Review of trades and trading tips for the British pound

The test of the price at 1.2149 occurred when the MACD indicator was in the overbought zone, which clearly limited the further downside potential of the pair. For this reason, I did not buy the pound. The outcome will be determined during the FOMC meeting in the American session. The FOMC statement and Jerome Powell's press conference will truly impact market volatility. A firm stance by the Fed will lead to a rise in the dollar and a fall in the pound. A more dovish position and hints of rate hikes in December will boost demand for GBP/USD, leading to an upward movement. For this reason, I will act based on the implementation of scenario #1.

Buy Signal

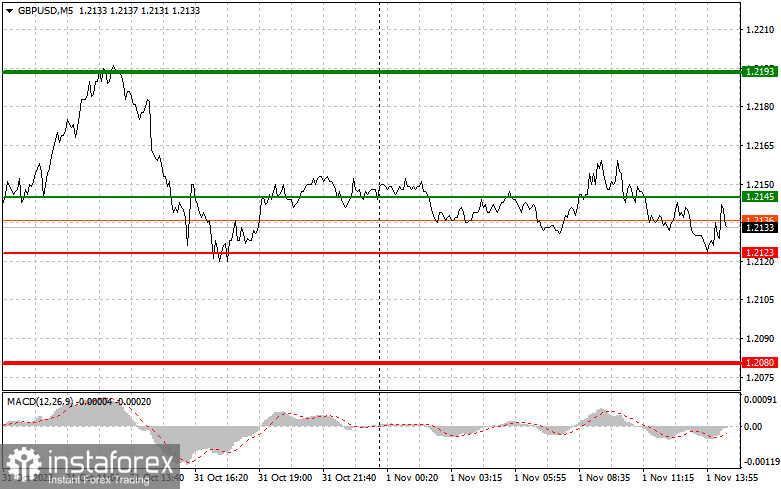

Scenario #1: You can buy the pound today when the entry point reaches around 1.2145 (the green line on the chart), with the aim of reaching the level of 1.2193 (the thicker green line on the chart). I recommend exiting your long positions around 1.2193 and opening short positions in the opposite direction (expecting a 30-35 point movement in the opposite direction from that level). You can only expect the pound to rise after the FOMC's decision on interest rates. Important! Before buying, make sure that the MACD indicator is above the zero mark and is just starting to rise from it.

Scenario #2: You can also buy the pound today in the event of two consecutive tests of the price at 1.2123 when the MACD indicator is in the oversold zone. This will limit the downside potential of the pair and lead to a market reversal upward. You can expect an increase towards the opposite levels of 1.2145 and 1.2193.

Sell Signal

Scenario #1: Selling the pound today is only possible after the level of 1.2123 (the red line on the chart) is updated, which will lead to a rapid decline in the pair. The key target for sellers will be the level of 1.2080, where I recommend exiting your short positions and opening long positions immediately in the opposite direction (expecting a 20–25 point movement in the opposite direction from that level). Pressure on the pound will increase in the case of a firm and unwavering stance by the Fed, with hints of a clear rate hike in December. Important! Before selling, make sure that the MACD indicator is below the zero mark and is just starting to decrease from it.

Scenario #2: You can also sell the pound today in the event of two consecutive tests of the price at 1.2145 when the MACD indicator is in the overbought zone. This will limit the upside potential of the pair and lead to a market reversal downward. You can expect a decline towards the opposite levels of 1.2123 and 1.2080.

Chart Explanation:

Thin green line – entry price for buying the trading instrument.

Thick green line – the anticipated price where you can set Take Profit or independently lock in profits, as further growth above this level is unlikely.

Thin red line – entry price for selling the trading instrument.

Thick red line – the anticipated price where you can set Take Profit or independently lock in profits, as further decline below this level is unlikely.

MACD Indicator. When entering the market, it is important to consider overbought and oversold zones.

Important: Novice traders in the forex market need to be very cautious when making trading decisions. It's best to stay out of the market before the release of important fundamental reports to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always use stop orders to minimize losses. Without placing stop orders, you can quickly lose your entire deposit, especially if you don't use proper money management and trade with large volumes.

And remember, for successful trading, you need to have a clear trading plan, similar to the one I have presented above. Making spontaneous trading decisions based on the current market situation is initially a losing strategy for intraday traders.