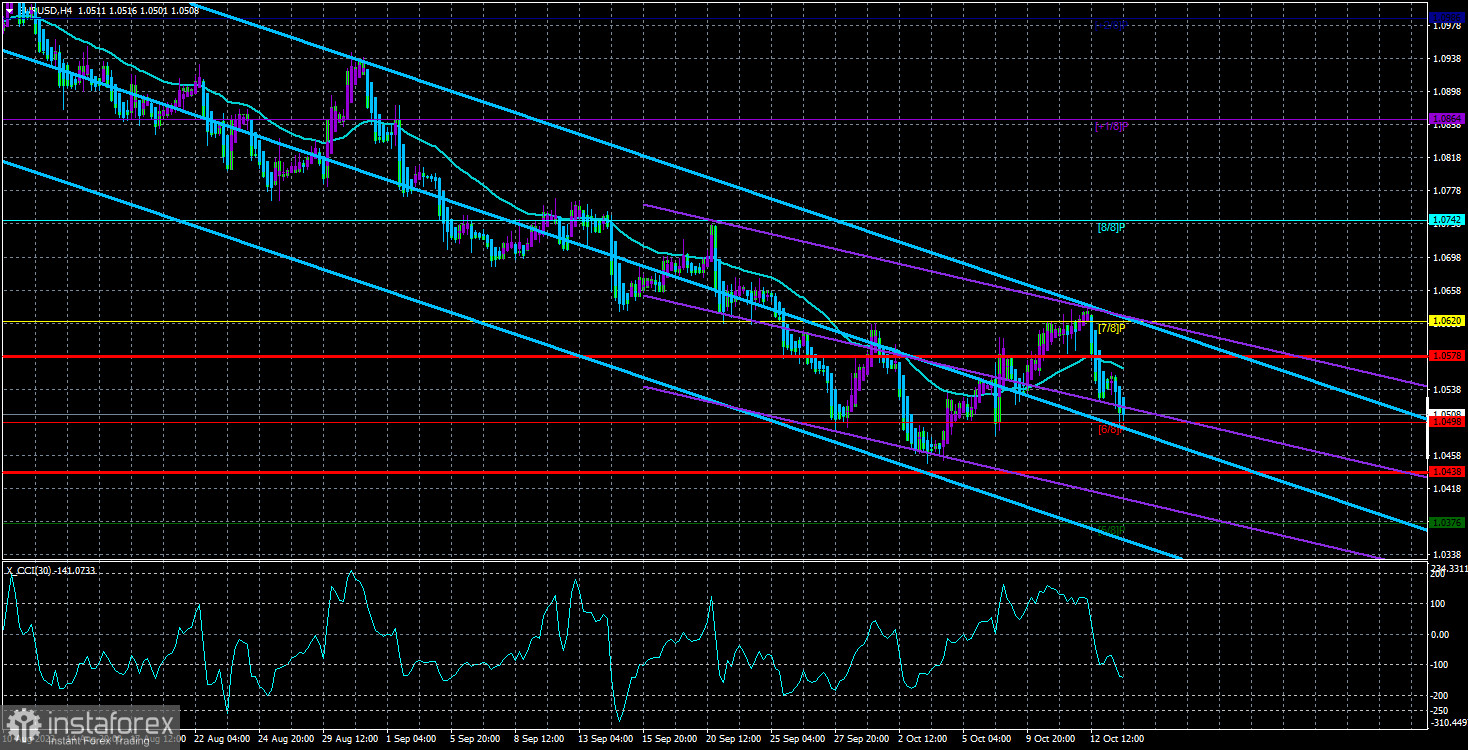

The currency pair EUR/USD continued its downward movement calmly throughout Friday. After the pair had been in a completely logical downtrend for two months and covered a distance of 800 points during that time, it was time for a correction. The European currency managed to correct by 180 points in just 5-7 trading days, and we expected to see the continuation of this correction. However, instead, on Thursday, the pair plummeted like stones. If there had been any important macroeconomic publications or fundamental events on that day, there might have been no questions. However, the report on American inflation turned out to be neutral and showed no changes compared to the previous month, and core inflation dropped to 4.1% as expected.

Despite the illogical fall of the euro on Thursday and Friday, the overall decline of the pair is absolutely consistent, as the market is currently in the stage of "course recovery" between the euro and the dollar. We believe that this could continue in the medium term. However, we have a feeling that a new stage of the upward correction will be formed this week. The pair is already rolling towards the level of 1.0000, and a fall in price parity cannot happen out of nowhere. There must be very weighty reasons for it.

Therefore, we still consider the target for the southward movement to be the level of 1.0200, but we still believe that the path to this target should be more challenging. The pair bounced off the Murray level "6/8" at 1.0495 a couple of weeks ago, and it may bounce off it again. This bounce will become the starting point for a new leg of the corrective movement.

Neel Kashkari is calm. We have talked many times about how the speeches of ECB and Fed representatives currently have no significant impact on the currency market. The reason is that it's now very difficult to expect a sharp change in the monetary policy course from both regulators, resonant decisions, or a prolonged increase in the key rate. If significant changes are not expected, then the rhetoric of central bank officials is not as important as it was half a year or a year ago. Nevertheless, it operates in the background. In other words, the market is not going to react to every single official's speech, but they all together allow for an overall assessment of the situation and the formation of a trading strategy.

For example, several Fed representatives have stated in the past two weeks that there is no need for a new tightening of monetary policy. Then, an inflation report was released, which showed no improvements compared to August and July. Therefore, the situation with inflation in the USA is worsening and is not currently favorable. Consequently, a stronger "hawkish" attitude from the Fed is implied. However, officials are doing the opposite, pretending that there will be no new rate hikes. This is a strange moment. The FedWatch tool indicates a 7% probability of a rate hike on November 1, and Neel Kashkari is talking about a "soft landing" for the US economy.

Neel Kashkari, President of the Federal Reserve Bank of Minneapolis, stated last week that inflation continues to decline, the labor market remains strong, and the Fed has every chance of returning inflation to 2% without a recession. He also confirmed the words of his colleague Lael Brainard about reducing the need for a rate hike due to rising Treasury yields. How does it work? As the yield of government bonds increases, demand for them also rises. Consequently, when free funds are withdrawn from the economy, investment volumes decrease, which slows down the economy and increases inflation. It now remains to be seen when inflation will actually begin to decline, not just in the words or dreams of FOMC members. We don't see any substantial reasons for the dollar to rise this week.

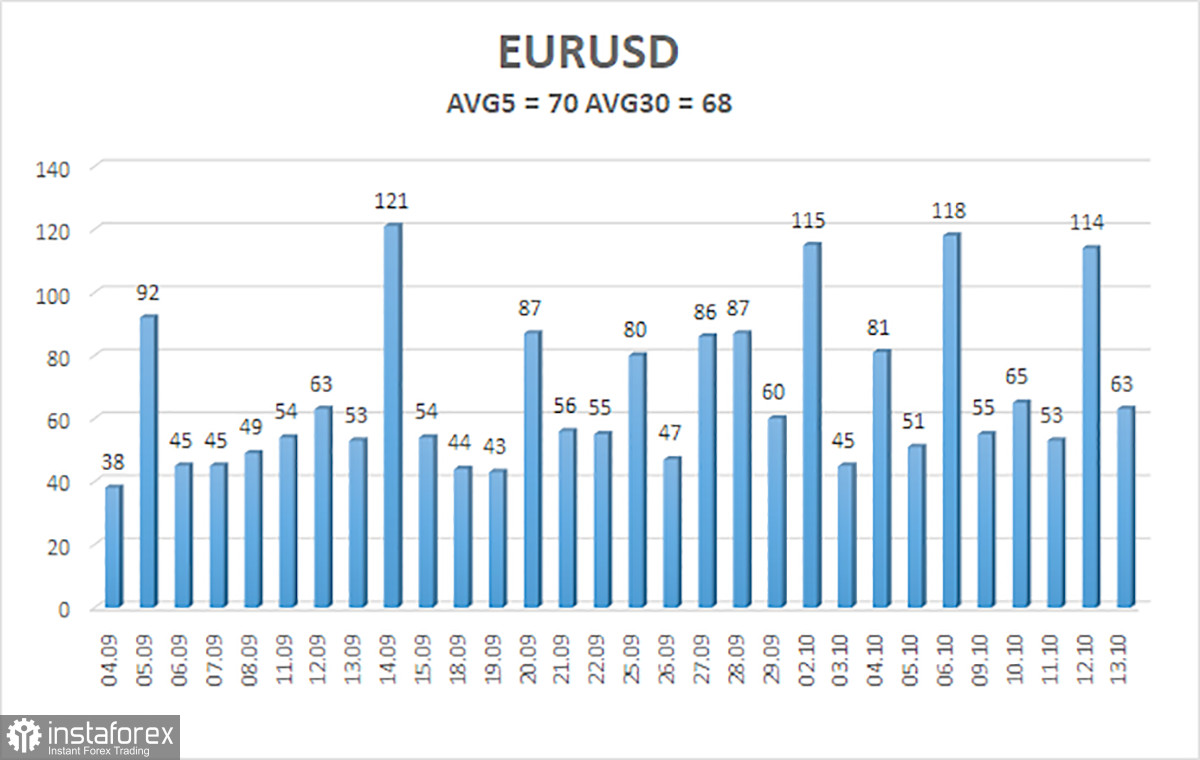

The average volatility of the EUR/USD currency pair for the last 5 trading days as of October 16 is 70 points, which is characterized as "average." Thus, we expect the pair to move between the levels of 1.0438 and 1.0578 on Monday. The reversal of the Heiken Ashi indicator upwards will indicate a possible resumption of the upward movement.

Key support levels:

S1 – 1.0498

S2 – 1.0376

S3 – 1.0254

Nearest resistance levels:

R1 – 1.0620

R2 – 1.0742

R3 – 1.0864

Trading recommendations:

The EUR/USD pair has settled back below the moving average. Therefore, short positions can be maintained with targets at 1.0438 and 1.0376 until the Heiken Ashi indicator reverses upward. Long positions can be considered if the price firmly closes above the moving average with targets at 1.0620 and 1.0742, but we are still not expecting a strong rise in the euro or, at most, a correction.

Explanations for the illustrations:

Linear regression channels – help determine the current trend. If both are pointing in the same direction, it means the trend is strong at the moment.

Moving average line (settings 20.0, smoothed) – defines the short-term trend and the direction in which trading should be conducted.

Murray levels – target levels for movements and corrections.

Volatility levels (red lines) – the likely price channel in which the pair will move in the next day, based on current volatility indicators.

CCI indicator – its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal in the opposite direction is approaching.