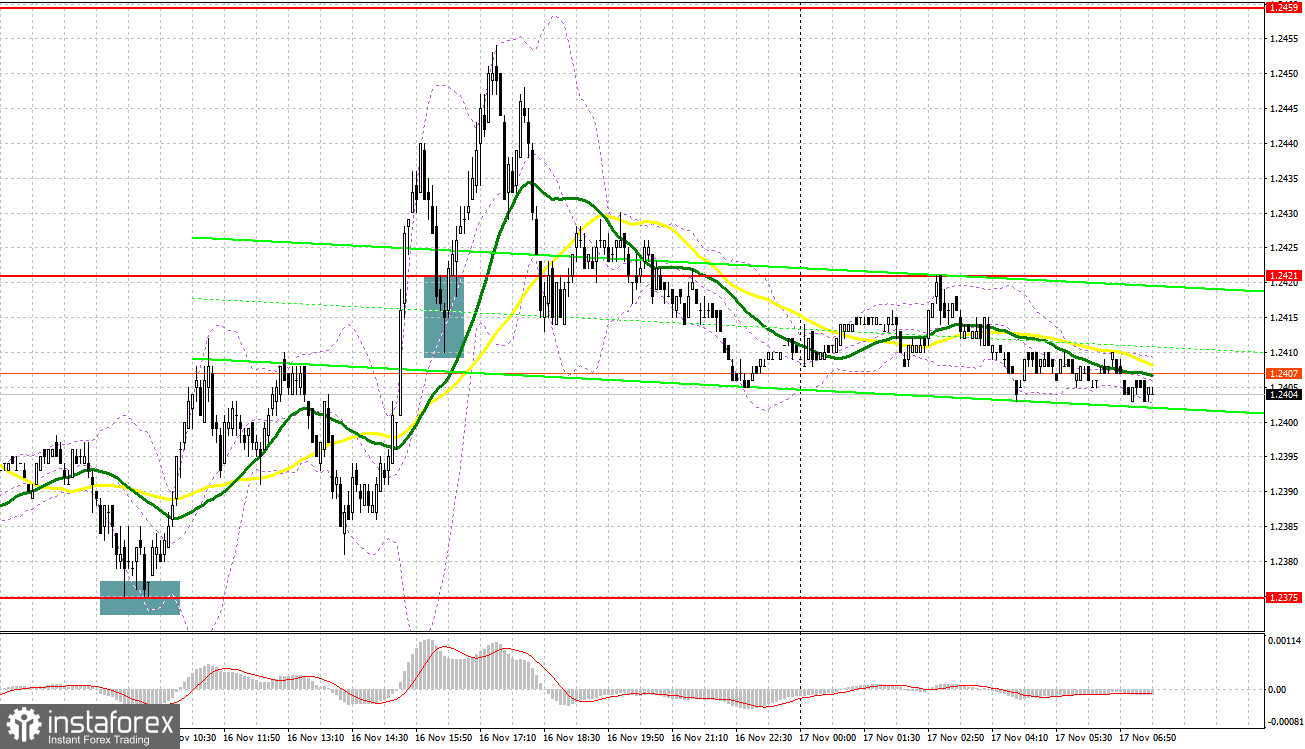

Yesterday, the pair formed some good entry signals. Let's have a look at what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.2375 as a possible entry point. A decline and false breakout at this mark produced a buy signal, sending the pair up by more than 30 pips. In the afternoon, a breakout and retest of 1.2421 generated another signal. As a result, the pair rose by another 35 pips.

For long positions on GBP/USD:

The pound has a chance of continuing the upward movement, but in order to do so, it needs good UK retail sales data, as well as aggressive comments from Deputy Governor for Markets and Banking David Ramsden on the topic of the Bank of England's monetary policy. If his remarks exert pressure on the pound, only a false breakout near the nearest support at 1.2375, will signal market entry into long positions in building a bullish correction. The target will be the resistance at 1.2411, which is in line with the moving averages, and is also where the pair is currently trading. A breakout and consolidation above this range will produce a buy signal, potentially targeting the 1.2451 area. The ultimate target is found at 1.2502 where I will be taking profits. Should the pair decline and buyers show no initiative at 1.2375, things will go bad, as sellers will get a chance to extend the corrective move. Only a false breakout near the next support level at 1.2340 will signal the opportunity to open long positions. I plan to buy GBP/USD immediately on a rebound from 1.2304, aiming for a correction of 30-35 pips within the day.

For short positions on GBP/USD:

Yesterday, the bears slightly wavered and today, everything will depend on who takes control of the level of 1.2411, where the pair is currently trading. I plan to sell GBP/USD on this mark once the report has been published and a false breakout is formed. This will generate a sell signal and the pair could move towards the support level at 1.2375. Breaching this level and subsequently retesting it from below will deal a more serious blow to the bulls' positions, lead to a cascade of stop orders, and open a path to 1.2340. The more distant target will be 1.2304, where I'd be taking profits. If GBP/USD grows and there are no bears at 1.2411 in the first half of the day, which will only happen if it's strong UK data, the pair could trade in the sideways channel and the bulls will get a chance to bring back the uptrend. In this case, I will postpone selling until a false breakout at 1.2451, which was formed yesterday. If downward movement stalls there, one can sell the British pound on a bounce from 1.2502, bearing in mind a 30-35-pips downward intraday correction.

COT report:

The Commitments of Traders (COT) report for November 7 showed a decrease in both long and short positions, but this did not significantly alter the market dynamics. Persistent pressure on the pound was observed throughout the week as the latest report on the UK's economic growth rate was disappointing, hinting at the real chances of a recession in Q4 this year. Considering the Bank of England's statements on maintaining high interest rates for an extended period, the chances of a substantial rise in the British pound remain slim. The only factor that could change this dynamic is weak US data indicating a further reduction in price pressures. The more the talks about unchanged US rates in December, the more pressure there will be on the US dollar, making the pound more valuable. The latest COT report states that non-commercial long positions decreased by 6,180 to 57,532, while non-commercial short positions fell by 10,299 to 73,784. Consequently, the spread between long and short positions increased by 310. The weekly closing price rose to 1.2298 from 1.2154.

Indicator signals:

Moving Averages

Trading just around the 30- and 50-day moving averages indicates sideways movement.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If GBP/USD declines, the indicator's lower border near 1.2385 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.