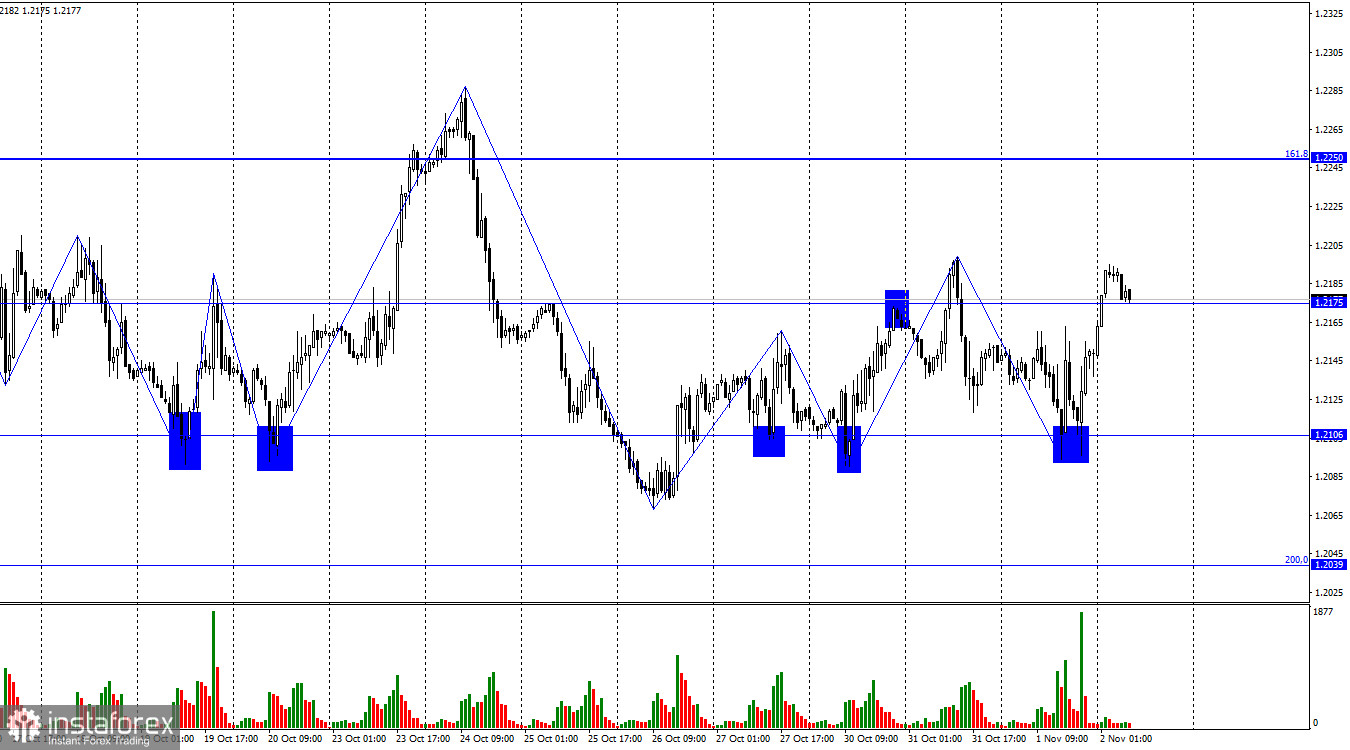

On the hourly chart, the GBP/USD pair experienced a drop to the level of 1.2106 yesterday, bounced off it, and reversed in favor of the British pound, rising towards the previous peak, which is just above the level of 1.2175. Thus, the upward momentum can continue towards the next corrective level of 161.8% (1.2250). However, there is a good chance that the dollar will reverse course and return to the level of 1.2106, near the peak of the most recent upward wave.

The wave situation at the moment is very ambiguous. All recent waves are nearly the same size, and their peaks and lows are breaking very poorly. The last downward wave did not break the lows of the previous one. The last upward wave did not break the peak of the previous one. Therefore, we have all the signs of horizontal movement, which implies a new drop in the pair to 1.2106 today. However, traders' sentiment today will largely depend on the results of the Bank of England's meeting.

The Bank of England's meeting is an important event for the pound, but traders' reactions may be unexpected. The Bank of England is unlikely to raise interest rates, and the sentiment of the MPC committee may continue to lean towards a dovish stance. Governor Andrew Bailey's rhetoric is also unlikely to be hawkish since the regulator has already raised the rate to 5.25%. Thus, I think it is much more likely to see a new drop in the pair today than a rise. The pound's decline will harmoniously fit into the current horizontal movement. Yesterday, the pound's rise was due to weak US statistics, and on Friday, the pound may rise due to weak payroll and unemployment reports.

On the 4-hour chart, the pair bounced off the corrective level of 50.0% (1.2289) and reversed in favor of the US dollar, starting a new drop towards the level of 1.2035. The quotes closed above the descending trend corridor, but it is still very difficult to expect further growth for the pound. There are no emerging divergences with any of the indicators today. A rebound from the 1.2035 level will allow us to expect a new rise for the British pound.

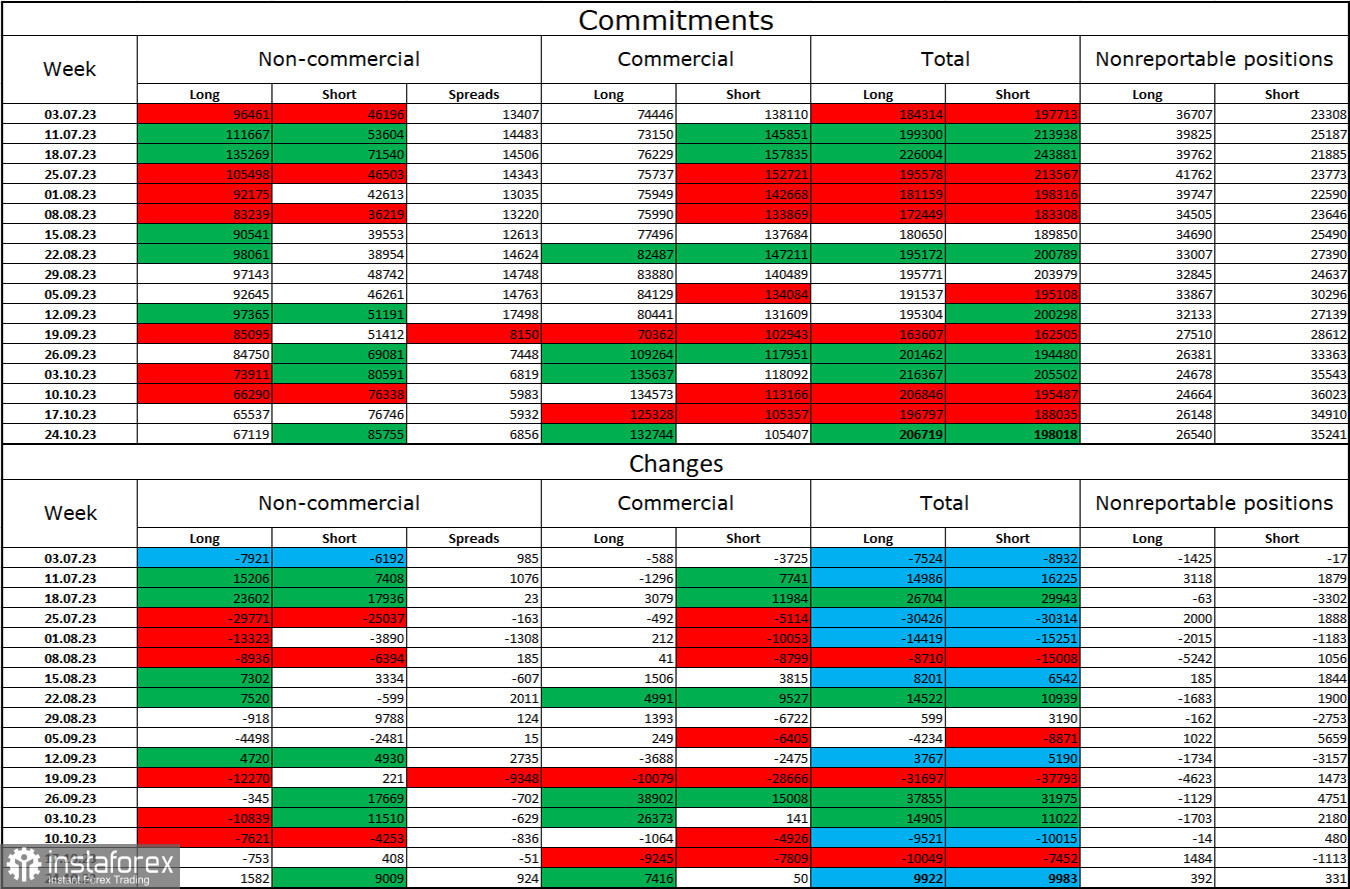

Commitments of Traders (COT) Report:

The sentiment of the "non-commercial" trader category has become more "bearish" in the latest report. The number of long contracts held by speculators increased by 1,582 units, while the number of short contracts increased by 9,009 units. The overall sentiment of major players has shifted towards "bearish," and the gap between the number of long and short contracts is widening, but now in the opposite direction: 67,000 versus 86,000. In my opinion, the pound still has excellent prospects for further declines. I still do not expect significant pound sterling growth in the near future. I believe that over time, the bulls will continue to get rid of their buy positions, as was the case with the euro.

News Calendar for the US and the UK:

UK - Monetary Policy Committee Vote Results (12:00 UTC).

UK - Interest Rate Decision (12:00 UTC).

UK - Monetary Policy Committee Meeting Minutes (12:00 UTC).

US - Initial Jobless Claims (12:30 UTC).

UK - Speech by the Bank of England Governor Bailey (14:15 UTC).

Thursday's economic calendar contains a large number of important entries. The impact of the news on market sentiment for the rest of the day will be significant.

Forecast for GBP/USD and trader advice:

Selling the pound is possible today on a reversal near the level of 1.2198, on a bounce from 1.2250, or on a close below 1.2175 on the hourly chart with a target of 1.2106. Buying opportunities were possible on a bounce from 1.2106, with a target of 1.2175. This target has been reached. New buying opportunities arise on a bounce from the level of 1.2106, with targets at 1.2175 and 1.2198.