GBP/USD

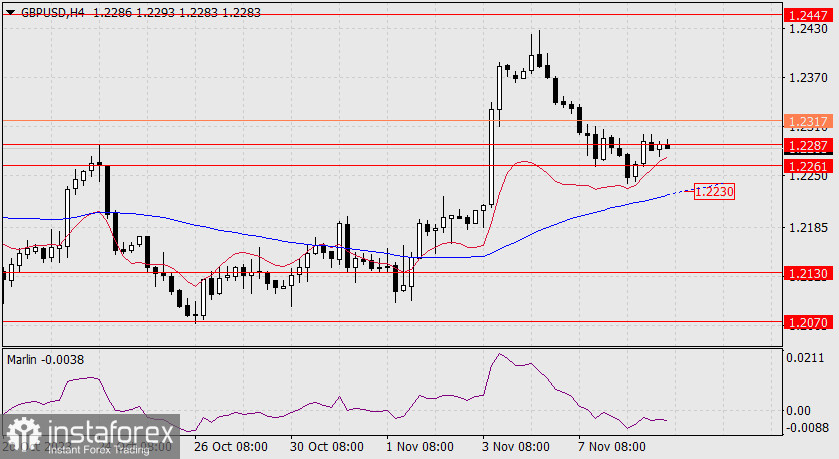

On Wednesday, the price was stuck in a range between 1.2261/87, reinforcing the duality of emerging scenarios. The first and main scenario involves breaking above the MACD line (1.2317) and rising towards 1.2447. The second and alternative scenario entails breaching yesterday's low at 1.2240, followed by a decline to 1.2130.

The progress below the MACD line indicates a bearish bias, but over the past three days, the price has fallen above the balance line. Therefore, this is considered as a corrective phase as a result of the price's growth from last Friday. Price movements both below and above the MACD line could equally turn out to be false.

On the 4-hour chart, the price is advancing above both indicator lines. However, the Marlin oscillator on this timeframe is in negative territory, which may slow down the growth. The MACD line serves as additional support (1.2230). In the evening (19:00 London time), Federal Reserve Chairman Jerome Powell will speak at the annual conference in Washington.