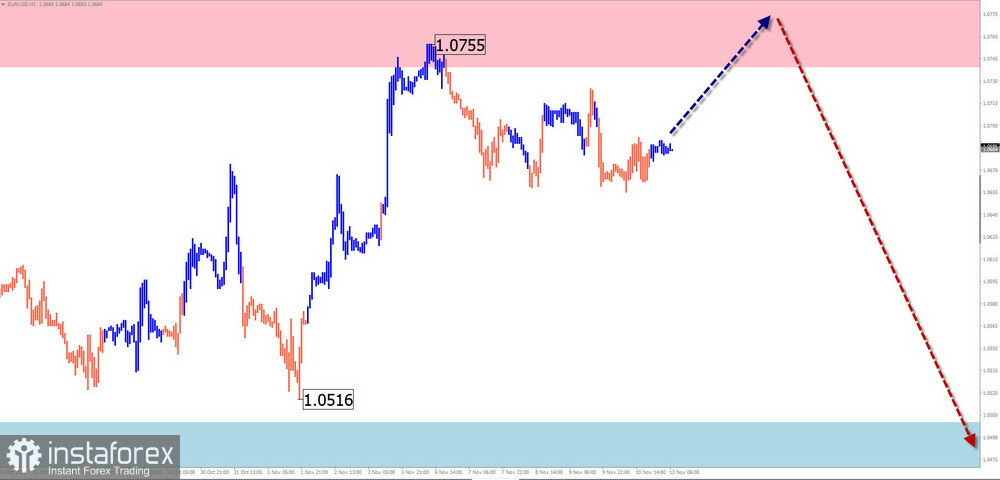

EUR/USD

Analysis:

In the short term, the current wave structure is descending from July 18. For the main trend, this is a correction. The wave is not completed yet. The middle part (B) is developing in the structure. The structure appears complete, but there are no signals of an imminent reversal on the chart. The price moves along the resistance zone of the daily timeframe.

Forecast:

Next week, the continuation of the overall sideways movement of the euro is expected. In the first few days, there may be temporary pressure on the resistance zone. Afterward, a reversal is anticipated, and the downward trend will resume. The highest volatility can be expected closer to the end of the week. The support zone demonstrates the lower boundary of the expected weekly movement of the pair.

Potential Reversal Zones:

Resistance:

- 1.0740/1.0790

Support:

- 1.0500/1.0450

Recommendations:

Sales: can be used after the appearance of corresponding signals in the support area of your trading system.

Purchases: no conditions for such transactions are expected next week.

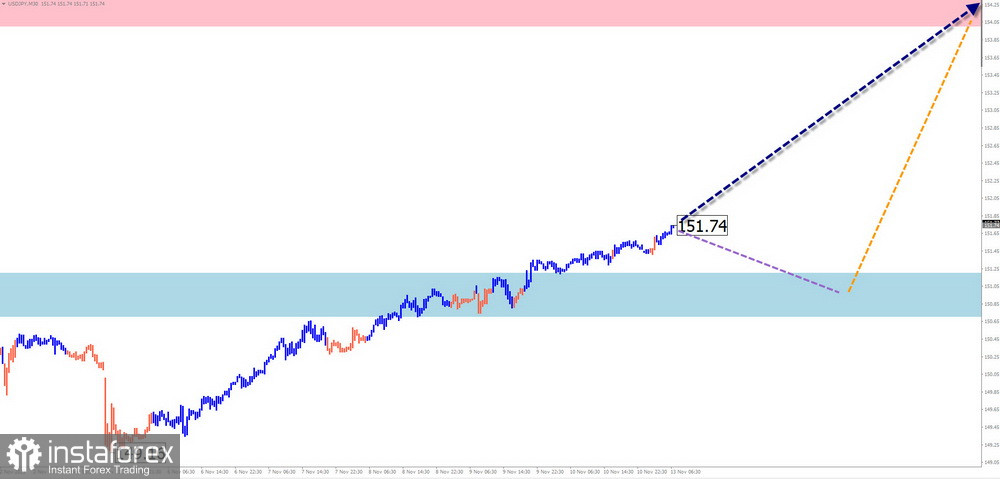

USD/JPY

Analysis:

On the chart of the main pair of the Japanese yen, an ascending trend dominates. Since mid-July, an unfinished section has started. Since the end of October, a price segment with reversal potential has been developing in the main direction. Upon its confirmation, a full-fledged correction will continue. Quotes are approaching the support zone of the large timeframe.

Forecast:

During the current week, an overall upward vector of movement is expected. In the next couple of days, a flat or a decrease is possible. Later, the formation of a reversal and an increase in quotes towards the resistance zone can be expected. The greatest volatility is likely in the second half of the week.

Potential Reversal Zones:

Resistance:

- 154.00/154.50

Support:

- 151.20/150.70

Recommendations:

Sales: have low potential and can only be used within the intraday with fractional lots.

Purchases: become possible after the appearance of reversal signals in the support zone of your trading system.

GBP/JPY

Analysis:

The unfinished wave structure of the pound/yen pair has been reported since mid-summer of this year. Over the past two months, quotes have formed a horizontal correction in the form of a stretched plane. The price approaches a level of strong resistance. By now, the wave structure looks complete, but there are no reversal signals in the near future.

Forecast:

At the beginning of the week, the most likely scenario will be the continuation of a sideways flat. Later, the formation of a reversal and the beginning of a downward price movement can be expected, right up to the contact with the support boundary. The high probability of an increase in activity will coincide with the release of important economic news.

Potential Reversal Zones:

Resistance:

- 185.90/186.40

Support:

- 181.70/181.20

Recommendations:

Sales: will become relevant after the appearance of confirmed reversal signals.

Purchases: possible with fractional lots within individual sessions. The potential is limited to the resistance zone.

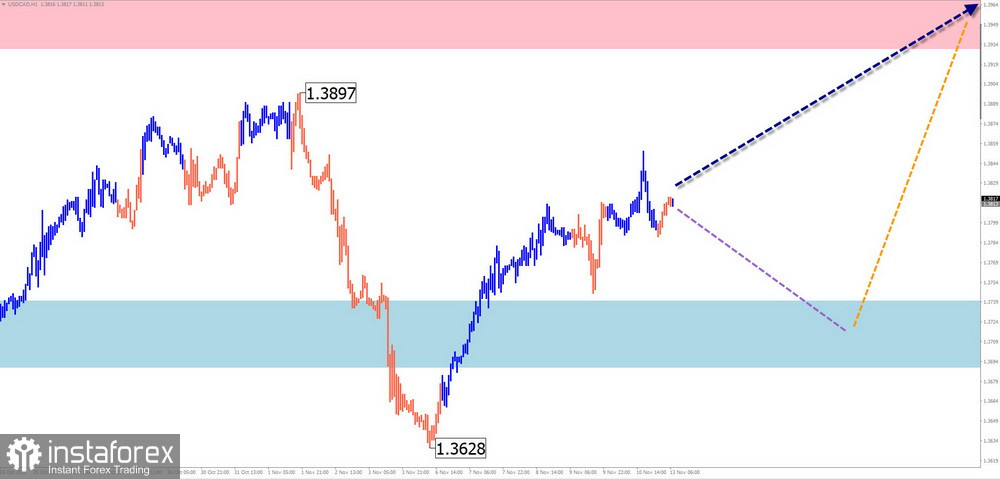

USD/CAD

Analysis:

The rising trend in the pair's market led the price of the Canadian dollar to a potentially reversal zone on a large scale. In early October, a complex wave structure started to develop towards the main course in the form of a shifting plane. The structure lacks a finishing section.

Forecast:

In the next couple of days, a sideways flat is most likely. A decrease in the boundaries of the support zone is not excluded. Later, a change in course and the resumption of the price rise can be expected, with the potential for the price to rise to the calculated resistance boundaries.

Potential Reversal Zones:

Resistance:

- 1.3930/1.3980

Support:

- 1.3740/1.3690

Recommendations:

Purchases: will become possible after the appearance of signals in the resistance zone.

Sales: can be used with fractional lots within individual sessions.

NZD/USD

Brief Analysis:

An unfinished wave on the chart of the New Zealand dollar major is directed downward. It has been counting since mid-July. The wave structure completed the middle part (B). The descending section of November 6 has reversal potential. Upon its confirmation, it will give way to the final part (C). The quotes are approaching the upper boundary of the powerful potential reversal zone of the daily timeframe.

Weekly Forecast:

During the upcoming week, a gradual decrease in quotes towards the calculated support is expected. In the first few days, a temporary increase is not excluded, up to the boundaries of the resistance zone. The greatest volatility can be expected towards the end of the week.

Potential Reversal Zones:

Resistance:

- 0.5940/0.5990

Support:

- 0.5810/0.5760

Recommendations:

Sales: can be used within individual sessions from the resistance zone.

Purchases: risky, can be unprofitable.

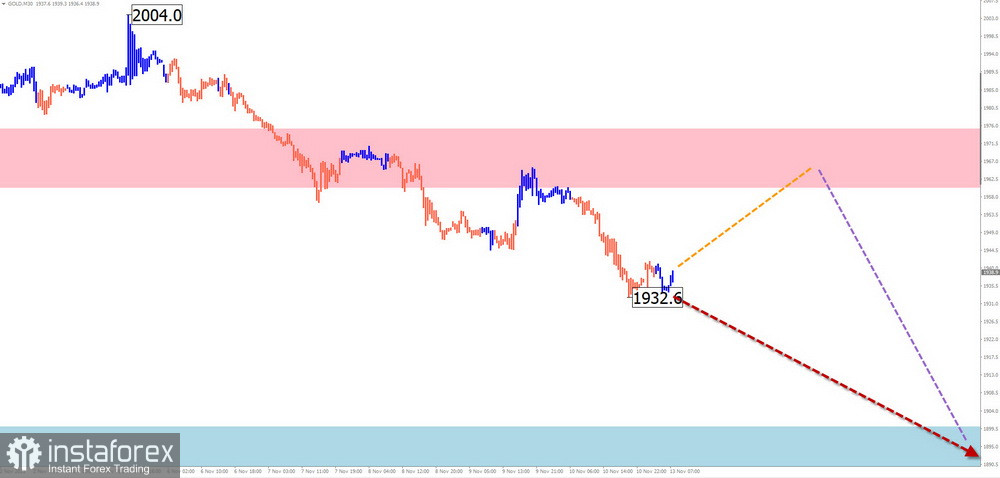

Gold

Analysis:

In the short term, the unfinished wave structure today is ascending, counting from October 3. In its structure, a corrective wave has been developing since the end of October. Last week, the price broke through the intermediate support. Before the continuation of the decline, it is necessary to consolidate below its level.

Forecast:

In the next few days, the continuation of the overall downward vector is expected. In the next couple of days, a flat or temporary increase is highly probable. The greatest activity is expected towards the end of the week.

Potential Reversal Zones:

Resistance:

- 1960.0/1975.0

Support:

- 1900.0/1885.0

Recommendations:

Purchases: premature until confirmed reversal signals appear.

Sales: will be possible from the resistance zone within individual sessions. It is wiser to reduce the trading volume.

Explanations:

In simplified wave analysis (SWA), all waves consist of three parts (A, B, and C). On each timeframe, the last, unfinished wave is analyzed. Dashed lines indicate expected movements.

Attention: The wave algorithm does not consider the duration of instrument movements over time!