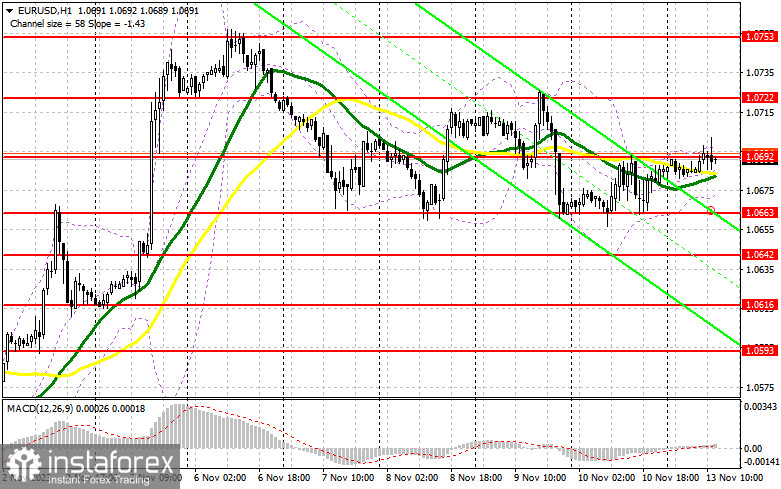

In my morning forecast, I drew attention to the level of 1.0692 and recommended making decisions on market entry based on it. Let's look at the 5-minute chart and analyze what happened there. The rise and the formation of a false breakout around 1.0692 provided an excellent selling signal for the euro, but a significant downward movement did not materialize. Something may change during the American session. Considering that trading is within a sideways channel, the technical picture still needs to be revised for the second half of the day.

To open long positions on EUR/USD, the following is required:

Apart from the speech of FOMC member Lisa D. Cook, who will likely advocate further fighting inflation, there is nothing in the second half of the day. So, do not be surprised if trading continues around the mid-range of the sideways channel at 1.0692 due to low market volatility. In case of a negative market reaction to the speeches, buyers must show themselves around the same strong support at 1.0663, tested several times. Only the formation of a false breakout there, similar to what I analyzed in previous reviews, will provide a good entry point for long positions, expecting an upward trend and another resistance test at 1.0692. A breakthrough and update from top to bottom of this range will allow a leap to 1.0722 and 1.0753. The furthest target will be the area of 1.0774, where I will take profit. In the case of a decline in EUR/USD and the absence of activity at 1.0663 in the second half of the day, bears may gain significant control over the market at the beginning of the week, strengthening the downward correction and leading to a more significant downward movement to 1.0642. Only the formation of a false breakout there will signal market entry. I will consider opening long positions from the bounce at 1.0616 with a target for an intraday upward correction of 30-35 points.

To open short positions on EUR/USD, the following is required:

Sellers continue to fight for the market, but the desire to buy the euro around 1.0692 is diminishing. The euro may react positively to today's statements from the Fed representatives, so active defense of resistance at 1.0692, around which trading is currently taking place, is a priority. Forming another false breakout at this level will provide a good selling signal, continuing the downward correction to support at 1.0663. A breakthrough of this level with consolidation below will provide another sell signal with a target of 1.0642. The furthest target will be the minimum of 1.0616, where I will take profit. In case of an upward movement of EUR/USD during the American session and the absence of bears at 1.0692, buyers will return to the market and try to reach resistance at 1.0722. Selling can be considered there, but only after an unsuccessful consolidation. I will consider opening short positions from the bounce at the monthly maximum of 1.0753 with a target for a downward correction of 30-35 points.

Indicator signals:

Moving averages:

Trading is conducted around the 30 and 50-day moving averages, indicating a sideways market.

Note: The author considers the period and prices of moving averages on the hourly chart H1 and differs from the general definition of classical daily moving averages on the daily chart D1.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator, around 1.0675, will act as support.

Description of indicators:

- Moving Average (MA): 50-period (yellow on the chart), 30-period (green on the chart).

- Moving Average Convergence Divergence (MACD): Fast EMA period 12, Slow EMA period 26, Signal SMA period 9.

- Bollinger Bands: Period 20.

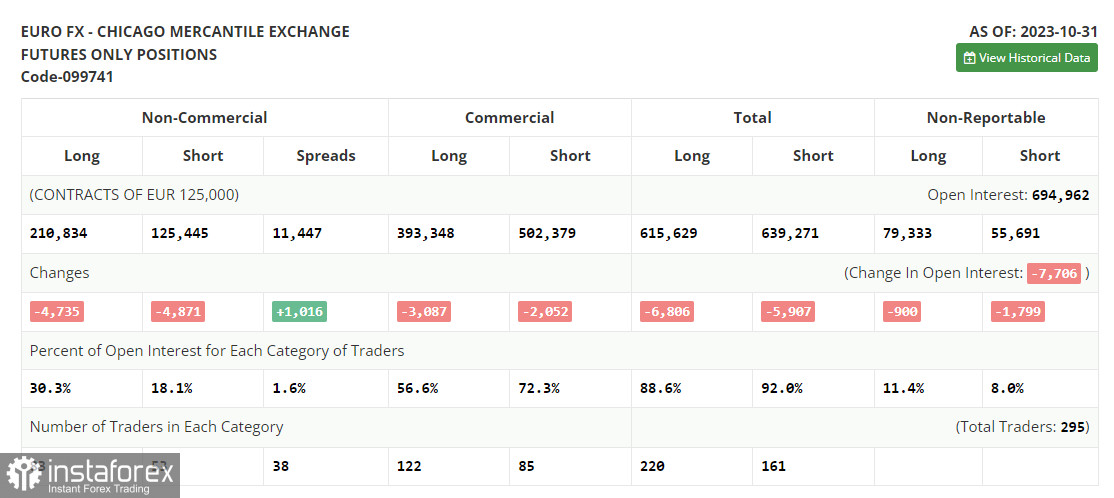

- Non-commercial traders (speculators) - individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open positions of non-commercial traders.

- The total non-commercial net position is the difference between short and long non-commercial positions.