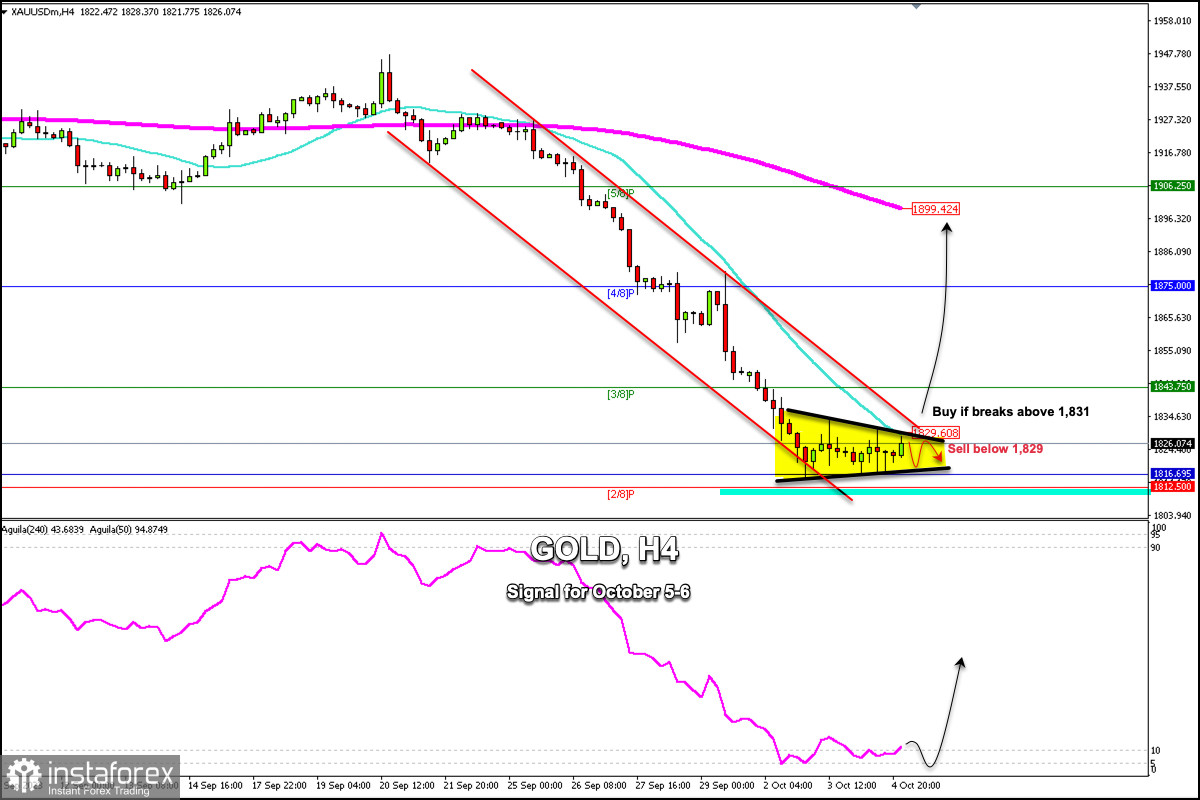

Early in the European session, gold is trading around 1,826.07, consolidating above the 2/8 Murray at 1,812 and below the 21 SMA at 1,829.

On October 2, gold dropped to 1,815.21. Since then, it has been bouncing and consolidating around this zone. It means that if gold trades above 1,830 (21 SMA) in the next few days, we could expect a recovery during which the price could reach 1,843 and 1,875 (4/8 Murray).

On the H4 chart, we can see the formation of a symmetrical triangle. If gold breaks and consolidates above 1,830, we could expect a recovery and the metal could reach 1,840 and 1,875 and even the 200 EMA around 1,899 in the next few days.

The economic data that could give a strong boost to gold and relieve downward pressure could be the Non-Farm Payrolls (NFP) report that will be published this Friday. 170,000 jobs are expected.

If this data is above what analysts predict, gold could resume its bearish cycle and it could reach 2/8 Murray located at 1,812. On the other hand, if the data falls short of expectations, gold could gain strong momentum and quickly reach 1,850 and 1,875.

On the 4-hour chart, we can see that the eagle indicator is in an extremely oversold zone. Therefore, we expect that gold could recover in the next few days, but for this, we should expect it to consolidate above 1,831.

Our trading plan for the next few hours is to buy gold in case it rebounds towards the 1,818 area, with the target at 1,829. This data will be to continue trading within the symmetrical triangle.

Additionally, if a strong breakout and consolidation occurs above 1,830 (21 SMA), it will be seen as a signal to buy. The Eagle indicator is in the oversold zone which supports our bullish strategy.