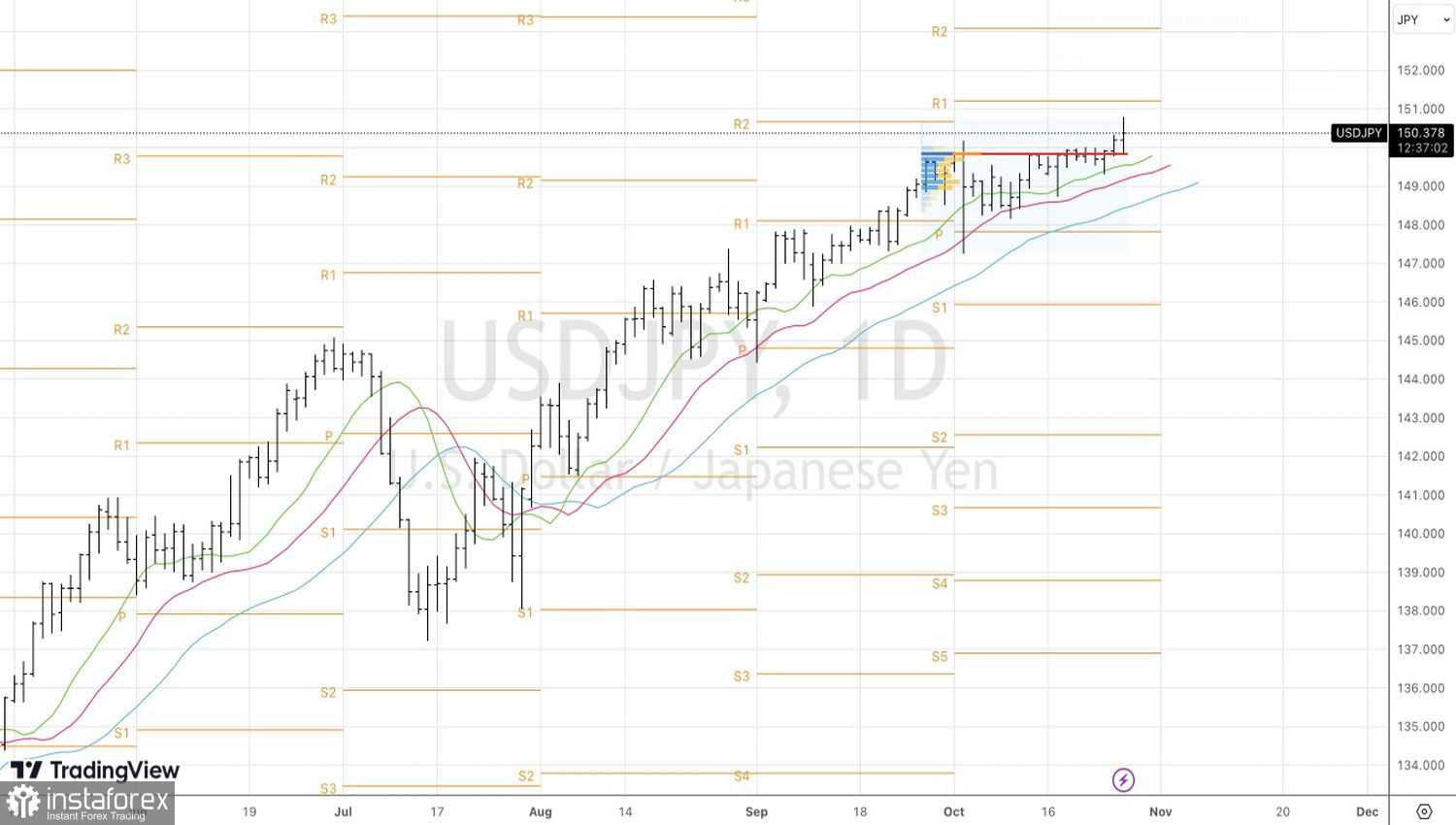

The higher the USD/JPY quotes rise, the more often the market recalls currency interventions. The pair flirting with the psychologically significant level of 150 is strikingly similar to the events of autumn 2022. Back then, the Bank of Japan spent about $60 billion to save the yen. It didn't work the first time, but luck came later. Today, a deja vu feeling constrains the bullish movements in USD/JPY.

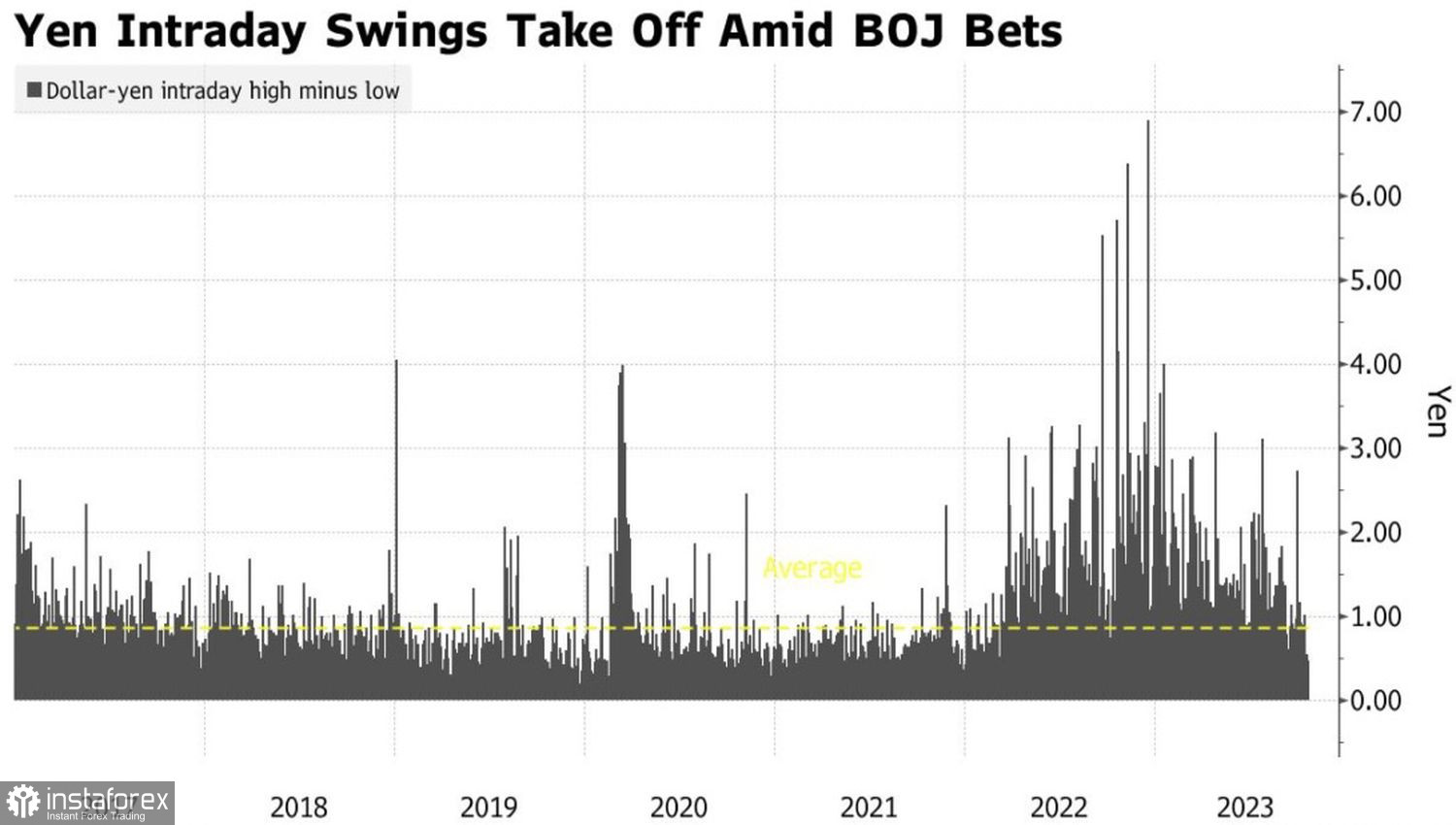

Just like last year, government officials talk about the undesirability of sharp exchange rate fluctuations and their readiness to intervene in the Forex market if necessary. They claim to have all the tools for it. However, there is one exception: the current volatility of the Japanese currency is at its lowest since 2019. If Tokyo is concerned about exchange rate fluctuations rather than a specific USD/JPY level, this is not the best time for interventions.

Dynamics of USD/JPY exchange rate volatility

However, investors are still nervous, especially as the Bank of Japan's meeting on October 31 approaches. The rapidly rising yields of local bonds could lead to an unexpected decision by the Board of Governors to abandon control over the 10-year bond rates. Verdicts about expanding the targeted range, first to +/-0.5% and then to +/-1%, happened out of the blue for the markets, causing the yen to strengthen against major world currencies. Will history repeat itself at the end of the second month of autumn? No one knows, but it's essential to stay vigilant.

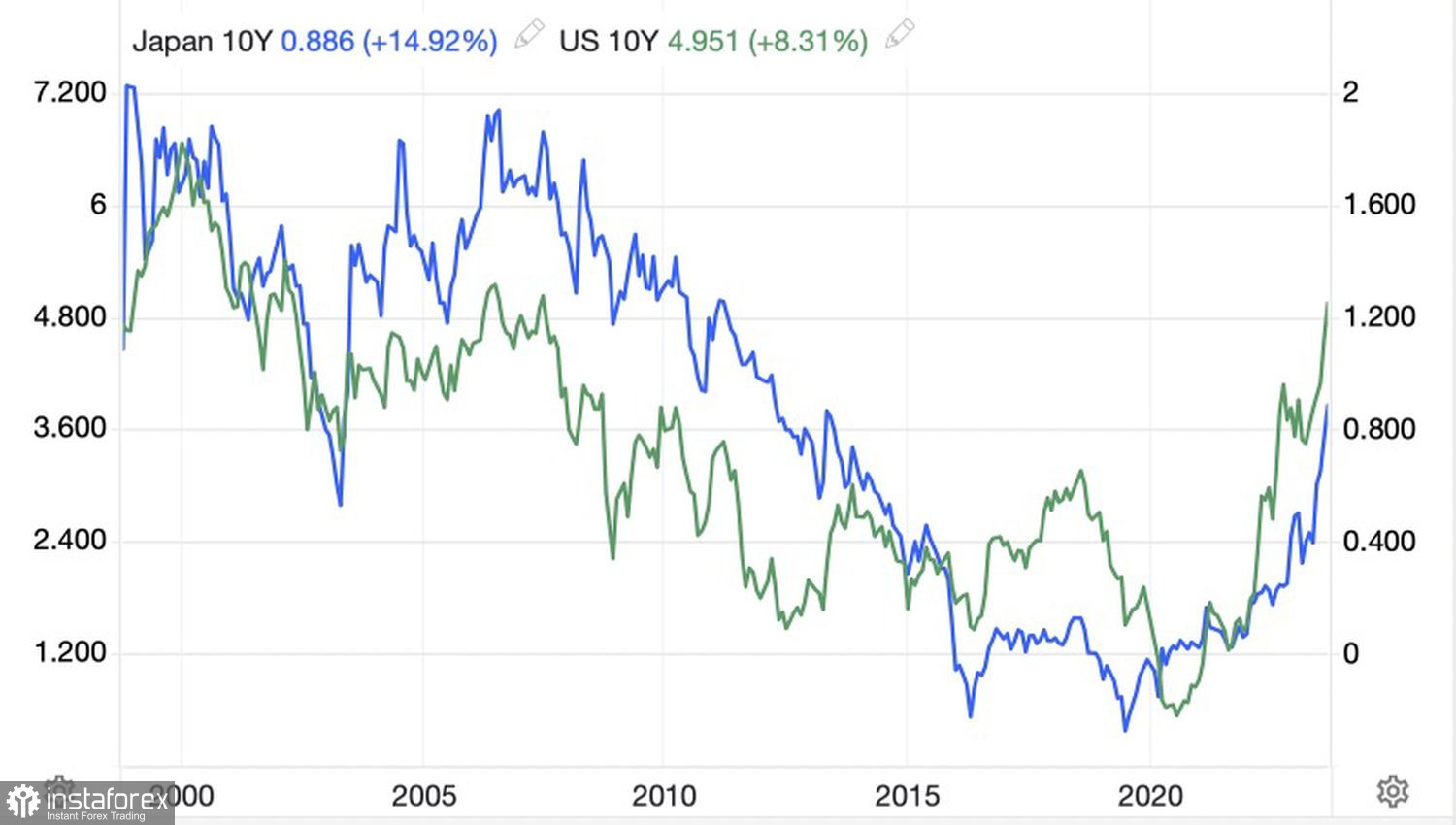

Even though currency interventions or the abandonment of yield curve control can lead to a sharp drop in USD/JPY, the upward trend will still remain intact. It is driven by divergences in monetary policy and economic growth, as well as the accompanying rally in U.S. bond yields compared to their Japanese counterparts.

Dynamics of U.S. and Japanese bond yields

Bloomberg experts forecasts the U.S. economy to expand by 4.5% in the third quarter, and American business activity hints at further GDP growth. In Japan, on the other hand, purchasing manager indices have been declining for the fifth consecutive month. Being below the critical mark of 50 signals a potential recession.

The futures market assesses the chances of a federal funds rate hike at 29% in December and 38% in January. Even if the Federal Reserve's monetary policy tightening cycle is over, the cost of borrowing will remain at 5.5% for a long time. A significant divergence from negative overnight rates in Japan has made the yen the major underperformer among G10 currencies. Since the beginning of the year, it has lost about 13% of its value against the U.S. dollar.

There is no reason to doubt the strength of the upward trend from a technical standpoint. It is gaining momentum and is quite capable of pushing USD/JPY to levels of 151.2 and 153. Use pullbacks towards moving averages with subsequent rebounds from them to form long positions.