Bitcoin is starting the second trading week on a bullish note, testing the $31k level. The previous week was also favorable for the cryptocurrency, with the exception of some consolidation on Tuesday and Wednesday. During that time, macroeconomic factors and relative geopolitical stability positively influenced the cryptocurrency's upward movement.

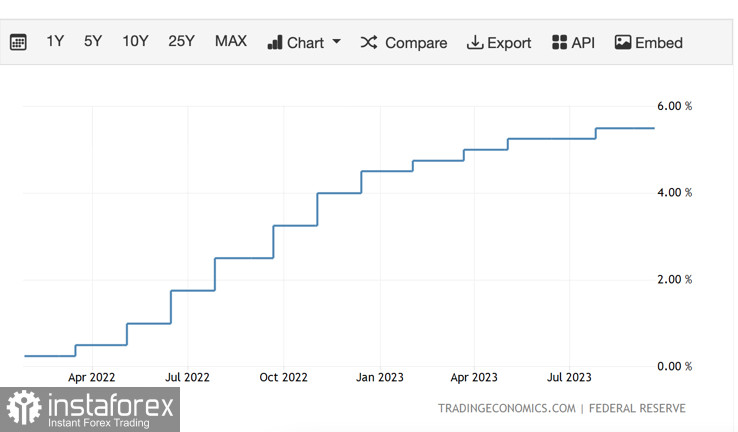

Given the continued positive momentum over the weekend, Bitcoin began Monday with a strong upward move towards $31k. This was largely due to increased trading activity and a strong defense of the $29.5k level. The absolute confidence of investors in a pause in the Fed's key rate hike in November also played a key role in Bitcoin's strong rally. However, do all these factors provide ironclad confidence that BTC/USD will continue its upward movement in the new trading week?

Fundamental Factors

Among the key macroeconomic factors that allowed Bitcoin to resume its upward movement, the pause in the Fed's key rate hike and relative calm in the Middle East stand out. The ground operation in the Gaza sector has been postponed, and oil prices remain stable as a result. However, considering the rise in the price of Bitcoin, even in the event of an escalation in the situation in the Middle East, the cryptocurrency may end up among the winners.

It has been reported that in recent weeks, with the rising tension in the Persian Gulf region, Bitcoin has increased its correlation with precious metals, especially gold. This suggests that investors are using BTC as a safe-haven asset. This is a peculiar situation, given the manipulation of the Bitcoin price by a Cointelegraph journalist, which led to an $80 million liquidation. Nevertheless, with the stable and prolonged rise in Bitcoin's price, more investors are turning to it as an alternative to gold.

At the same time, the cryptocurrency market continues to be pumped with positive news regarding the potential approval of a spot BTC-ETF. The likelihood of approval of such a product is increasing as the cryptocurrency market's capitalization grows. However, it is worth considering that the SEC is likely to delay a decision on a spot BTC-ETF after a manipulative case that occurred last week.

BTC/USD Analysis

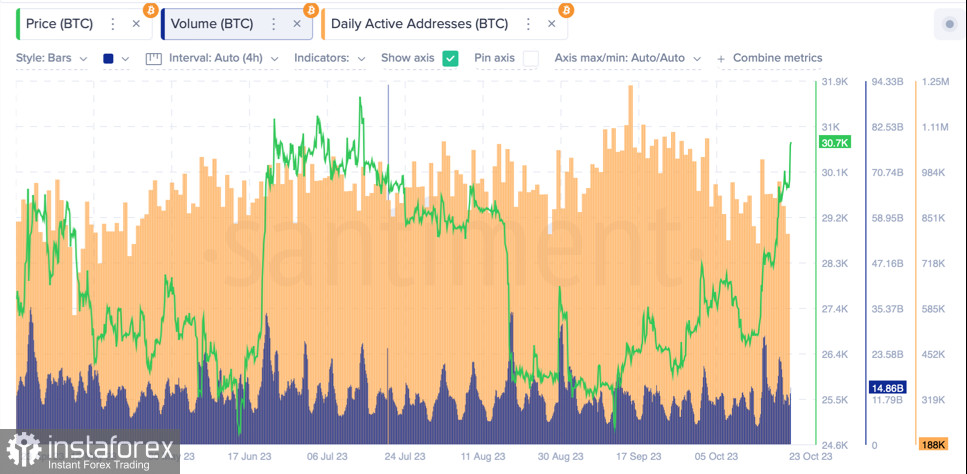

For the second consecutive week, we are witnessing active buying from Asian markets, which may be related to the recovery of the Chinese economy. As of October 23rd, Bitcoin is trading near the $30.5k level, constantly making upward surges toward $31k. Daily trading volumes are at $14.7 billion, which is a significant turnover for the beginning of the trading week.

BTC/USD has successfully established itself above the $30.5k level, which serves as a platform for further movement towards $31k and beyond to $36k. However, it is essential not to overestimate the current upward movement of Bitcoin. The cryptocurrency is still within a wide consolidation period that has lasted for over six months. If BTC/USD confidently and irreversibly breaks through the $32k level, the situation will change at a macro level.

For now, we are witnessing local buying efforts within the context of a global consolidation period. Technical metrics continue their upward movement, although the stochastic oscillator has shifted to a sideways range in the overbought zone, suggesting a potential local correction to $30k. There is also an activation of sellers in the $30.8k-$31k zone, with the aim of seizing the initiative to push the bulls below $30.5k.

Conclusion

Bitcoin is starting the new trading week rapidly, updating local highs. Market sentiment remains bullish, but it's important to take into account the ongoing risks related to macroeconomic factors and geopolitics. Given the relative calm on the global stage, it's worth focusing on the $31k level as the primary target for the bulls. In terms of significant changes, pay close attention to the $31.8k-$32.1k range, as a breakout could pave the way for a move to $40k.