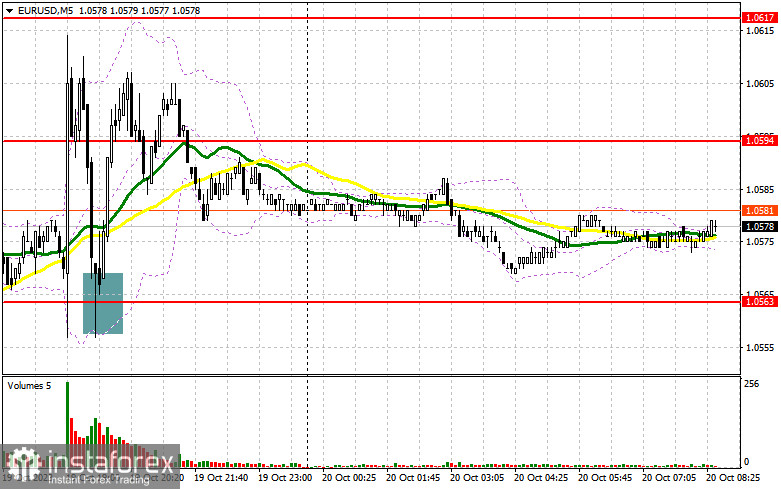

Yesterday, the pair formed just one entry signal. Let's have a look at what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.0540 as a possible entry point. The price reached this level but failed to form a proper entry point due to low market volatility. In the afternoon, the instrument formed a good entry point for buying the euro after defending the level of 1.0563 and performing its false breakout. As a result, the pair went up by 40 pips.

For long position on EUR/USD:

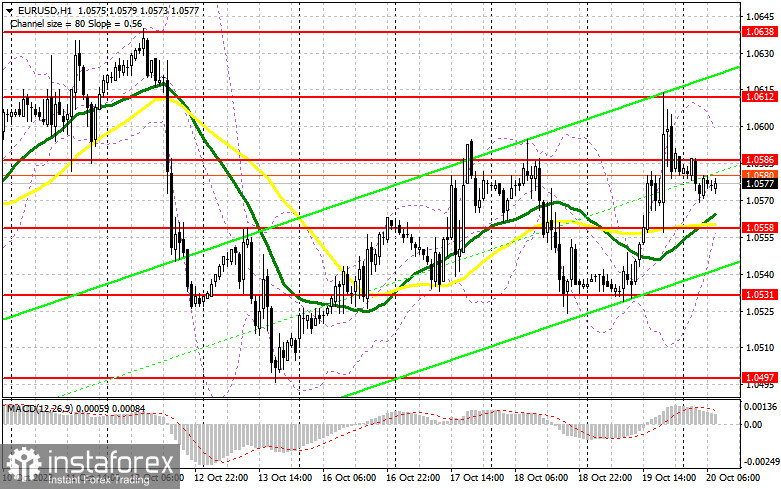

Following Jerome Powell's recent comments about a potential pause in the rate-hiking cycle, the euro saw significant strengthening against the backdrop of a weakening US dollar. Today's agenda includes Germany's Producer Price Index (PPI) report, which is unlikely to lend the same support to the euro. Hence, an optimal buying opportunity might arise on dips, particularly after a false breakout around the new support level at 1.0558. This is where the moving averages support the buyers. This will create a good entry point for long positions, aiming for an upward correction and potentially testing yesterday's resistance at 1.0586 which was formed yesterday. A breakout and a downward retest of this range can pave the way for a surge up to 1.0612. The ultimate target is found at 1.0638 where I plan to take profits. If EUR/USD declines and shows a lack of activity around 1.0558 in the first half of the day, the euro might face additional pressure, handing control back to the sellers. In such a scenario, only a false breakout around 1.0531 would provide an entry signal. I would immediately go long on a bounce from 1.0497, aiming for an intraday upward correction of 30-35 pips.

For short positions on EUR/USD:

Euro sellers seemed to have missed their opportunity yesterday. Now would be a good time to strategize to keep the pair within the newly formed sideways channel seen over the week. It is critical for bears to defend the immediate resistance at 1.0586 in the early half of the day. A false breakout at this level can serve as a selling signal, targeting a downward move to the support at 1.0558, which also acts as the midpoint of the sideways channel. A breakout and consolidation below this range, followed by a downward retest, might offer another selling signal targeting yesterday's low at 1.0531. The ultimate target is seen at the low of 1.0497 where I aim to take profits. If EUR/USD ascends during the European session and bears fail to hold at 1.0586, buyers might attempt to continue the correction. In such a scenario, I would postpone going short until the price reaches the 1.0612 resistance. Selling there would be viable but only after a failed breakout. I would go short immediately after a bounce from the high of 1.0638, considering a downward correction of 30-35 pips.

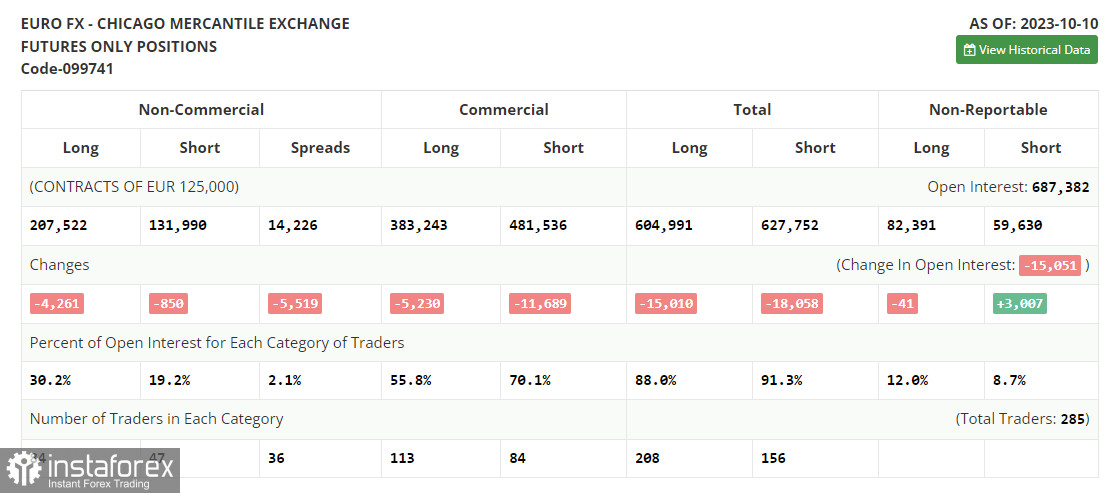

COT report

The Commitments of Traders (COT) report for October 10 showed a reduction in both long and short positions. Given recent US data releases and the high inflation reported in September this year, many traders and economists are questioning whether the Federal Reserve will maintain its pause or increase borrowing costs during its November meeting. The ongoing conflict between Israel and HAMAS, along with various negative impacts on the global economy, has led to a sharp decline in demand for risk assets, which further pressures the European currency. The European Central Bank's firm stance poses yet another challenge to the euro as the Eurozone's economy continues to contract. The only positive factor is the weakening euro which now looks quite appealing to investors. The COT report reveals that non-commercial long positions decreased by 4,261 to 207,522, while non-commercial short positions declined by 850 to stand at 131,990. This resulted in the spread between long and short positions shrinking by 5,519. The closing price was up at 1.0630 compared to 1.0509, indicating a slight upward correction in the euro.

Indicator signals:

Moving Averages

Trading above the 30- and 50-day moving averages indicates an attempt to develop an uptrend.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If the pair declines, the lower band of the indicator at 1.0558 will act as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.