As expected, the pound continued to fall on Tuesday. This was more of a consequence of the pound's rapid growth last week, acting as a rebound. It seems that this process has come to a logical conclusion, raising questions about the further development of events. However, this is in the absence of influential economic releases. The currency market doesn't thrive on standing still. So, investors will still need to orient themselves to something, and most likely, the euro will serve as the benchmark. The euro's dynamics will depend on today's retail sales data. The decline is expected to accelerate from -2.1% to -2.8%. This, in turn, will exert pressure on the euro, which will then pull down the pound.

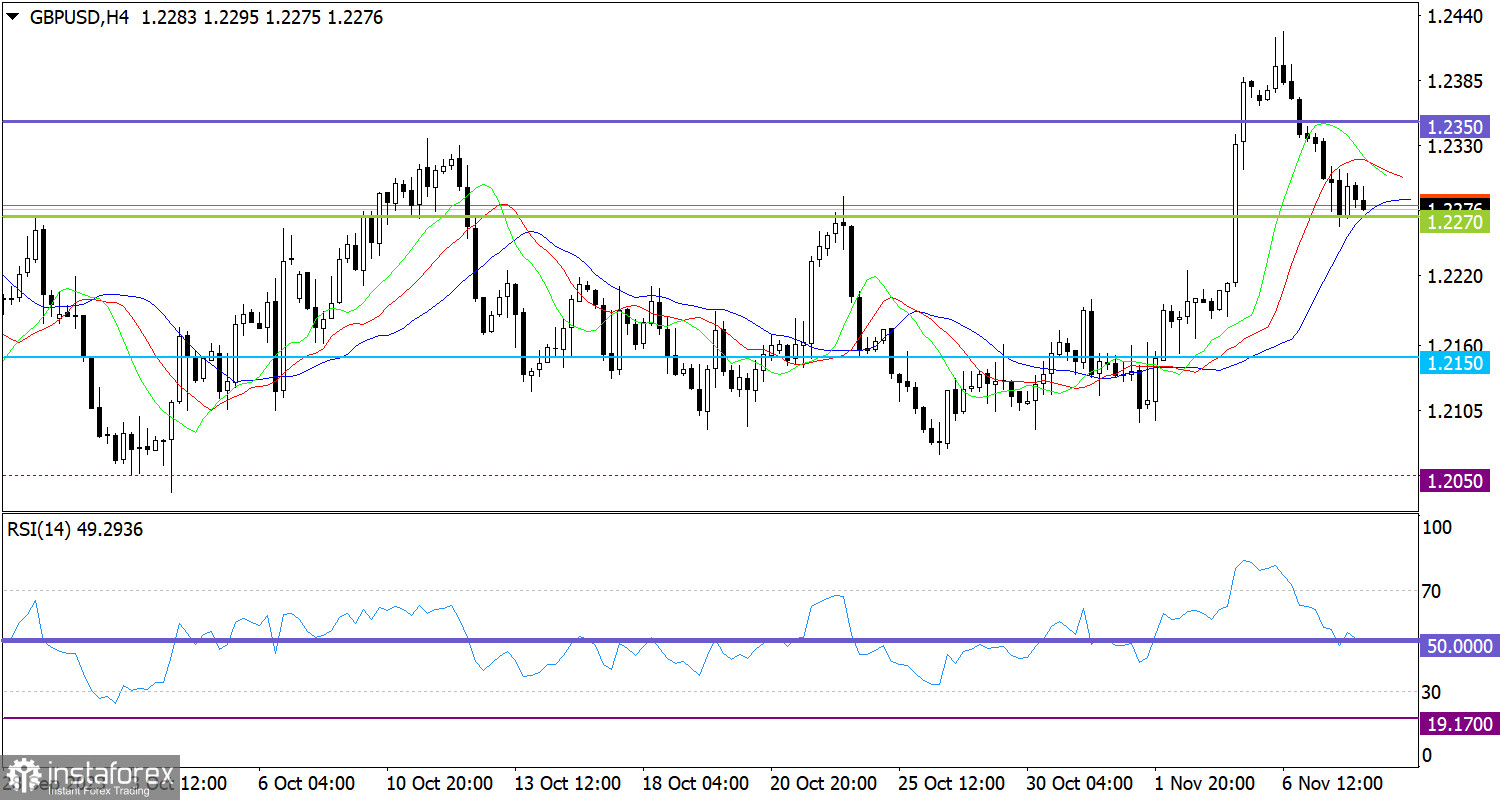

During a technical retracement from the 1.2400 level, the GBP/USD pair fell to the 1.2270 mark. This may lead to the recovery process in the dollar.

On the four-hour chart, the RSI reached the 50 middle line. If the RSI moves below 50, it shows that more traders are selling the pound.

The Alligator Indicator on the same time frame has some intersections between the MAs, meaning that the upward cycle is slowing down. This could also indicate a change in sentiment.

Outlook

In case the price stays below 1.2270, the volume of short positions may increase. In this scenario, the pound will continue to fall towards 1.2200.

The bullish scenario will come into play in case the price doesn't settle below 1.2270, which acts as support.

Complex indicator analysis points to a downward cycle in the short- and intraday time frames.