EUR/USD

The euro managed to break free from its "hopelessness" after slipping below 1.0483 and found the strength to climb back above this level. Of course, it was aided by the stock market, which increased by 0.81% (S&P 500) yesterday, along with its own technical signs pointing to the possibility of a correction. In turn, the stock market was able to rise thanks to a 5.49% drop in oil (WTI), which, due to its high cost, was hampering business development and fueling inflation.

As we expected, US employers in the private sector added an estimated 89,000 jobs in September against an expected 153,000 and 180,000 in August. The Employment Index registered 53.4, down from the August figure of 54.7. As a result, investors increasingly expect weakness in Friday's US labor data.

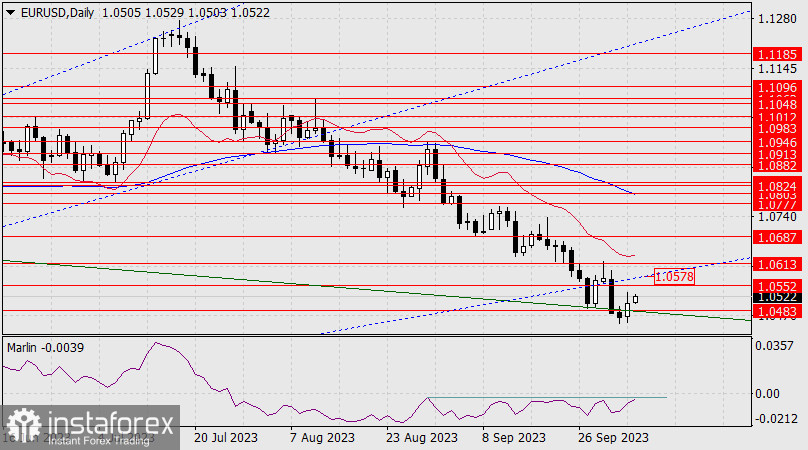

The price may surpass the Fibonacci best level on the daily chart (1.0578) and rise towards 1.0613 and 1.0687. The Marlin oscillator has more grounds to enter the positive territory, which it has not been able to do since the end of August.

On the 4-hour chart, Marlin is in the positive territory. The price is preparing to break above the MACD line (yesterday's high at 1.0533). After consolidating above this level, we can expect the pair to rise towards 1.0578.