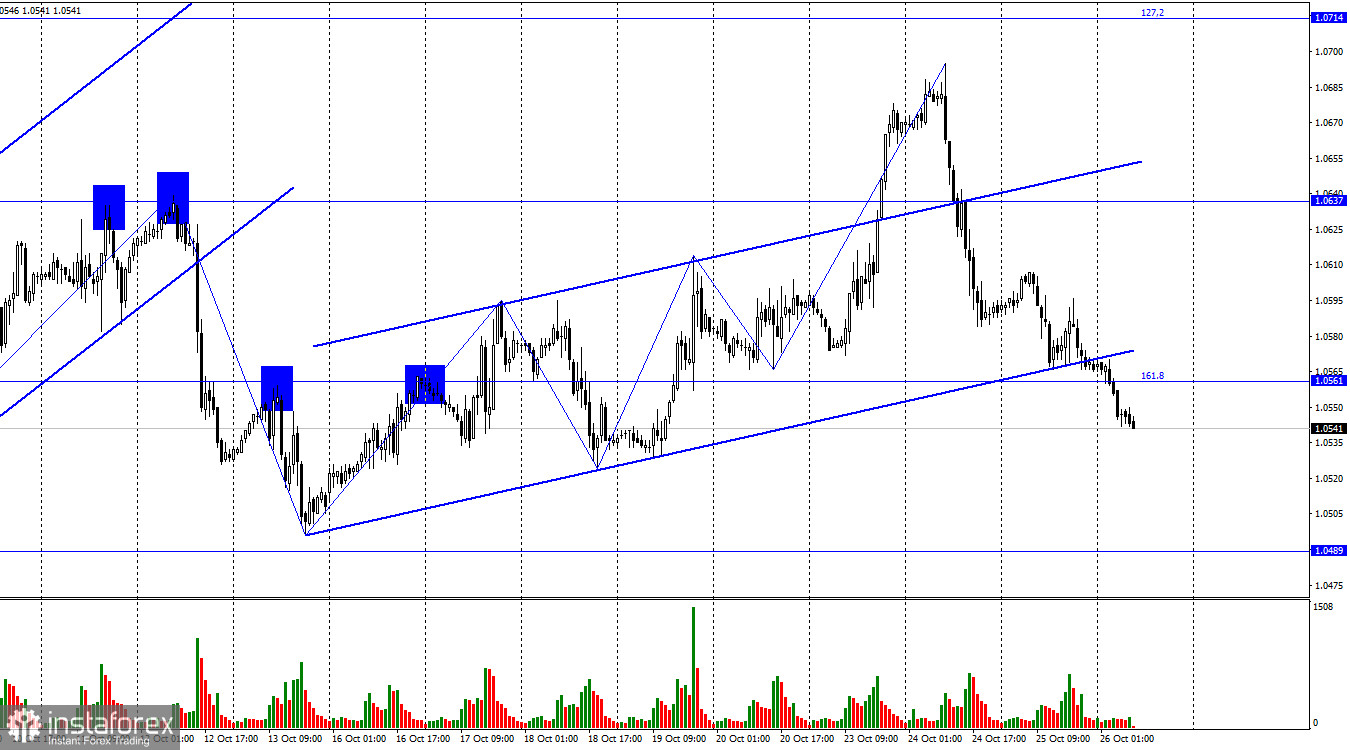

The EUR/USD pair continued its decline on Wednesday, securing its position below the ascending trend corridor and the corrective level of 161.8% (1.0561). Thus, trader sentiment has turned "bearish," and the decline in quotes may continue towards the next level at 1.0489 or slightly higher, where one of the recent price lows is located. A close above the 1.0561 level would favor the euro and some growth towards the 1.0637 level.

The wave situation became clearer yesterday. If a "bullish" trend was forming in the last week, the last downward wave broke through the lows of the penultimate wave. Thus, the first sign of a trend change to "bearish" has been received. Combined with a close below the trend corridor, I would say that the pair has excellent chances to continue its decline. The first downward wave of the new trend turns out to be quite large, so I expect an upward wave to form today or tomorrow.

Today is the ECB meeting. The fact that the European currency has been declining for three consecutive days clearly indicates that the market does not believe in an interest rate hike or Christine Lagarde's promises to raise rates in the future. The market is set for "dovish" rhetoric and words about the need to keep rates at their current level for an extended period. We have heard all of this from ECB Council members many times. I am not expecting any surprises from the regulator today, but it's important to remember that ECB meetings always carry risks. One wrong word from Lagarde, and the market can turn 180 degrees. Considering that an upward wave is now highly likely, this scenario has a good chance of materializing.

On the 4-hour chart, the pair has established itself below the corrective level of 100.0% (1.0639), allowing for a decline towards the corrective level of 127.2% (1.0466). Closing below this level would increase the chances of further decline towards the next Fibo level at 161.8% (1.0245). The pair closed below the trend corridor, but it is almost the same as on the hourly chart.

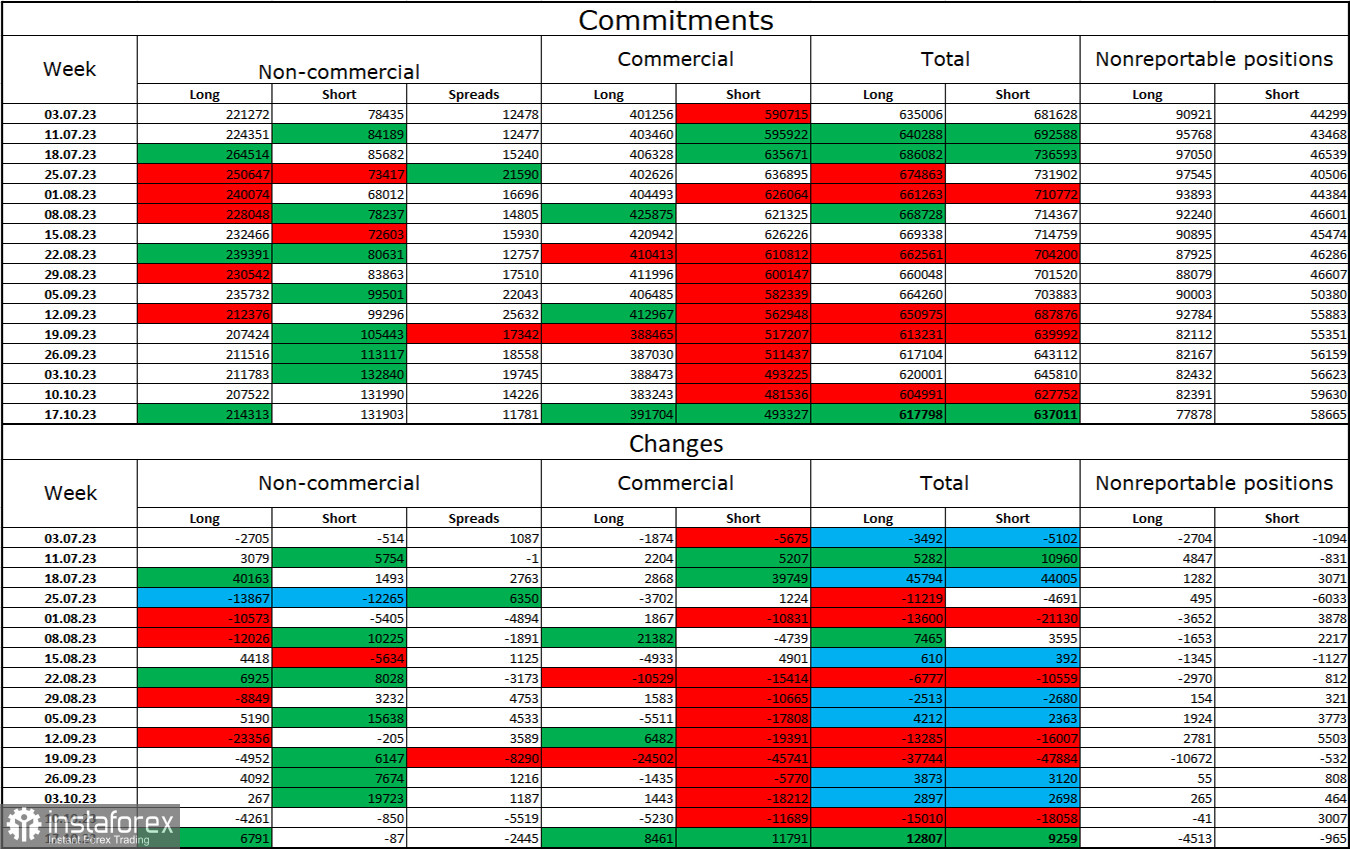

Commitments of Traders (COT) Report:

In the last reporting week, speculators opened 6,791 long contracts and closed 87 short contracts. Large traders' sentiment remains "bullish" but has noticeably weakened in recent weeks and months. The total number of long contracts held by speculators is now 214,000, while short contracts amount to 132,000. The difference is now less than double, although several months ago, the gap was threefold. I think the situation will continue to change in favor of the bears. Bulls have dominated the market for too long, and now they need a strong information background to start a new "bullish" trend. Such a background is currently lacking. Professional traders can continue to close their long positions in the near future. I believe that the current figures allow for further declines in the euro in the coming months.

Economic Calendar for the USA and the European Union:

European Union - ECB Interest Rate Decision (12:15 UTC).

European Union - ECB Monetary Policy Statement (12:15 UTC).

USA - Durable Goods Orders (12:30 UTC).

USA - GDP in the Third Quarter (12:30 UTC).

USA - Initial Jobless Claims (12:30 UTC).

European Union - ECB Press Conference (12:45 UTC).

On October 26, the economic calendar includes numerous interesting entries. The most significant event is the ECB meeting, but the other data and reports are also highly important. The impact of the information flow on trader sentiment throughout Thursday can be very strong.

EUR/USD Forecast and Trader Advice:

Buy opportunities for the pair may arise today if there is a rebound on the hourly chart from level 1.0489 (1.0495) with a target at 1.0561. As for selling, I recommend it when the hourly chart closes below the range, targeting 1.0489 (1.0495).