Should we move on? This question, according to Jerome Powell, was raised by the members of the FOMC during the meeting on October 31 - November 1. A rate hike on federal funds after two consecutive pauses is still possible, but progress in combating inflation reduces the chances of resuming the monetary restriction cycle. The markets are betting on its end and actively selling the U.S. dollar. The inability of the bears on EUR/USD to break below the lower boundary of the trading range of 1.05-1.07 has become a sign of their weakness and a catalyst for purchases.

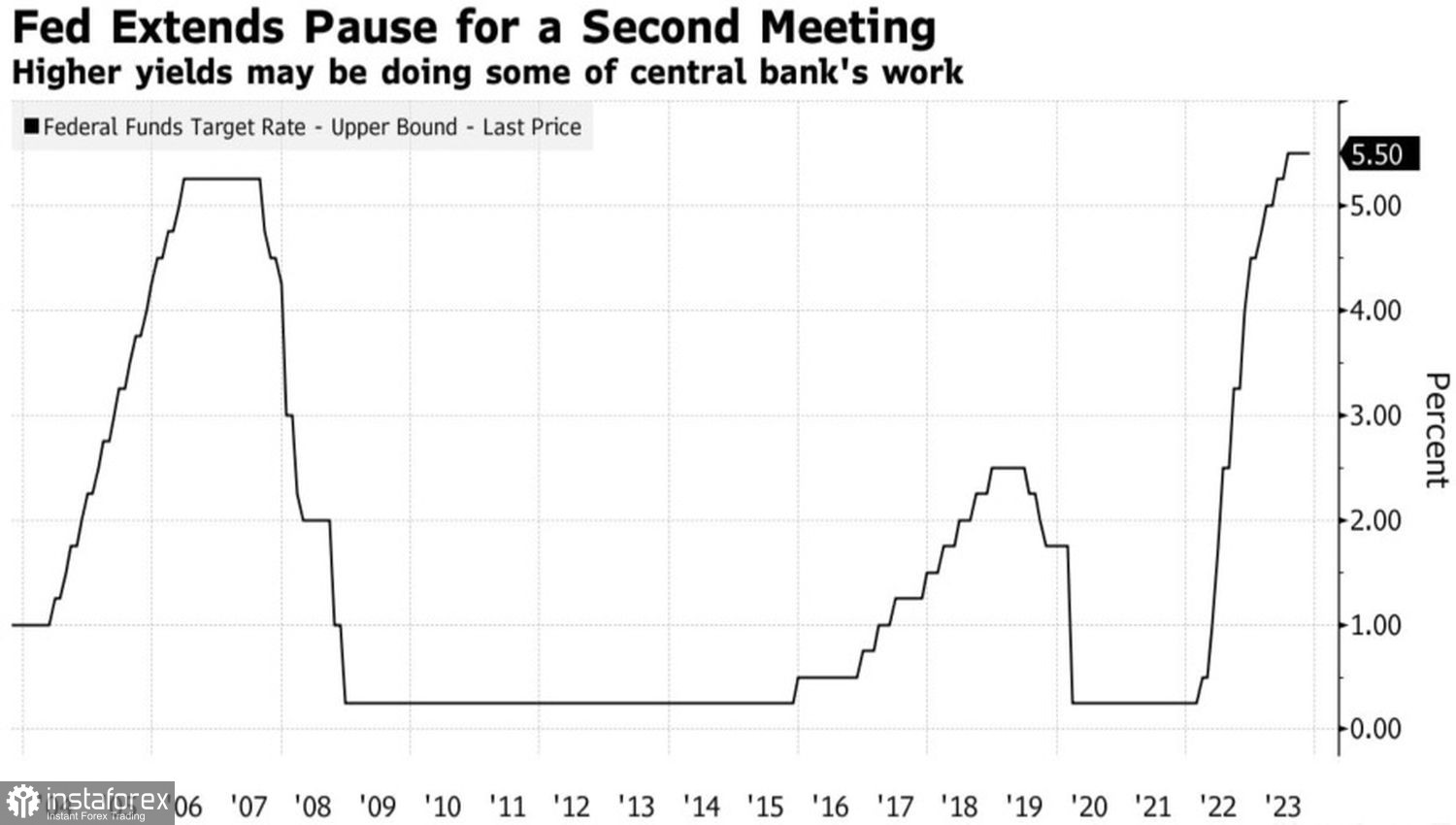

Federal Funds Rate Dynamics

Federal Reserve Chairman Jerome Powell has spoken extensively about inflation moving toward the target and the risks of overdoing monetary policy tightening while making too little balance today. However, the market heard what it wanted to hear: the Federal Reserve has put an end to the rate hike on federal funds. What about the September forecasts of the FOMC regarding its increase to 5.75%? The central bank chairman called them individual assessments of officials at a specific moment in time, not a guide to action. Their effectiveness between meetings has significantly decreased.

Investors perceived such rhetoric as further evidence of a dovish pivot in 2024. Derivatives have reduced the chances of an increase in borrowing costs this year from nearly 30% to 14% and are laying the groundwork for expectations of four 25 bps acts of monetary restriction next year. This refers to a decrease in the federal funds rate to 4.5%. Is it surprising that the U.S. stock market indices have shown better results following FOMC meetings since July 2022?

Stock Index Reactions to the Federal Reserve Meetings

Indeed, the main reason for the S&P 500 correction in July-October was the rapid rally in U.S. Treasury bond yields. After the Department of Treasury disclosed plans for their issuance in the fourth quarter, and they turned out to be lower than the expectations of primary dealers, debt market rates went down. And then the hints from the Federal Reserve about the end of the monetary policy tightening cycle added fuel to the fire.

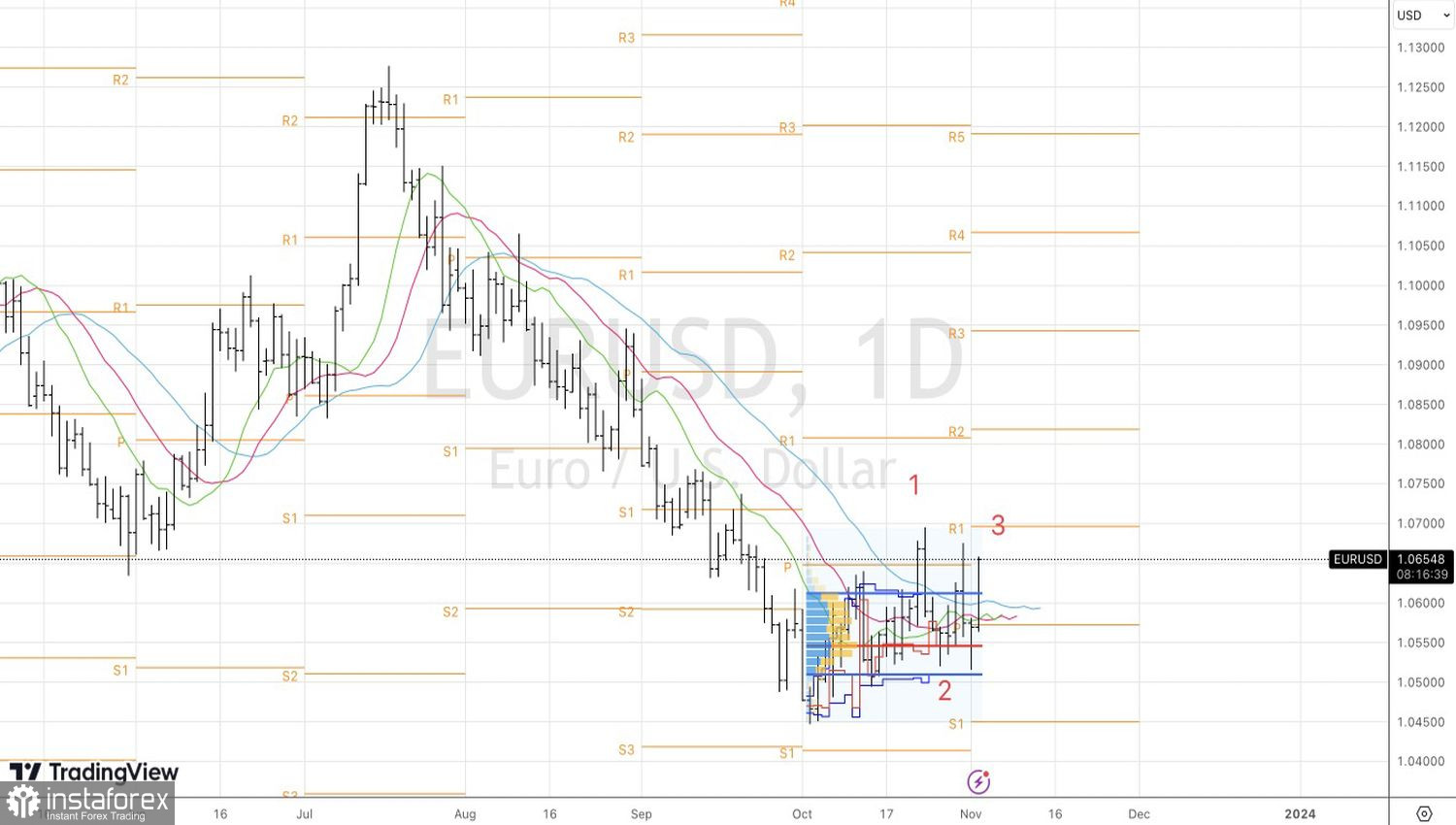

In fact, the narrative in the markets has changed. If until November they were counting on the long-term retention of borrowing costs at a plateau, now, just like in the first half of 2023, they are discussing the dovish pivot of the Federal Reserve. Plus, the Treasury's plans to sell bonds at auctions are not as aggressive as in August, reducing the likelihood of a continuation of the yield rally and depriving the bears on EUR/USD of their main trump card.

The U.S. dollar is no longer the king of Forex. It has died. Long live the new king? Who will it be? It's hard to say for now, but closing short positions on the main currency pair increases the risks of it breaking out of the consolidation range of 1.05-1.07.

Technically, the formation of a pin bar with a long lower shadow followed by a rally in EUR/USD indicates the seriousness of the bulls' intentions. The previously mentioned intraday trading strategies should be replaced with purchases on the breakout of resistances at 1.0655 and 1.067.