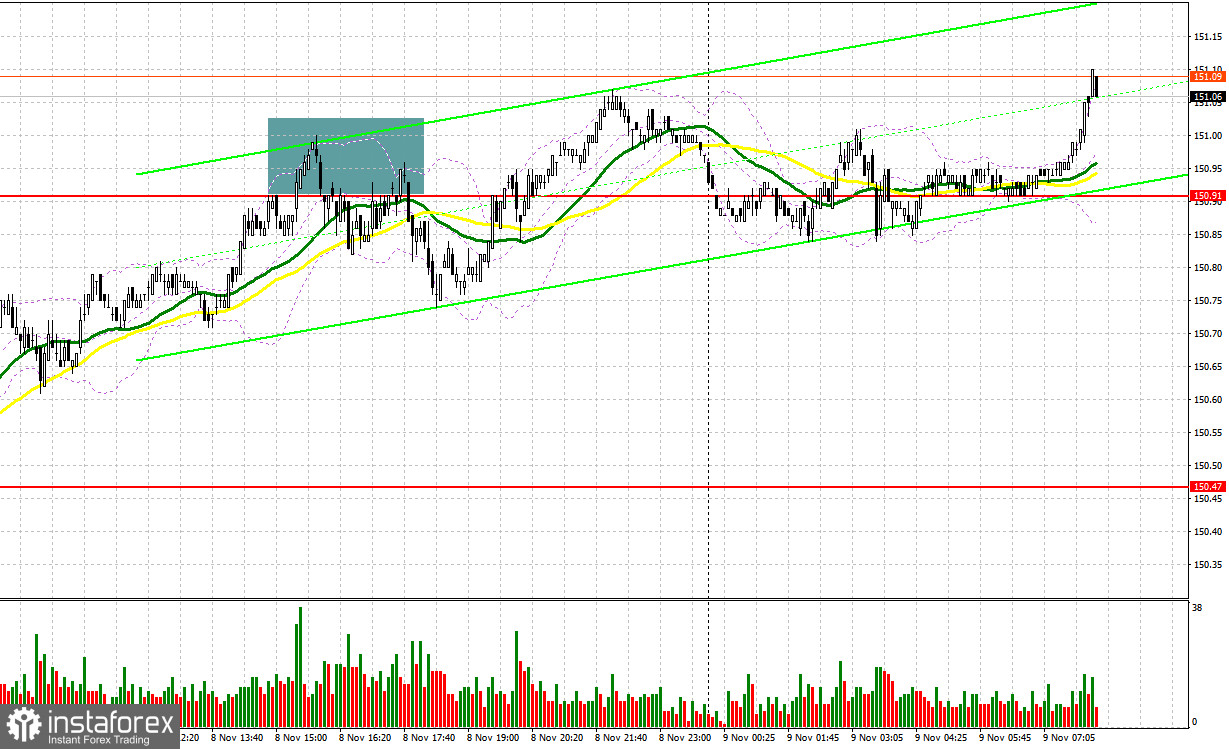

Yesterday, only one market entry signal was formed. Let's look at the 5-minute chart and analyze what happened there. In the second half of the day, the rise of the US dollar continued; however, active defense of the level of 150.91 during the US session led to a sell signal. And although the pair did not experience a significant decline from the entry point, a downward movement of 17 points did take place.

To open long positions on USD/JPY, you need:

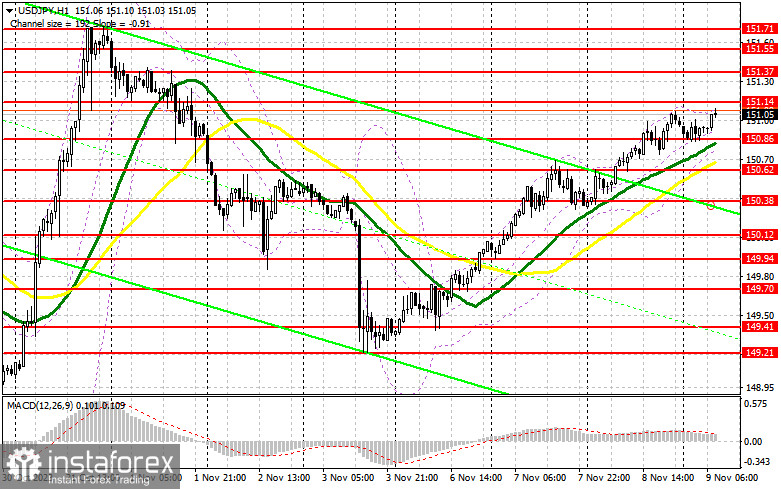

Yesterday's statements by Federal Reserve Chairman Jerome Powell weakened the positions of the US dollar, which, at the moment, allowed sellers to defend the level of 151.00. However, the pair's growth continued. Today, we are waiting for a quite important speech by the Governor of the Bank of Japan, Kazuo Ueda, which will be devoted to interest rates and the future of the economy. Considering the recent statements of the governor, it is unlikely that changes will be made to the soft monetary policy. This is bad for the yen and good for US dollar buyers, who will surely take advantage of it. Against this background, it is unlikely to expect a downward movement of the pair. To open long positions, the most suitable option would be the formation of a false breakout near the nearest support of 150.86, just below which the moving averages pass, playing on the side of buyers. This will provide an entry point for long positions, with the target of updating the nearest resistance at 151.14. A breakthrough and consolidation above this range will also allow buyers to strengthen their positions in the market, giving a buy signal with a target of reaching 151.37. The ultimate target will be the area of 151.55, where I will make a profit. In the scenario of a pair's decline and the absence of activity at 150.86 from buyers, nothing terrible will happen. You can try to enter the market near the next support at 150.62. But only a false breakout will give a signal to open long positions. I plan to buy USD/JPY immediately on the rebound from 150.38, with the aim of a correction of 30-35 points within the day.

To open short positions on USD/JPY, you need:

Sellers yesterday tried to somehow stop the bullish market, but it turned out quite poorly. As long as the central bank stays away from what is happening, the yen's decline will continue. Today, I expect to get the first entry point for short positions only after the formation of a false breakout near the nearest resistance at 151.14, which will return pressure to the pair and lead to a downward movement to support at 150.86, formed as a result of yesterday's trading. A breakthrough and a reverse test from bottom to top of this range will deal a more serious blow to the positions of buyers, leading to the removal of stop orders and opening the way to 150.62. A more distant target will be the area of 150.38, where I will take a profit. In the case of a further increase in USD/JPY, and most likely this will happen, and the absence of activity at 151.14 in the first half of the day, buyers will retain the initiative while maintaining the chances of continuing the bullish trend. In this case, I will postpone sales until a false breakout at 151.37. In the absence of downward movement, I will sell USD/JPY immediately on the rebound from 151.55, but only count on a pair's correction down by 30-35 points within the day.

Indicator signals:

Moving averages

Trading is carried out above the 30 and 50-day moving averages, indicating a rise in the dollar.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differ from the general definition of the classic daily moving averages on the D1 daily chart.

Bollinger Bands

In case of a decline, the lower border of the indicator at 150.75 will act as support.

Description of indicators:

- Moving average (moving average determines the current trend by smoothing volatility and noise). Period 50. Marked on the chart in yellow.

- Moving average (moving average determines the current trend by smoothing volatility and noise). Period 30. Marked on the chart in green.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages). Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands (Bollinger Bands). Period 20.

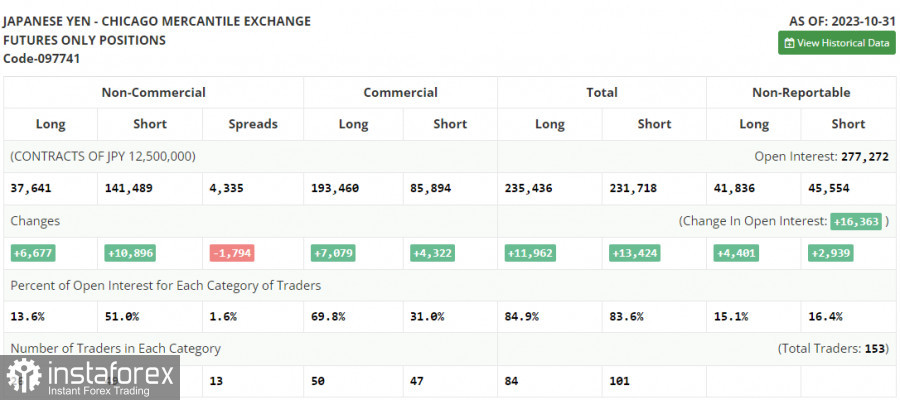

- Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- The total non-commercial net position is the difference between short and long positions of non-commercial traders.