The Bank of Canada will hold its meeting on October 25, which is also the penultimate meeting of the year. According to the overwhelming consensus among experts, the central bank will maintain all of its monetary policy parameters as they are. However, some intrigue surrounds the upcoming meeting. There is no doubt about the formal outcomes of the October meeting. Yet, the tone of the accompanying statement and the rhetoric of the head of the central bank may differ from those in September. Some indirect indicators suggest that it may not be in favor of the Canadian dollar due to the decreasing inflationary pressures in the country. However, if the central bank maintains its combative stance and allows another interest rate hike in the upcoming meetings, USD/CAD sellers will have a significant reason to launch a counterattack.

Let's be clear: the hawkish scenario is unlikely due to the decline in key inflation indicators in September. However, it cannot be completely ruled out. The recent statements of Bank of Canada Governor Tiff Macklem have been quite vague, so the bulls should not relax just yet. The Bank of Canada could present a hawkish surprise in the form of a change in rhetoric.

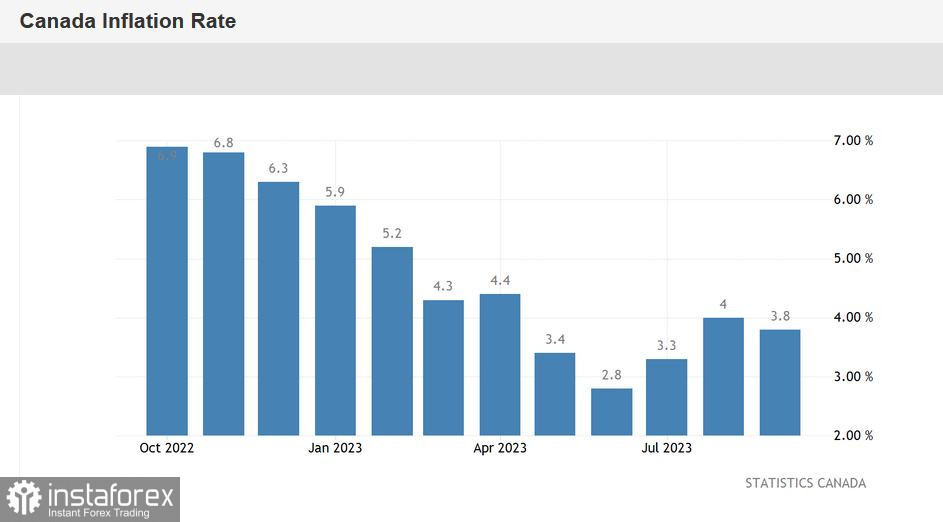

But let's start with the arguments against the Canadian dollar (loonie). Last week, Canada released its key inflation report for September. All components of the report ended up in the "red zone," falling short of forecasts. For instance, the Consumer Price Index (CPI) decreased by -0.1% on a monthly basis, compared to an expected increase of 0.2%. This reading entered negative territory for the first time since December 2022. On an annual basis, the CPI reached 3.8%, missing forecasts of 4.1%. This indicator had been showing an upward trend over the last two months by reaching the 4.0% target. Therefore, the September result has symbolic significance.

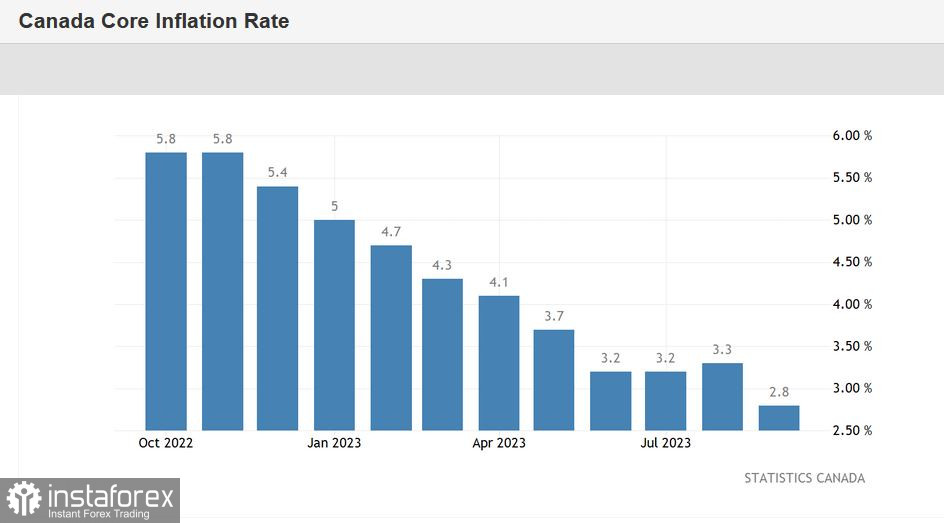

The core Consumer Price Index, which excludes the volatile prices of energy and food, also ended up in the "red zone." On a monthly basis, the core index fell by -0.1%, compared to an expected increase of 0.3%, and on an annual basis, it dropped to 2.8%, the lowest level since July 2021. The consensus estimate was for it to be at 3.3%.

The structure of the report indicates a slowdown in the pace of food inflation. In August, this component grew by 6.9% year-on-year, while in September, it increased by 5.8%. Commenting on this release, representatives from the Statistics Office noted that the slowing cost of living was also due to a decrease in prices for a range of goods and services (travel, durable goods, and the aforementioned food items). However, the primary pressure on inflation came from expenses related to gasoline and electricity, rent, mortgage interest payments, and dining out.

The bulls were pleasantly surprised by the data. Clearly, the easing of price pressure in Canada has created the conditions for the country's central bank to keep its key interest rate unchanged. The majority of currency strategists are confident that the Bank of Canada will maintain the status quo.

However, many analysts caution that the country's inflation level remains too high to be considered comfortable, despite the downward trends of recent months. During his last speech, Macklem expressed concern about the slow pace of softening inflation. According to him, at the October meeting, central bank members will focus on discussing a key question: whether the Bank should stick to the current interest rate (5.0%) or take additional steps to restore price stability.

As we can see, despite the "red"hue of inflation in September and the effectively predetermined outcome of the October meeting, it's premature and unreasonable to talk about an impending "defeat" for the loonie. Comments from Macklem, as well as the tone of the accompanying statement, could disappoint the bulls. If the Bank suggests the need for another rate hike, the Canadian dollar will rally, especially in light of Fed Chair Jerome Powell's cautious remarks last week.

But if the Bank of Canada is content with the pace of inflation and states that the current monetary policy is "working as expected," the pair will continue to rise, at least towards the resistance level at 1.3800.

From a technical perspective, on the daily chart, the pair is in between the middle and upper Bollinger Bands lines, and above all the lines of the Ichimoku indicator (including the Kumo cloud), which shows a bullish Parade of Lines signal. This indicates a high chance that the pair will rise further. The immediate target for the upward movement is the aforementioned 1.3800 level, which corresponds to the upper Bollinger Bands line on the daily chart. The support level is the middle Bollinger Bands line on the same timeframe, at 1.3640.