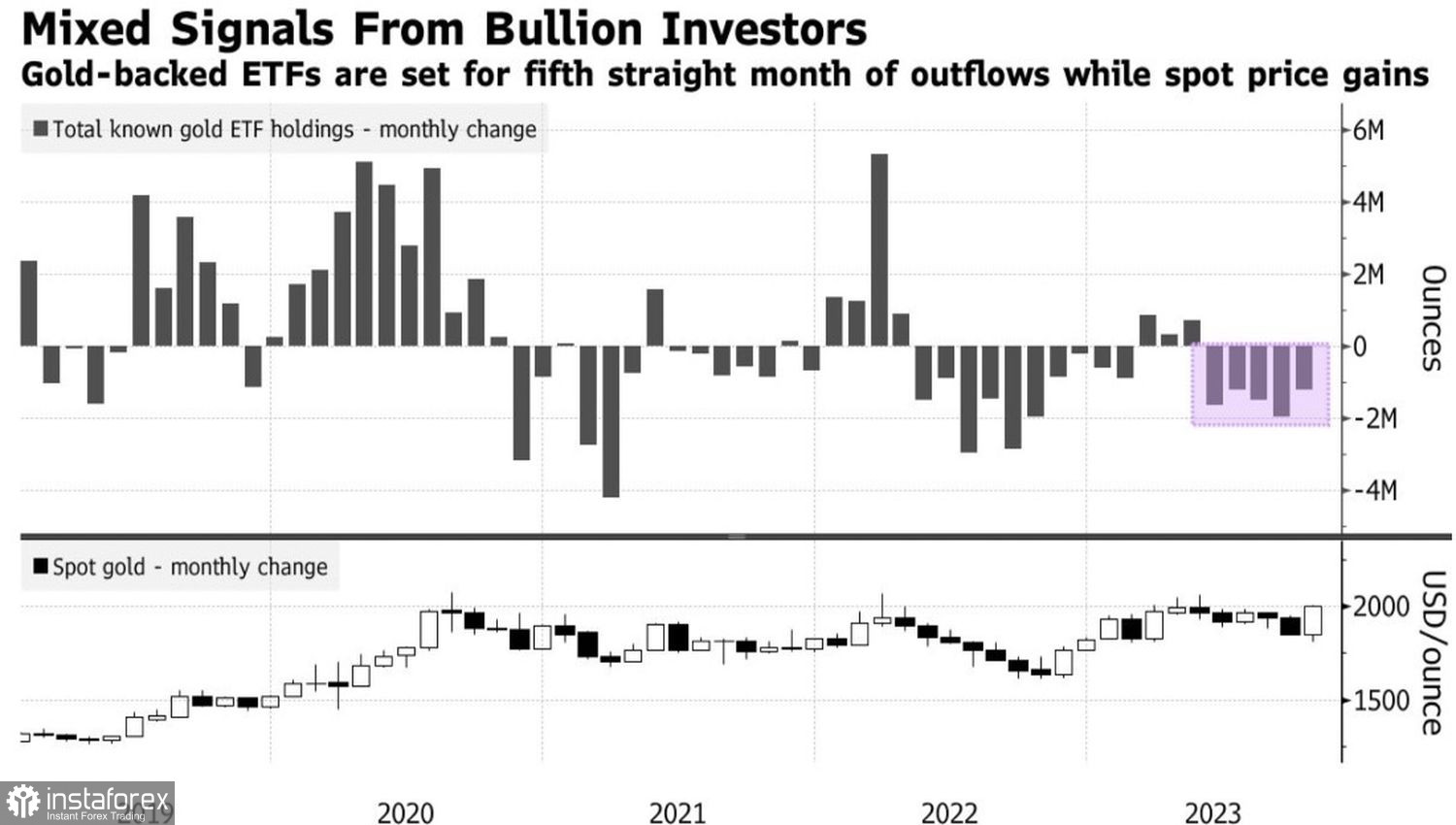

Gold in 2023 continues to surprise. Despite the strong dollar, soaring to its highest levels since 2016, the yield of 10-year Treasury bonds, and the ongoing capital outflow from gold-oriented ETFs for the fifth consecutive month, it has surged above the psychologically important $2000 per ounce mark. And we can attribute this to de-dollarization and geopolitics.

Dynamics of capital flows into gold ETFs

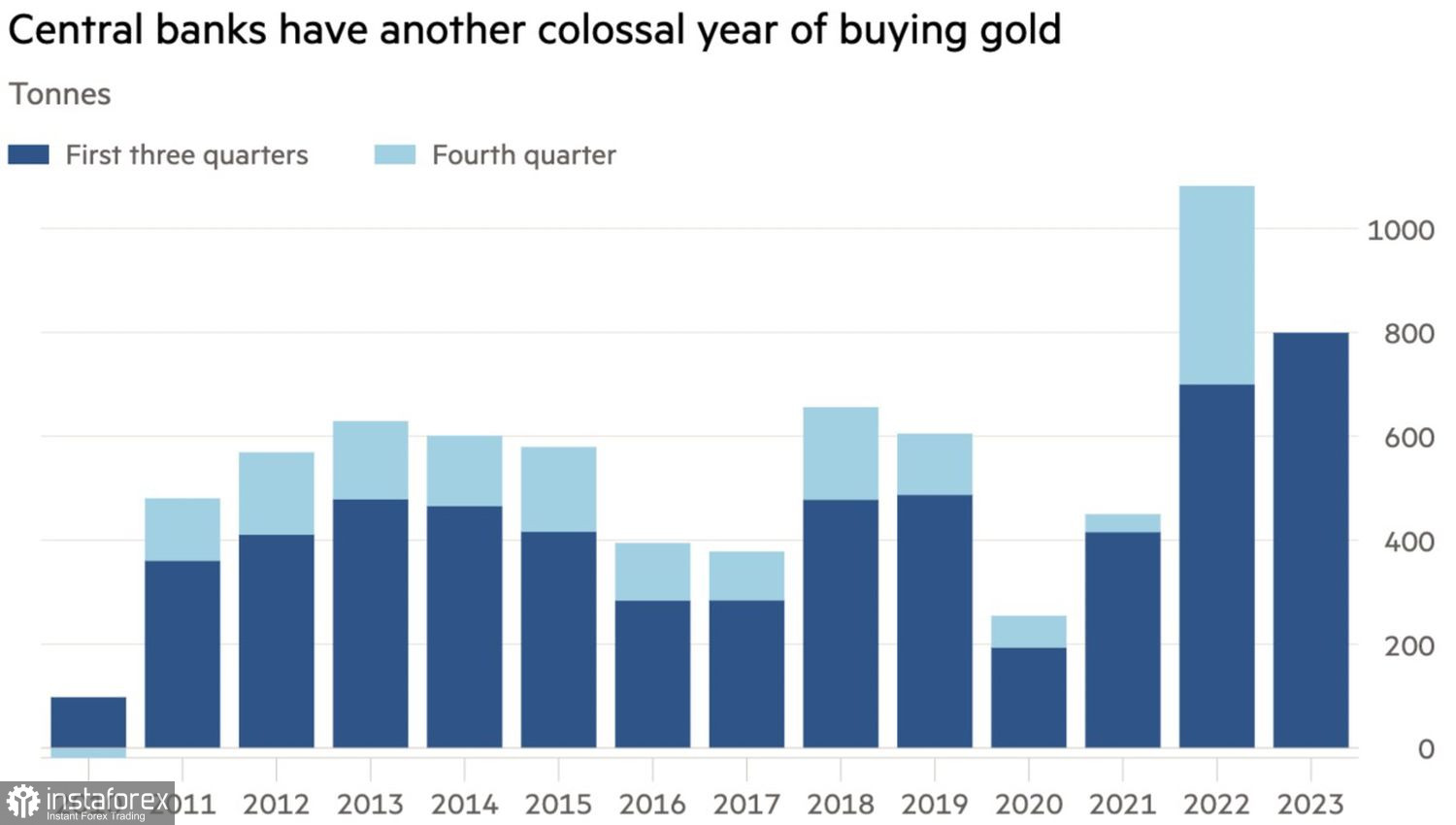

Buy while the blood is flowing. Wars have traditionally had a favorable impact on gold positions. At the same time, the freezing of Russian gold and currency reserves against the backdrop of the armed conflict in Ukraine has triggered processes of moving away from the U.S. dollar and active acquisition of precious metals by central banks. In 2022, they purchased a record 1081 tons, and it seemed that this figure would not be surpassed in the coming years. However, it turned out differently.

From January to September, gold and currency reserves grew by 800 tons, exceeding last year's pace. China is the leader, having acquired 181 tons, increasing the share of gold in its reserves to 4%. In the third quarter, the aggregate figure for central banks increased by 337 tons. Poland and Turkey showed activity, purchasing 57 tons and 39 tons, respectively.

Dynamics of gold purchases by central banks

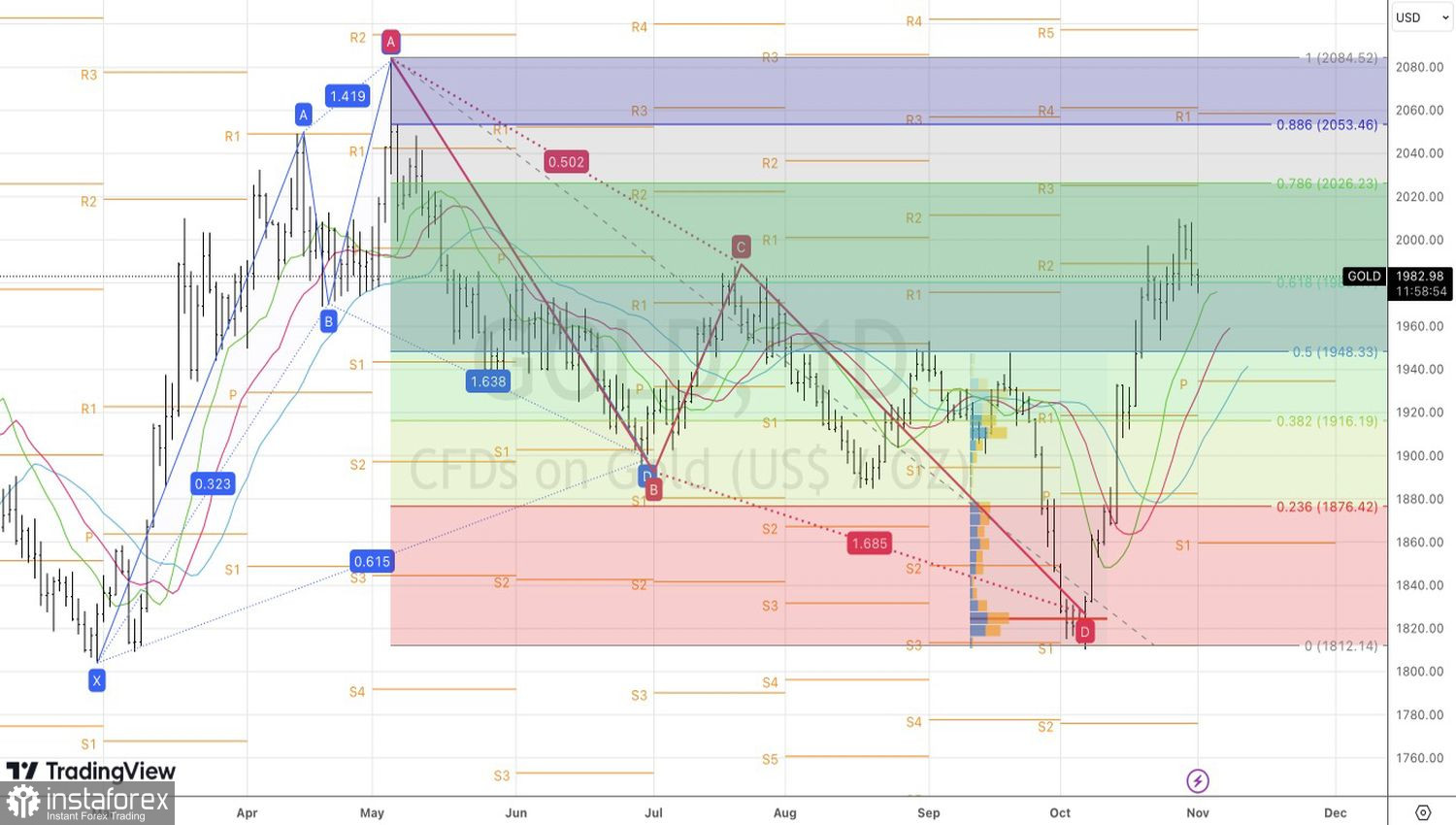

For a long time, XAU/USD quotes were supported by high demand from China. Premiums between Shanghai and London reached up to $100 per ounce. However, this bullish factor gave way to geopolitics. Since the start of the armed conflict in Israel, gold has risen by 9%. Investors have been actively hedging the risks of escalating tensions by increasing the share of precious metals in their portfolios. The topic of Israel's invasion of Gaza was widely discussed in the market. The limited offensive was seen as de-escalation, causing the bulls to retreat.

The outcome of the FOMC meeting and U.S. labor market statistics also play a significant role in the XAU/USD pullback. There's a prevailing view in the Forex market that if the central bank succeeds in achieving a soft landing for the U.S. economy, the yield on 10-year Treasury bonds could soar to 7%. Such high rates would be a real catastrophe for gold. If geopolitical tensions decrease, it also risks falling as rapidly as it rose.

It is predicted that the Federal Reserve will make a "hawkish" pause, keeping interest rates at the same level and leaving the door open for future hikes. If it doesn't, investors will consider the monetary tightening cycle to be over and begin to discuss a dovish pivot. This would weaken financial conditions and make it harder for the Federal Reserve to combat the still-high inflation.

Technically, bears in gold still have the opportunity to realize the 5-0 harmonic trading pattern. To do this, they need to push gold quotes below the 50% Fibonacci level from the last downward wave, which is around $1948 per ounce. As long as precious metal trades above this level, the sentiment remains bullish. We can use pullbacks to establish long positions with targets at $2001, $2012, and $2026.