On Tuesday, the US inflation report for October was released, and perhaps I won't be wrong in saying that no one expected such a market reaction. I'll start by saying that inflation reports are undoubtedly very important, but their significance lies not only in the reports themselves but also in their values, their alignment with market expectations, and their impact on the central bank's monetary policy. Let's consider all three of these points.

Inflation for October slowed to 3.2%. For the US economy, this is undoubtedly good news, but not so much for the dollar, as both instruments clearly showed on Tuesday. In my opinion, the oddities began with the very first point. Inflation in the US decreased, and the dollar fell against the euro by 150 points and against the pound by 200. The greenback's decline is far from over. Even in central bank meetings, such a market reaction is rare.

The second point is the relationship between forecasts and actual values. The markets expected to see a decrease to 3.3%, but ultimately observed 3.2%. The difference isn't drastic. The forecast was already known a week ago, so the markets had enough time to factor it in. So how did a 0.1% deviation cause such a strong reaction? There is not much difference between 3.3% and 3.2%!

The third point is the impact on monetary policy. Obviously, the probability of a rate hike in December or January has decreased after the report was published. However, it was already low even before the inflation data was released. For instance, the markets priced in a 7% probability of a rate hike in December and 20% in January. In other words, they practically did not expect new tightening. After the report, according to the FedWatch CME tool, the probability of a rate hike in December and January dropped to 5%.

In conclusion, I believe that the demand for the US dollar has fallen too sharply and does not correspond at all to the inflation report. Moreover, it significantly disrupted the wave markings of both instruments. It is clear that waves 2 or b will now take on a more extended form, as I warned, but everything could have been much simpler.

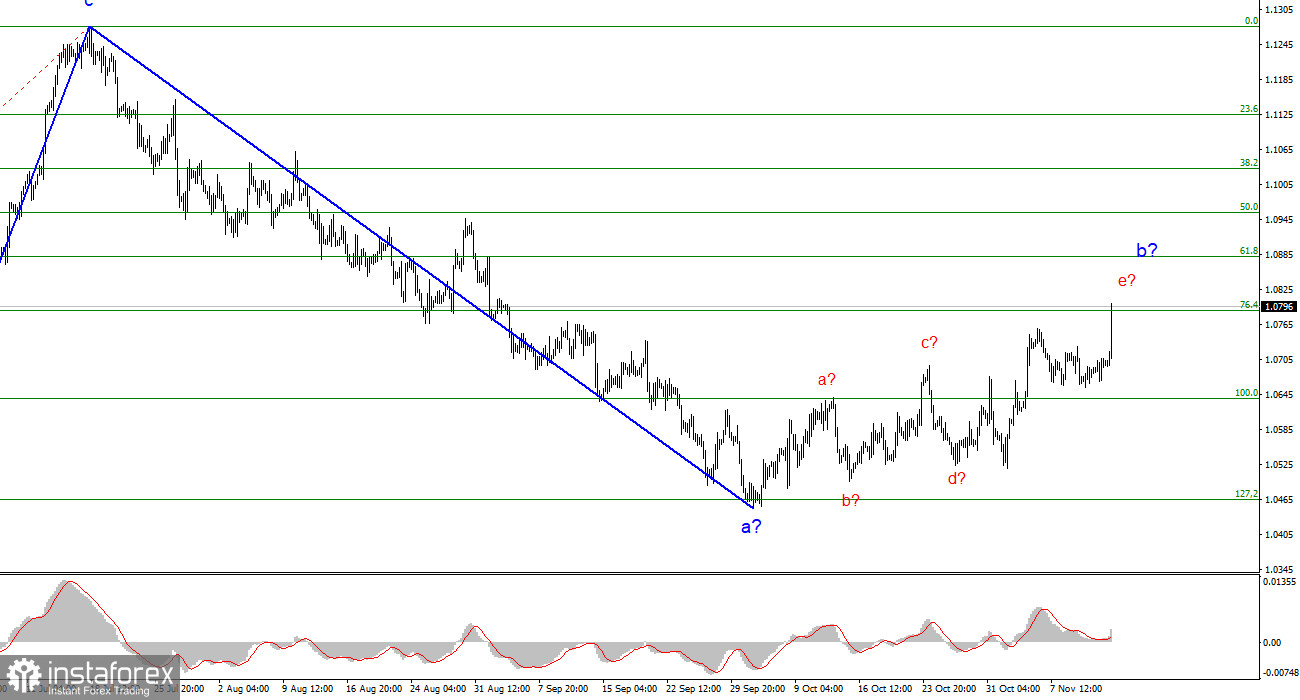

Based on the analysis, I conclude that a bearish wave pattern is still being formed. The pair has reached the targets around the 1.0463 level, and the fact that the pair has yet to breach this level indicates that the market is ready to build a corrective wave. It seems that the market has completed the formation of wave 2 or b, so in the near future I expect an impulsive descending wave 3 or c with a significant decline in the instrument. I still recommend selling with targets below the low of wave 1 or a. But be cautious with short positions, as wave 2 or b may take a more extended form.

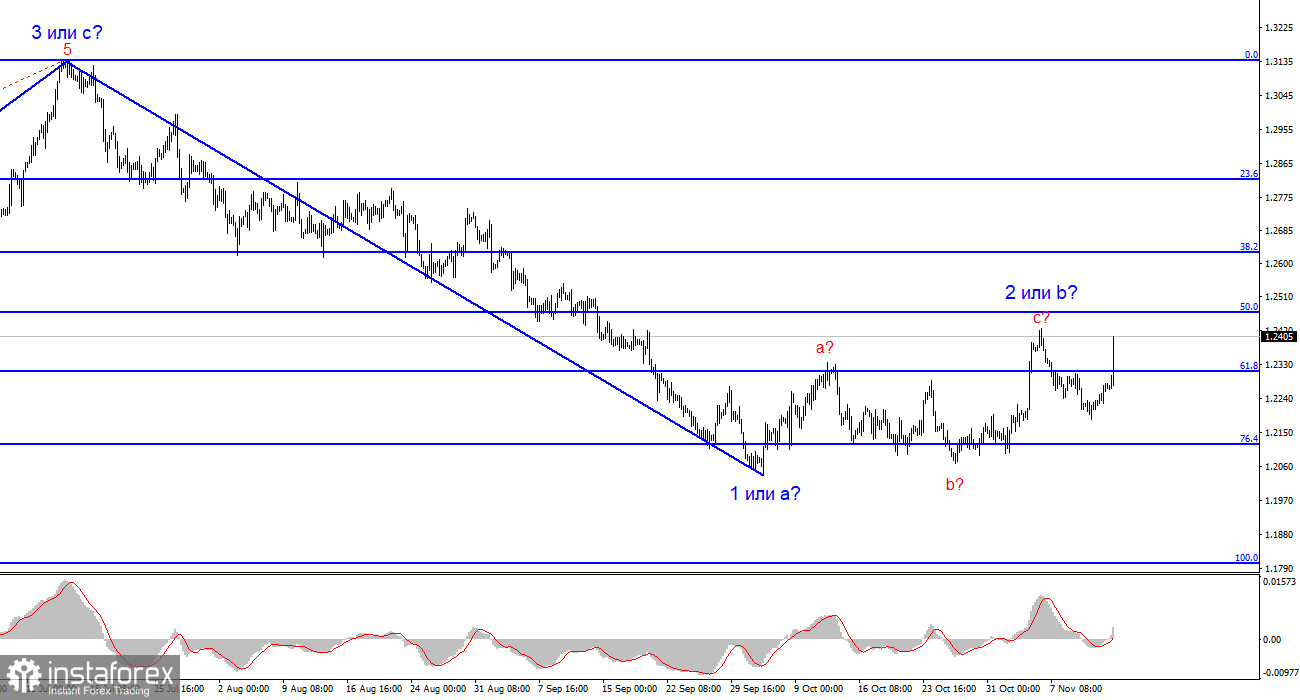

The wave pattern for the GBP/USD pair suggests a decline within the downtrend segment. The most that we can count on is a correction. At this time, I can already recommend selling the instrument with targets below the 1.2068 level because wave 2 or b will end. It would have already ended if not for a series of disappointing reports from America. Initially, just a good amount of short positions should be enough because there is always a risk of complicating the existing wave.