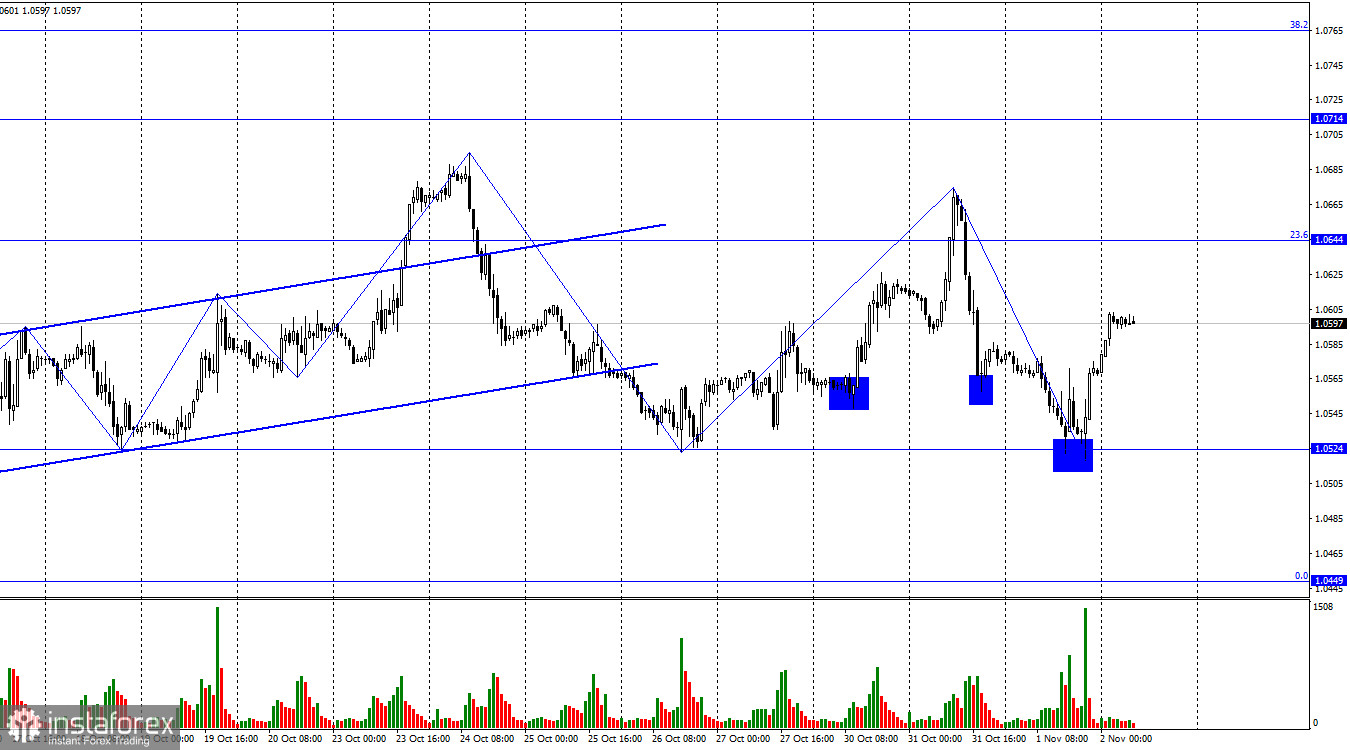

The EUR/USD pair fell to the level of 1.0524 on Wednesday, which it had previously tested twice, bounced from it, and reversed in favor of the European currency. The upward movement toward the corrective level of 23.6% (1.0644) has started, but this process can end at any moment. The current chart pattern is very ambiguous, and the movement is almost horizontal. I believe that we can expect a new trend to develop below the level of 1.0524.

The wave situation continues to be confusing. The last upward wave did not surpass the previous peak and was quite substantial. The last downward wave only slightly broke the previous low by a few points and did not answer the question of whether the trend has turned bearish. Trends change almost every few days, corresponding to horizontal price action. In this situation, it's best not to rush into trading, as the pair changes its direction too frequently.

The informational background was significant yesterday, but it had a relatively weak impact on the chart pattern. The US dollar could have breached the level of 1.0524 yesterday if it weren't for weak data from the US and Jerome Powell's unclear rhetoric. The ISM index in the manufacturing sector fell from 49 to 46.7 points, which was unexpected. The ADP employment report showed an increase of 113,000 jobs instead of the expected 150,000. These two reports halted the dollar's rise. In the evening, Powell did not provide clear guidance on the Federal Reserve's actions in the near future. He discussed possibilities, uncertainties, and concerns. The market was left uncertain about whether the Fed would take aggressive measures to combat inflation if it continues to accelerate or if the US central bank would follow the path of the ECB, which is planning to address inflation by keeping interest rates unchanged for an extended period.

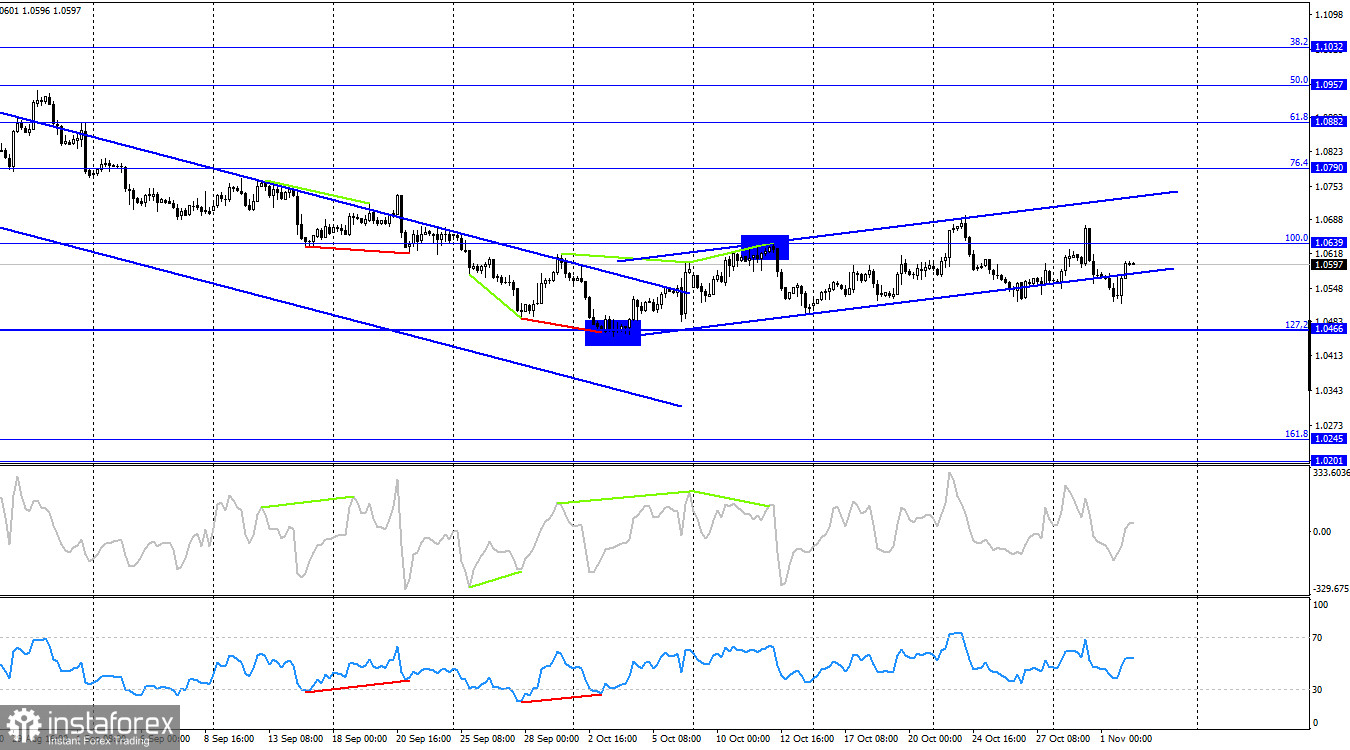

On the 4-hour chart, the pair has settled below the corrective level of 100.0% (1.0639), which suggests a potential decline toward the corrective level of 127.2% (1.0466). If the pair consolidates above 1.0639, it could point to a resumption of the upward movement towards the Fibonacci level of 76.4% (1.0790). There are currently no clear divergences observed in any of the indicators.

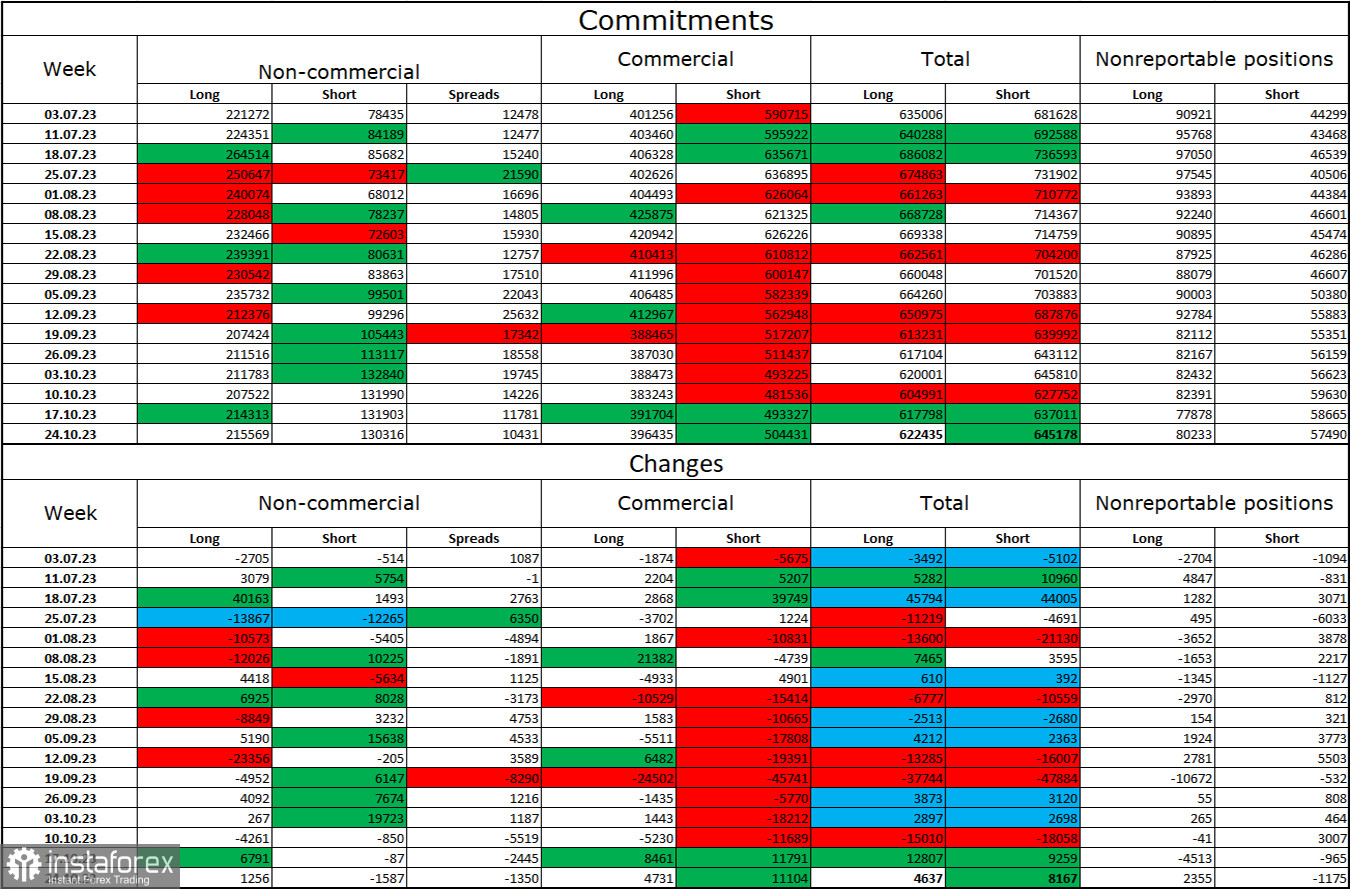

Commitments of Traders (COT) report:

In the latest reporting week, speculators opened 1,256 long contracts and closed 1,587 short contracts. The sentiment of large traders remains bullish but has noticeably weakened in recent weeks and months. The total number of long contracts held by speculators now stands at 215,000, while short contracts amount to 130,000. The difference is now less than twofold, whereas a few months ago, it was three times as large. I believe the situation will continue to shift in favor of the bears. Bulls have dominated the market for too long, and they now need strong fundamental support to start a new bullish trend, which is currently lacking. Professional traders may continue to close their long positions in the near future. I think the current figures allow for a continued decline in the euro in the coming months.

News Calendar for the US and the EU:

European Union - Germany's Manufacturing Purchasing Managers' Index (PMI) (08:55 UTC).

European Union - Change in the Number of Unemployed in Germany (08:55 UTC).

European Union - Germany's Unemployment Rate (08:55 UTC).

European Union - Manufacturing Purchasing Managers' Index (PMI) (09:00 UTC).

USA - Initial Jobless Claims (12:30 UTC).

On November 2, the economic calendar includes five entries, but only one or two can be considered important. The impact of the news on traders' sentiment on Thursday might be weak.

Forecast for EUR/USD and trading advice:

Buying the pair was possible on the hourly chart with a rebound from the level of 1.0524, targeting 1.0644 and 1.0714. Today, I recommend selling on a bounce from the level of 1.0644 or one of the previous two peaks. The target is 1.0524.