On Tuesday, the EUR/USD pair reached a two-month price high, in a response to the US inflation data for October. All components of the data came out in the red zone, after which the greenback came under significant pressure across the market. Earlier in the day, the US Dollar Index was around 105.60, and after the release of the data, it plummeted to the 104.50 level within minutes. The yield on 10-year US Treasury bonds dropped to 4.46% (before the release, the yield was 4.60%).

In turn, for the first time since September, EUR/USD entered the 1.08 level. By the way, the pair rose not only because of the dollar's weakness, but also due to the euro's strength, which solidified its positions against the backdrop of decent data from the ZEW Institute. But more on that later, for now, let's focus on the US data, which holds much more significance for all dollar pairs.

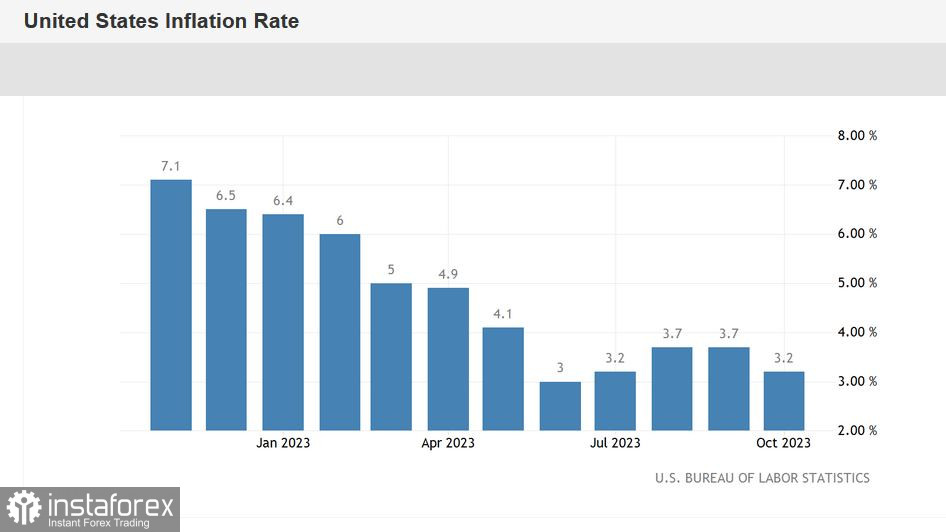

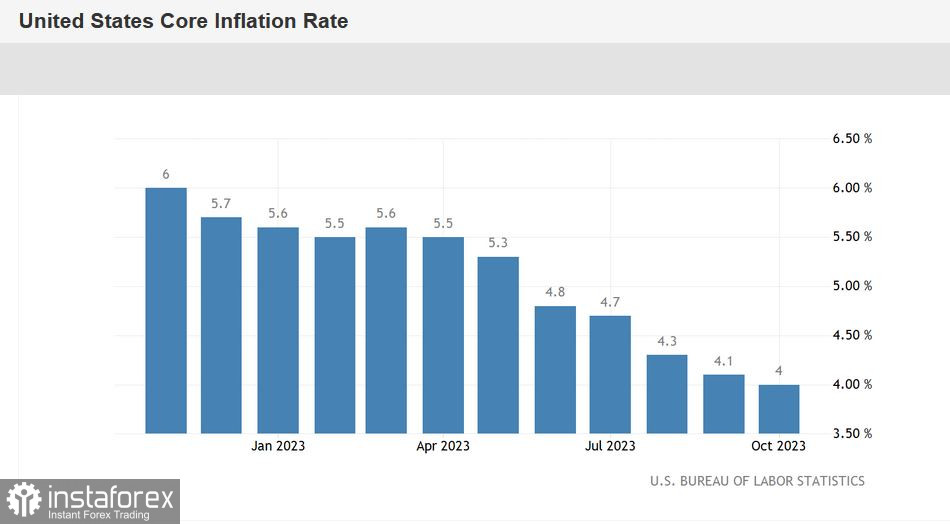

So, according to the data, the Consumer Price Index (CPI) in the United States in October remained unchanged at 0.00% on a monthly basis (the lowest value since July 2022). In annual terms, the indicator stood at 3.2%. It is important to note that the CPI dropped to 3.0% in June, but then gradually started gaining momentum, reaching 3.7% in August (it also came out at 3.7% in September). According to forecasts, the indicator was expected to decrease to 3.4%, so the actual result of "3.2%" in these circumstances is certainly a significant one. The core Consumer Price Index, excluding food and energy prices, also turned red. On a monthly basis, the core CPI came out at 0.2%, with a forecast of growth to 0.5%. On an annual basis, the indicator decreased to 4.0% – the weakest growth rate since September 2021.

The structure of the report indicates that energy prices in October fell by as much as 4.5% on an annual basis (for comparison, in the previous month, this component decreased by only 0.5%). Food prices increased by 3.3% last month (in September, this component increased by 3.7%). Transportation services became 9.2% more expensive, and prices for new cars rose by 1.9% (while in September, the increase was 2.5%).

As mentioned earlier, all components of the data came out in the "red zone," despite relatively weak forecasts. The significance of this report lies in the fact that it essentially dashed the hawkish hopes of dollar bulls regarding a rate hike. Recall that last week, the greenback strengthened its positions amid the rather hawkish stance of some of the Federal Reserve officials. Laurie Logan, Michelle Bauman, and, most importantly, Fed Chair Jerome Powell stated that the current interest rate level may not be effective enough to curb inflationary growth. In this context, the officials warned that the Fed would not hesitate to resort to an additional rate hike "if necessary."

The latest report suggests that there is no urgent need for additional tightening of monetary policy, at least in the context of the December meeting. This is eloquently evidenced by the data from the CME FedWatch Tool. After the inflation data, the probability of a rate hike in December decreased to 3.5%. The probability of a quarter point rate hike in January is now at 5%. At the same time, the likelihood of a 25-basis-point rate cut in the spring (at the May meeting) has increased to almost 50%.

In other words, the latest report neutralized the hawkish intentions of some of the Fed members. The market is practically certain that the US central bank will maintain the status quo at the upcoming meetings. Moreover, traders are gradually gaining confidence that the Fed will resort to monetary easing in the first half of 2024. I suppose that if the next CPI report (for November) repeats the trajectory of October, the probability of a rate cut in May will exceed 50%. All these fundamental factors work against the dollar.

On the other hand, the euro strengthened thanks to data from the ZEW Institute. In particular, the Economic Sentiment Index in Germany rose to 9.8 points in November, against a forecast of growth to 5.0 (the strongest result since March). The indicator climbed out of the negative territory for the first time since May. The Eurozone Economic Sentiment Index also entered the green zone, rising to 13.8 (with a forecasted growth to 6.1) from the September level of 2.3.

However, the ZEW indices only complemented the overall picture for the pair. The main driver of the EUR/USD growth is the greenback, which lost a significant advantage.

All this suggests that the EUR/USD pair will likely attempt to consolidate around the 1.08 level and then move higher toward the main target of 1.1000. The current fundamental background supports this scenario. The nearest resistance level is at 1.0860 – the Kijun-sen line on the weekly chart. Overcoming this target will pave the way for the bulls to aim for the 1.09 level.