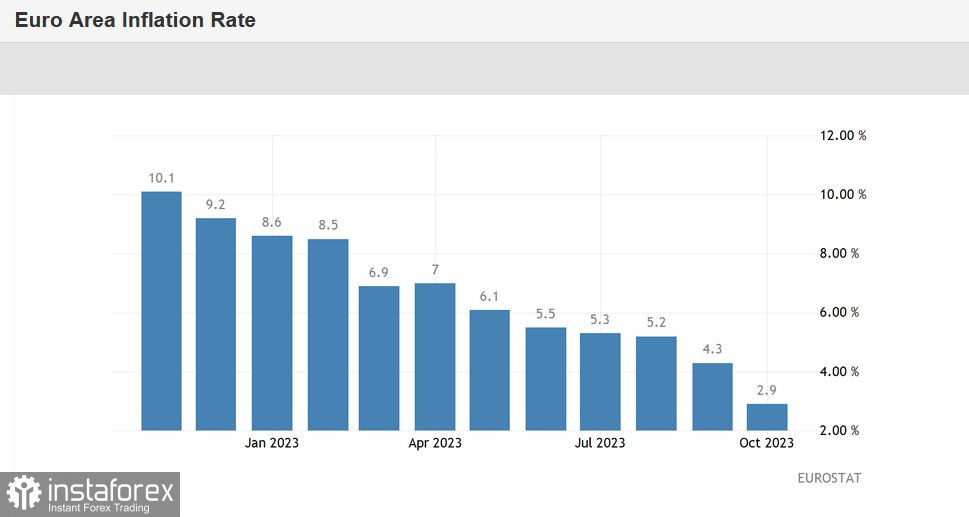

The euro-dollar pair, after a sharp surge towards the resistance level of 1.0670 (the lower boundary of the Kumo cloud on the D1 timeframe), made a 180-degree turn and is currently trading in the middle of the 5th figure. Such price dynamics were primarily driven by the weakening of the euro: yesterday's report on inflation growth in the Eurozone was clearly unfavorable for the single currency.

On Monday, German figures also demonstrated a similar downward trajectory. Inflation in Germany and the Eurozone is actively declining, and this fact has put a strong emphasis on the discussion of the possible additional tightening of the European Central Bank's policy. Furthermore, after the published data (reflecting a slowdown in inflation amid a slowing European economy), the market again started to discuss the possibility that the central bank may consider lowering interest rates in the first half of next year.

In light of these assumptions, the EUR/USD pair came under significant pressure, losing over 100 pips in just a few hours. If it weren't for the upcoming FOMC meeting, with results expected today, selling the pair could be confidently recommended. However, the prospects of a bearish trend still appear uncertain, given the cautious position expressed by the head of the Federal Reserve at the end of October. Therefore, it is safer to remain in a wait-and-see position until the FOMC's decision is announced.

But let's return to the inflation reports. Germany's annual consumer price index fell immediately to 3.8%, while the harmonized index dropped to 3.0% (the weakest growth rate since August 2021). Simultaneously, it was announced that the German economy contracted by 0.1% in the third quarter due to weak purchasing power.

The report on inflation growth in the Eurozone also did not favor the euro, especially the overall consumer price index. Despite an expected decline to 3.1% on an annual basis, it plummeted to 2.9% (compared to 4.3% in September). This is the weakest growth rate of the indicator since July 2021. The core consumer price index predictably dropped to 4.2% (the lowest value since August 2022).

The report's structure indicates a significant decrease in energy costs. Energy prices in the Eurozone plummeted by over 11% YoY last month (for comparison, in September, this component dropped by 4.6%). Additionally, the growth in prices for food, alcohol, and tobacco slowed significantly (from 8.8% to 7.5%), as well as for services.

Simultaneously, Eurostat reported that the Eurozone's GDP contracted by 0.1% in the third quarter, whereas most experts expected stagnation. This is primarily due to the fact that the largest European economy, Germany, slipped into negative territory, which had a significant impact on the overall European result. France's GDP increased by 0.1%, while Italy's remained unchanged.

So, in summary, we have a slowdown in inflation in Germany (and in the Eurozone as a whole), along with a simultaneous contraction of the economy—both in Germany and the Eurozone.

It's evident that, on the one hand, the European Central Bank's strict monetary policy is bearing fruit. On the other hand, it's clear that the largest economies in the Eurozone are burdened by high interest rates, demonstrating either stagnation, contraction, or minimal growth.

All of this indicates that the ECB will continue to maintain a pause in raising interest rates. In the foreseeable future (at least in the coming months), the ECB may not consider easing its policy. The fight against inflation (which is quite successful) takes precedence, even at the expense of economic growth.

In one of her speeches, ECB President Christine Lagarde acknowledged that the Eurozone's economy would remain weak at least until the end of this year. At the same time, she noted that as inflation decreases, demand for exports from the Eurozone grows, and real household incomes continue to recover, the economy will strengthen "over the next few years." This disposition, which will evidently be voiced by the ECB for quite some time, will exert background pressure on the euro. Therefore, stable growth in the EUR/USD pair is only possible due to the "steady weakness" of the greenback.

The Federal Reserve, which will conclude its November meeting today, can play a decisive role here. Formal outcomes are predetermined—all parameters of monetary policy will remain unchanged. The main intrigue lies in the subsequent rhetoric of Fed Chairman Jerome Powell and the tone of the accompanying statement.

If the regulator does not rule out a rate hike in December (the probability of this scenario is only 26%, according to the CME FedWatch Tool), the EUR/USD pair may not only test the nearest support level at 1.0500 (the lower Bollinger Bands line on the daily chart) but also return to the main price barrier at 1.0450 (the price low of the current year). If the Federal Reserve indicates that it is willing to keep the rate at the current level for an extended period (hoping for a cumulative effect), the pair will return to the range of 1.0600-1.0670, with the prospect of testing the 1.0700 level. It is advisable to maintain a wait-and-see position until the results of the November meeting are announced.