Friday turned out to be a rather dull day, with a very weak news background. Both instruments continued to decline, which, in my opinion, is not entirely logical, but the assumed waves 2 or b may take on a three-wave form. I would even say they should take on a three-wave form. The initial waves for both instruments look very long, so it's unlikely we'll see second waves lasting a week and 2-3 hundred points. Based on this, I expect both instruments to rise next week.

At the same time (on Friday), speeches by members of the ECB Governing Council continued in the European Union. Joachim Nagel, President of the German Central Bank, stated that the ECB will not back down until inflation reaches the target level. At the same time, he stated that in 2025, inflation in Germany could drop to 2.7%. With some simple mathematical calculations, it can be understood that inflation will decrease to 2% over the next three years, if not more. And this conclusion fully corresponds to the rhetoric of ECB Governing Council members, who mostly talk about maintaining high interest rates for a long time. Therefore, it's quite challenging to expect a tightening of monetary policy now.

For the European currency, this doesn't mean anything good, but at the same time, the euro has shown very strong growth in the last 12–14 months. Unfortunately, it has already lost most of its advantage against the dollar, but the Federal Reserve also raised rates over the last one and a half years, just like the ECB did. Thus, the rise of the European currency during this period was not entirely consistent. And the current fall of the euro and the rise of the dollar appear to be a belated response to the high FOMC rate.

Despite the fact that both instruments have built super-long initial waves, the third wave may turn out to be significantly shorter. It's hard for me to imagine the European currency dropping to the lows of 2022, which is about 1000 basis points away. And I don't expect it to drop to price parity with the dollar either, as that would be too strong a devaluation of the euro, which doesn't match the news background and the rates of the ECB and the Fed.

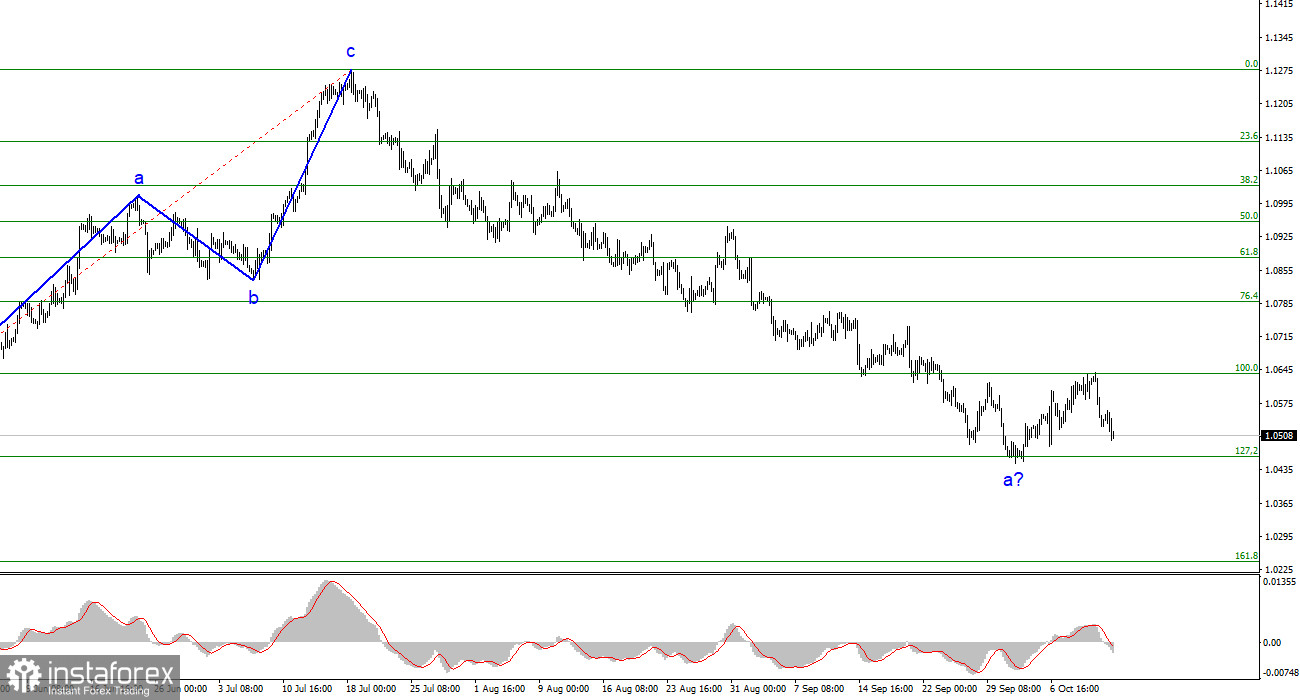

Based on this analysis, I conclude that the formation of a downward wave set continues. The targets around the 1.0463 level have been ideally achieved, and the unsuccessful attempt to break through this level indicates the market's readiness to build a corrective wave. In my recent reviews, I warned that it was worth considering closing short positions, as the probability of building an upward wave is currently high. The unsuccessful attempt to break the 1.0637 level, which corresponds to 100.0% according to Fibonacci, indicates the market's readiness to resume the decline, and selling the instrument is possible with a target of 1.0463. However, I believe that wave 2 or b will be three-wave.

The wave pattern of the GBP/USD pair suggests a decline within a new downward trend. The maximum the British pound can expect in the near future is the formation of wave 2 or b. However, as we can see, even with a corrective wave, there are currently significant problems. At this time, I would not recommend new sales, but I also do not recommend purchases, as the corrective wave may turn out to be quite weak.