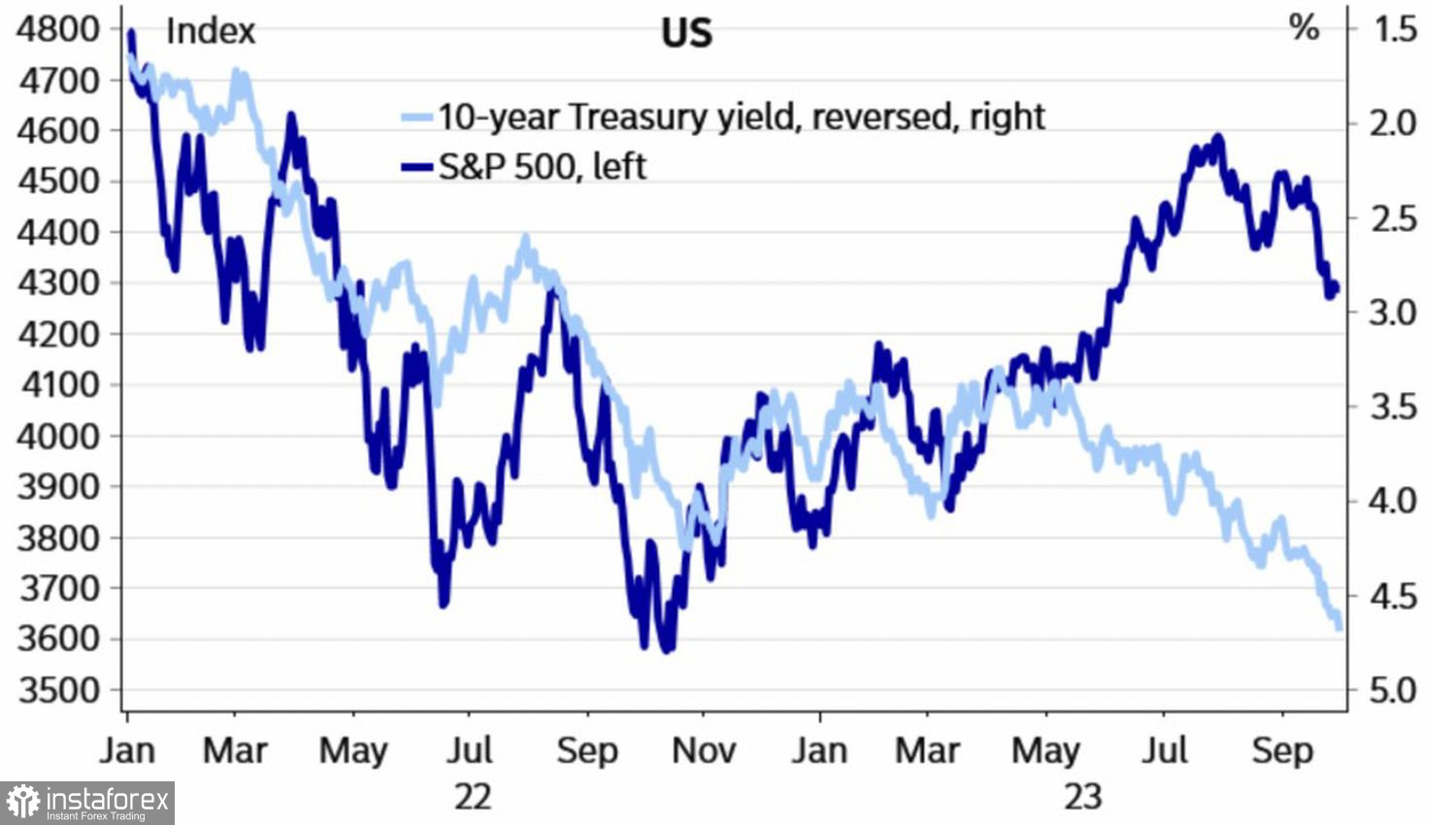

The rise in bond yields is hurting the stock market. The increase in the yield of debt obligations negatively affects the S&P 500. However, this is a cyclical process. Sooner or later, the money obtained from selling stocks will need to be invested somewhere, and investors will start buying bonds. Moreover, the U.S. economy is slowing down, and the pace of inflation is declining. This is not the environment where yields rise. The worse the economic statistics in the United States, the more reasons there are for a drop in interest rates and a correction in EUR/USD.

Dynamics of the S&P 500 and U.S. Treasury Bond Yields

The first test of the downward trend in the main currency pair will occur in the first week of October when data on private sector employment from ADP and the U.S. labor market report for September will be released. Disappointing statistics could lead to a drop in Treasury yields and a strengthening of the euro against the dollar. Moreover, the process can happen very quickly. Just like now, the market is driven by Greed for the dollar, and then it will be replaced by Fear. Who wants to lose such a colossal profit?

Nevertheless, if a pullback does occur, it will likely be of a technical nature. Structurally, nothing will change, especially in the debt market. For decades, it has existed under the conditions of quantitative easing programs from the Fed and other central banks, in a low inflation environment. Currently, a significant shift is taking place, without which the 11-week peak in EUR/USD would have been impossible. Investors need to get used to this new reality. There are alternatives to stocks, and quite a few of them! The TINA strategy no longer works.

Technically, on the daily chart of EUR/USD, a pin bar was clearly played out, allowing us to increase short positions. As the main currency pair approaches the pivot levels near the 1.042 mark, the risks of a rebound increase. Traders should lock in part of their profits and prepare for U.S. employment reports.