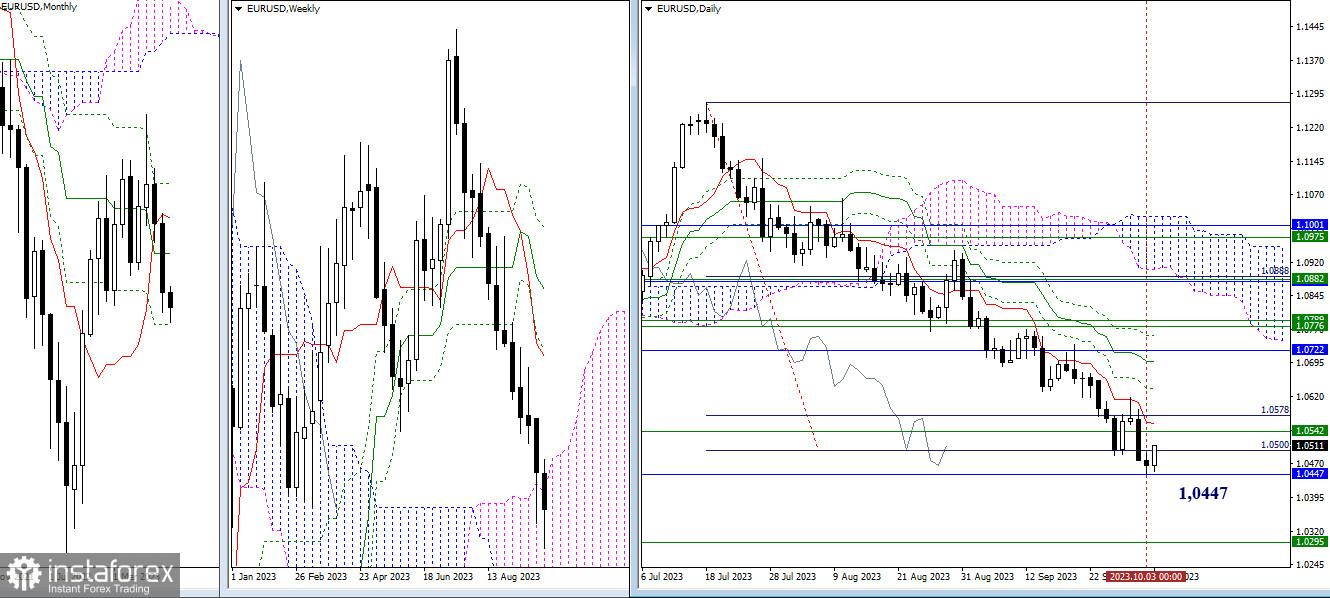

EUR/USD

Higher Timeframes

The attraction and influence of the monthly support (1.0447) turn out to be so significant that no other targets could deter traders from their desire to test this level. A break below 1.0447 will open the path to the lower boundary of the weekly cloud (1.0295). In turn, the formation and execution of an upward correction will lead to a retest of the levels passed yesterday at 1.0500 – 1.0542 – 1.0578.

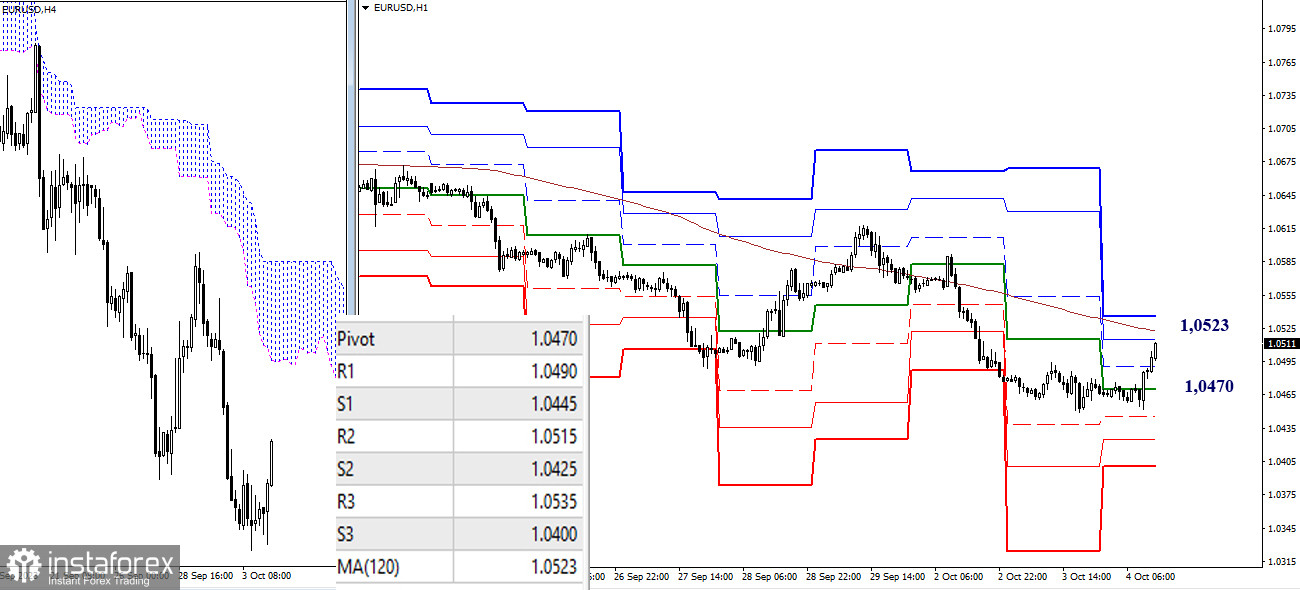

H4 – H1

On the lower timeframes, players are approaching a test of resistance in the weekly long-term trend (1.0523). A break and reversal of the moving average can alter the current balance of power. Trading above the level of 1.0523 will give the upper hand to buyers. As an additional reference point in this direction, 1.0535 (R3) can be mentioned today. If a rebound is formed while testing the weekly trend (1.0523), then classic pivot points (1.0490 – 1.0470 – 1.0445 – 1.0425 – 1.0400) may provide support to the market during a decline.

***

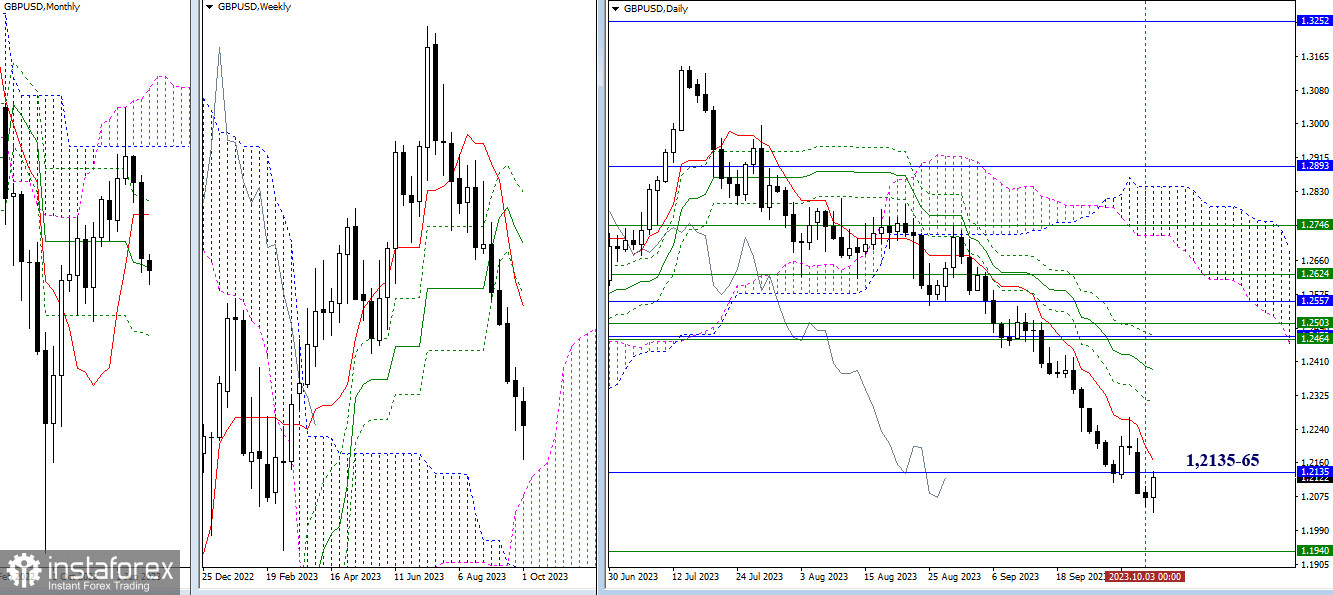

GBP/USD

Higher Timeframes

Despite updating the low, bearish traders did not show much activity yesterday. Today, the low was updated again, but the activity has shifted in favor of bullish traders, who have returned to the attraction zone of the monthly medium-term trend (1.2135) by now. Slightly higher is the resistance of the daily short-term trend (1.2165). A breakout of the zone between 1.2135 and 1.2165 will allow for considering new prospects for the development of the daily and weekly upward correction.

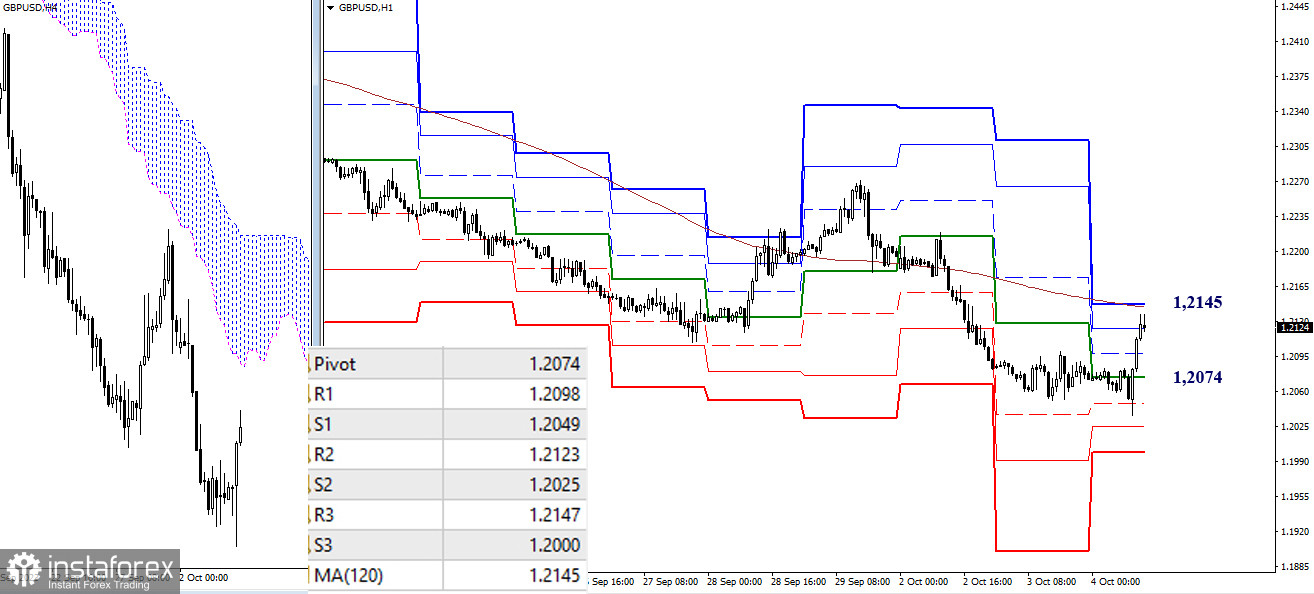

H4 – H1

A few hours ago, sentiment changed quite abruptly, and, as a result, bullish players have almost approached interaction with the weekly long-term trend (1.2145), which has combined its forces with the final resistance of the classic pivot points (1.2147). A breakout and a firm consolidation above this level will affect the distribution of forces. Changing the current preferences will lead to testing supports, which currently include all previously passed classic pivot points (1.2098 – 1.2074 – 1.2049 – 1.2025 – 1.2000).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)