Analysis of Tuesday's trades:

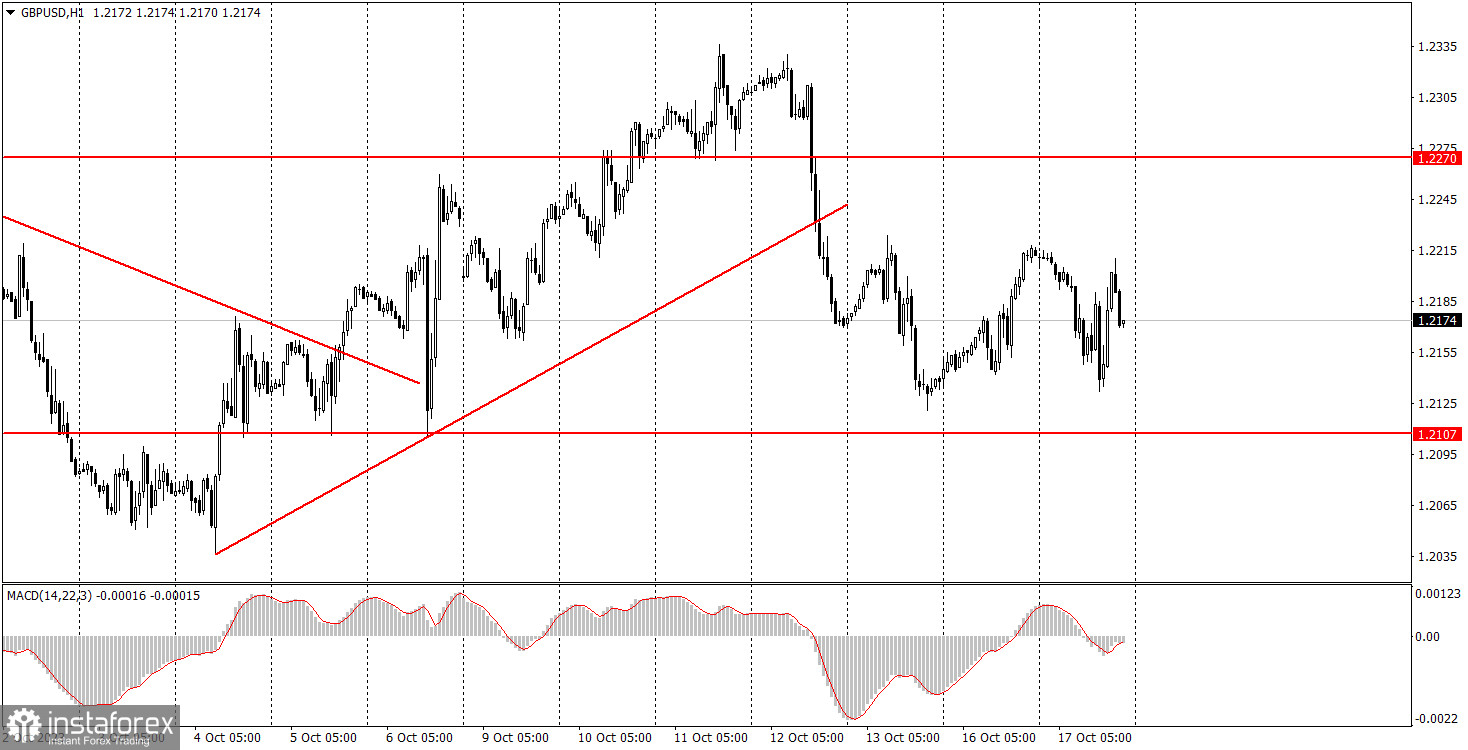

GBP/USD 1H chart

Following the outcomes of the second trading day of the week, GBP/USD demonstrated more of a bearish trend. Although we have been forecasting a resumption of an upward correction for the pound, its macroeconomic backdrop today stood somewhat distinct from that of the euro. While the European currency experienced a slight boost in the morning, thanks to the ZEW indices, the pound faced downward pressure due to the latest wage growth report, which indicated a considerably high value. Elevated wage growth rates typically imply that inflation might decelerate at a slower pace or might not slow down at all. Under circumstances where this would suggest that the Bank of England might implement additional rate hikes, once or twice, the pound would likely be buoyant. However, much to the pound's disadvantage, the Bank of England is nearing its peak rate, rendering shifts in inflation relatively inconsequential to its monetary policy.

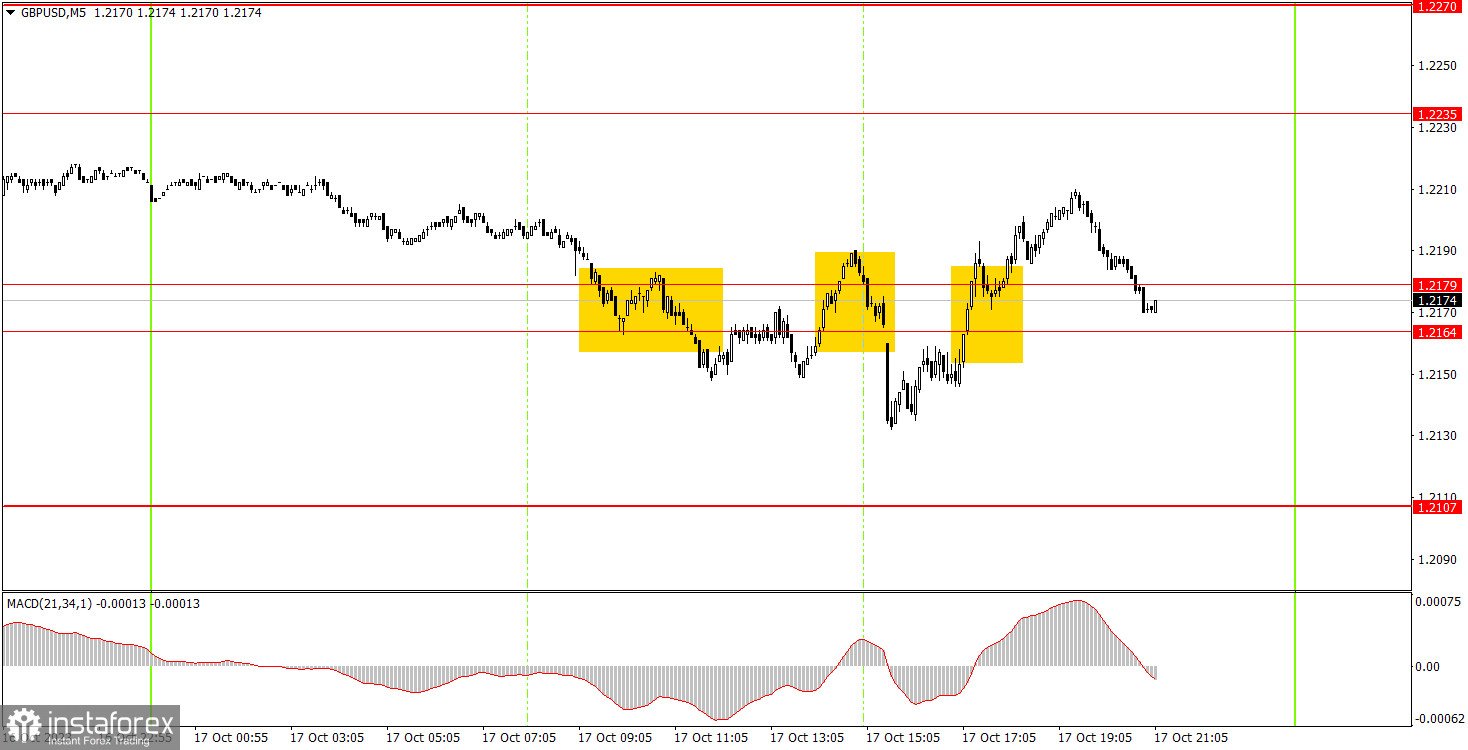

GBP/USD 5M chart

On Tuesday, the pound presented three trading signals, all of which were quite bad. The currency pair experienced significant fluctuations throughout the day, largely due to the influx of macroeconomic data, rendering all signals inaccurate. At certain intervals, price levels were simply disregarded. The initial two sell signals around the 1.2164-1.2179 range mirrored each other, with the price grudgingly moving downward by 20 points during the second attempt. Hence, there was no loss incurred, given a break-even Stop Loss should have been set. With the formation of a buy signal in the same range, the price again shifted in the intended direction by 20 points. As a result, both transactions culminated in a break-even.

Trading idea for Wednesday:

On the hourly timeframe, the GBP/USD pair might revert to its medium-term downtrend. Monday's rise of the British currency could be interpreted as a new phase of the upward correction, a logical progression, but it might also represent a retracement opposing last Thursday's and Friday's decline. The current scenario presents ambiguity; however, we are inclined towards the continuation of the upward correction. On the 5-minute timeframe tomorrow, the key levels to consider are 1.1992-1.2010, 1.2052, 1.2107, 1.2164-1.2179, 1.2235, 1.2270, 1.2372-1.2394, 1.2457-1.2488, 1.2544, 1.2605-1.2620, 1.2653, and 1.2688. Once the price moves 20 points in the intended direction post-opening the trade, set a break-even Stop Loss. Come Wednesday, a pivotal inflation report for September will be released in the UK, which might instigate a pronounced market response. The pair might once again oscillate extensively throughout the day. In the US, a less critical report on building permit issuances will be published.

Basic rules of a trading system:

1) Signal strength is determined by the time taken for its formation (either a bounce or level breach). A shorter formation time indicates a stronger signal.

2) If two or more trades around a certain level are initiated based on false signals, subsequent signals from that level should be disregarded.

3) In a flat market, any currency pair can produce multiple false signals or none at all. In any case, the flat trend is not the best condition for trading.

4) Trading activities are confined between the onset of the European session and mid-way through the U.S. session, post which all open trades should be manually closed.

5) On the 30-minute timeframe, trades based on MACD signals are only advisable amidst substantial volatility and an established trend, confirmed either by a trend line or trend channel.

6) If two levels lie closely together (ranging from 5 to 15 pips apart), they should be considered as a support or resistance zone.

How to read charts:

Support and Resistance price levels can serve as targets when buying or selling. You can place Take Profit levels near them.

Red lines represent channels or trend lines, depicting the current market trend and indicating the preferable trading direction.

The MACD(14,22,3) indicator, encompassing both the histogram and signal line, acts as an auxiliary tool and can also be used as a signal source.

Significant speeches and reports (always noted in the news calendar) can profoundly influence the price dynamics. Hence, trading during their release calls for heightened caution. It may be reasonable to exit the market to prevent abrupt price reversals against the prevailing trend.

Beginning traders should always remember that not every trade will yield profit. Establishing a clear strategy coupled with sound money management is the cornerstone of sustained trading success.