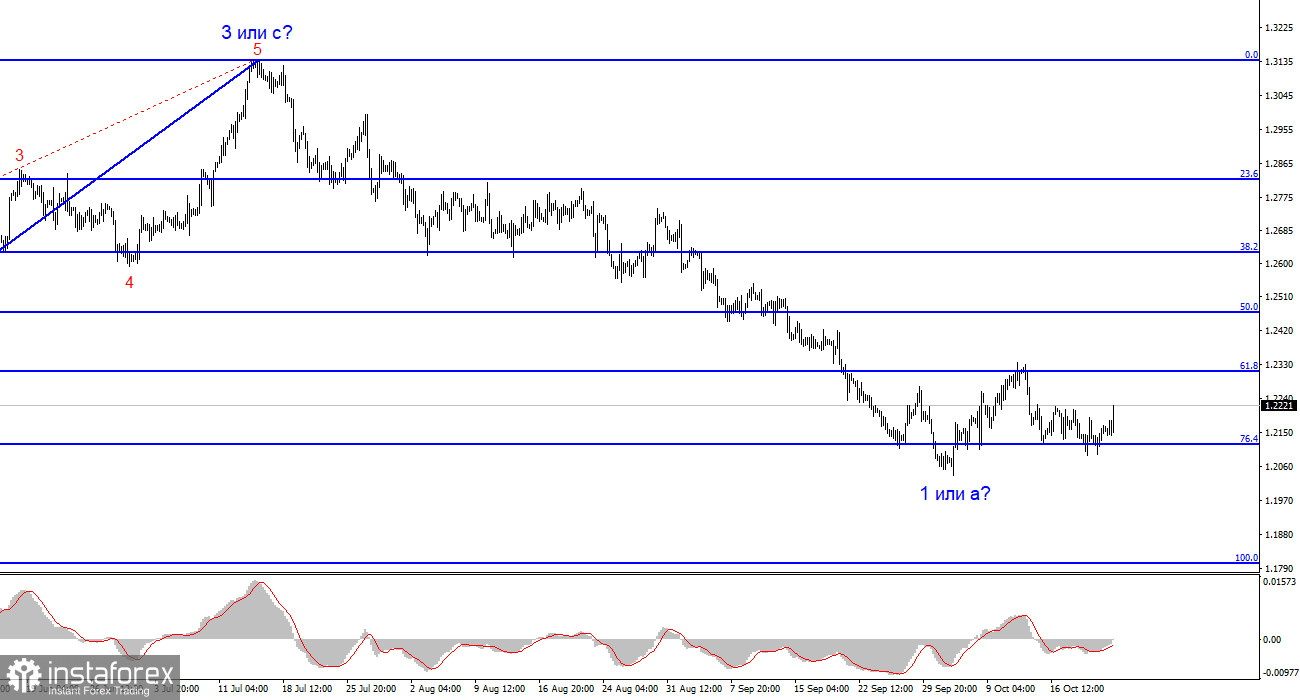

Lately, the wave analysis for both instruments has raised no questions. For a long time, the first waves of new downtrends were being formed. Now, the construction of the second wave has begun, which may conclude shortly or take a complex corrective form (e.g., a-b-c-d-e). Regardless, quotes continue to rise, and economists and analysts have started to debate whether the dollar has enough grounds to strengthen further.

I want to clarify that I believe that the dollar strength has got further to run, as the spread between the European Central Bank and the Federal Reserve rates is significant. This statement is unfair to the pound and the Bank of England, but it's worth remembering that in most cases, the pound follows the euro. The second reason why I believe in the dollar's strength is due to the wave analysis, which clearly indicates the beginning of a new downtrend. A trend must consist of at least three waves. Therefore, after completing the construction of the current waves 2 or b, a new downtrend will begin, which in strength may not be inferior to wave 1 or a.

Analysts at MUFG Bank believe that it will be challenging for the U.S. dollar to maintain high demand. They argue that the high yield on 10-year Treasury bonds will support the U.S. currency, but this factor alone may not be enough for the dollar to rise by 6-10 cents against the euro and the pound. In any case, such a move will take a lot of time. Analysts have also taken note of the GDP figures for the third and fourth quarters. Economic growth of 4.1% is expected in the third quarter, but the economy may contract significantly in the fourth quarter. In 2024, if not a recession, the pace of growth may noticeably slow down. Also, the Fed may start to ease monetary policy next year, which will impact the dollar.

These conclusions represent a relatively long-term perspective that does not affect the dollar at this time. Based on this, I conclude that movements will continue to align with the current wave analysis. If this is the case, you can look for entry points for new short positions, as waves 2 or b are unlikely to be strong. They might be lengthy and complex, but not strong.

Based on the analysis conducted, I conclude that a bearish wave pattern is currently being formed. The pair has reached the targets around the 1.0463 level, and the fact that the pair has yet to break through this level indicates that the market is ready to build a corrective wave. In my recent reviews, I warned you that it is worth considering closing short positions because there is currently a high chance of forming an upward wave. Since the pair has not breached the 1.0637 level, corresponding to 100.0% according to Fibonacci, this suggests that the market is ready to complete the formation of wave 2 or b. In this case, I recommend new short positions.

The wave pattern for the GBP/USD pair suggests a decline within the downtrend segment. The most that we can expect from the pound in the near future is the formation of Wave 2 or b. However, there are currently significant issues, even with the corrective wave. At this time, I would not recommend new short positions, but I also do not recommend longs because the corrective wave appears to be quite weak. In any case, this is a corrective wave.