The EUR/USD currency pair changed its direction once again during Thursday's trading and closed above the moving average line. In any case, we warned that the moving average is not currently a source of signals, and the pair can easily cross it often. Thus, the new closing above the moving average does not provide grounds to assume a continuation of the upward movement. We still advocate for an upward correction and believe that the pair should rise at least to the level of 1.0640, and ideally even higher. However, the market doesn't show much interest in buying. On one hand, this is not surprising, as the euro remains in a much worse position than the dollar. On the other hand, there was growth yesterday, although Powell's rhetoric in the evening speech should have triggered a pair's decline.

With a strong desire, you might even consider the chart above as showing a flat. From October 4th until now, the pair has been trading between the levels of 1.0500 and 1.0640. That is, it's been in the 140-point range for almost three weeks. However, the movement itself doesn't quite resemble a flat, so we still believe that the correction continues. The macroeconomic backdrop has almost no influence on the pair's movement. Yesterday, two reports of moderate significance were released in the United States: initial jobless claims and existing home sales. Both turned out stronger than expected, but for some reason, the dollar fell on this news. In the evening, when Powell was talking about a new rate hike, the dollar also managed to fall. This decline was not significant, but the market didn't utilize the excellent opportunity to resume the downward trend.

Thus, we believe that the correction will continue. Yes, it will be very complex, challenging, bumpy, and with downward retracements, but for now, we are not ready to conclude that the downward trend is resuming. Although the decline of the European currency remains our main scenario for the coming months.

De Galhau believes that the ECB should not raise rates. In principle, we've been hearing about the ECB's reluctance to raise rates further for about three months now. The absolute majority of ECB Monetary Committee members, in one way or another, indicate that they are not ready to vote for further tightening. However, there is a difference when such a stance is voiced by the heads of the central banks of Slovenia or Austria compared to France or Germany. We mentioned earlier that strong economies can support and have supported further tightening because they need to lower inflation as quickly as possible and their economies are strong enough to withstand higher rates. They can afford to raise rates more than Romania or Bulgaria, for example. Weaker economies, however, can face a severe recession due to excessive tightening. After that, the ECB would have to stimulate their economies. The regulator is trying to achieve a "soft landing," so it has to look for a middle ground rate that would suit all countries in the alliance.

Yesterday, the President of the Bank of France, Francois Villeroy de Galhau, stated that the regulator should take a patient approach. According to him, it's a time when the duration of maintaining the rate at its maximum value is more important than the rate itself. "We are trying and can provide a 'soft landing' for the economy," the policymaker believes. Thus, the rhetoric of ECB representatives is currently much milder than that of the Federal Reserve. Especially after Powell's speech yesterday, which indicated that the tightening is not over.

In summary, we can say the following: the correction (dollar decline) may continue in the near future, but it is unlikely to be strong. After its completion, we expect the main movement to resume (downward).

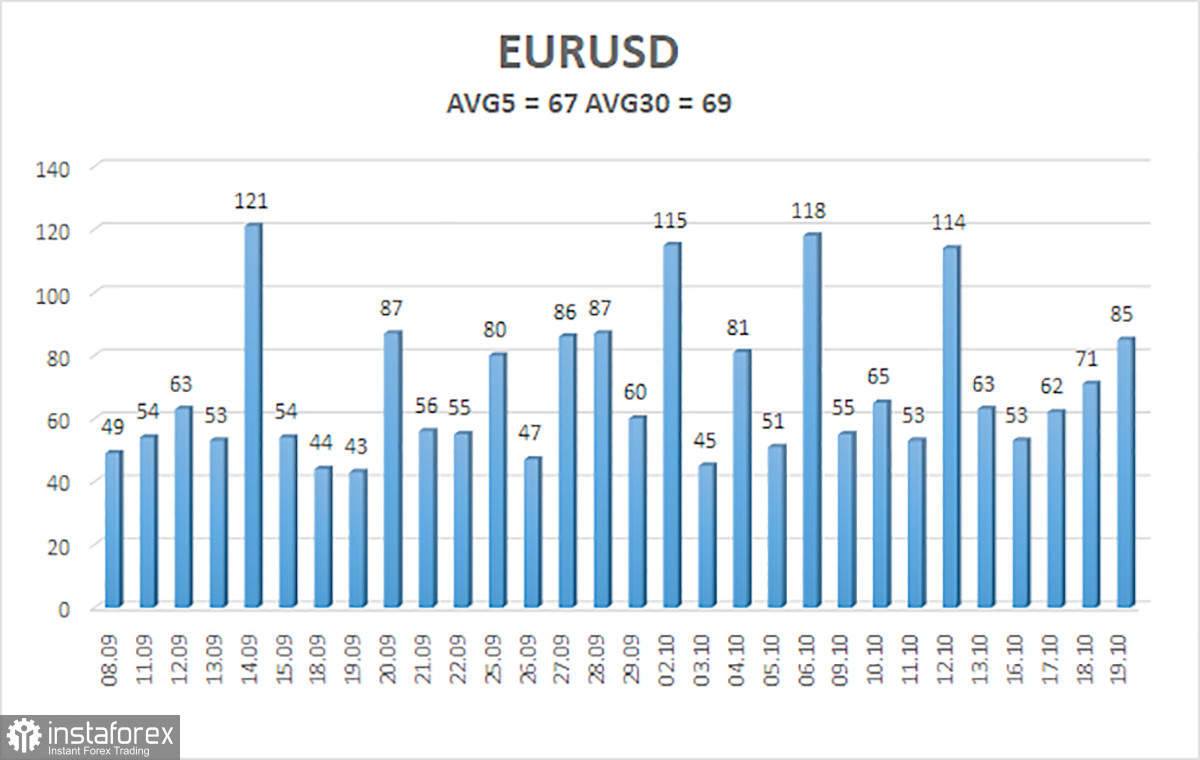

The average volatility of the euro/dollar currency pair over the last 5 trading days as of October 20th is 67 points and is characterized as "average." Therefore, on Friday, we expect the pair to move between the levels of 1.0508 and 1.0642. A reversal of the Heiken Ashi indicator upwards will indicate a new phase of the downward movement.

The nearest support levels:

S1 – 1.0498

S2 – 1.0376

S3 – 1.0254

Nearest Resistance Levels:

R1 – 1.0620

R2 – 1.0742

R3 – 1.0864

Trading Recommendations:

The EUR/USD pair has repositioned itself above the moving average. At this time, there is a high likelihood of a flat, so the price can easily cross the moving average in both directions. Each such crossing does not guarantee movement in the desired direction, not even by 50 pips. We advise caution with any trading signals.

Explanations for the illustrations:

Linear regression channels – help determine the current trend. If both are pointing in the same direction, it means the trend is currently strong.

Moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted at the moment.

Murrey Levels – target levels for movements and corrections.

Volatility levels (red lines) – the likely price channel in which the pair will spend the next day based on current volatility indicators.

CCI indicator – its entry into the overbought region (below -250) or the oversold region (above +250) indicates an impending trend reversal in the opposite direction.