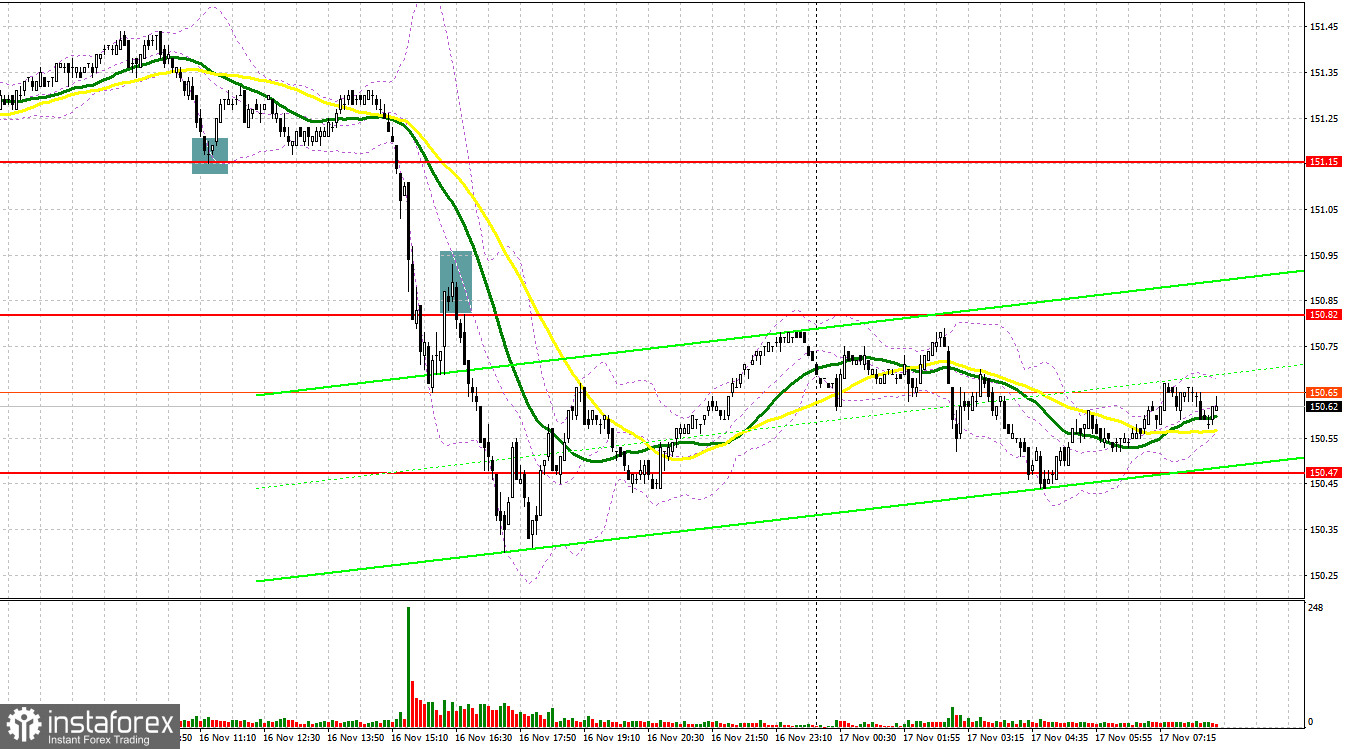

Yesterday, the pair formed several great signals to enter the market. Let's have a look at what happened on the 5-minute chart. A decline to 151.15 and its false breakout created a good entry point into long positions, However, after rising by 15 pips, the upside momentum slowed down. In the afternoon, downbeat data from the US triggered a large sell-off in the USD/JPY pair, while a breakout of 150.82 and its retest from below generated a good entry point for going short. As a result, the pair declined by more than 40 pips.

For long positions on USD/JPY

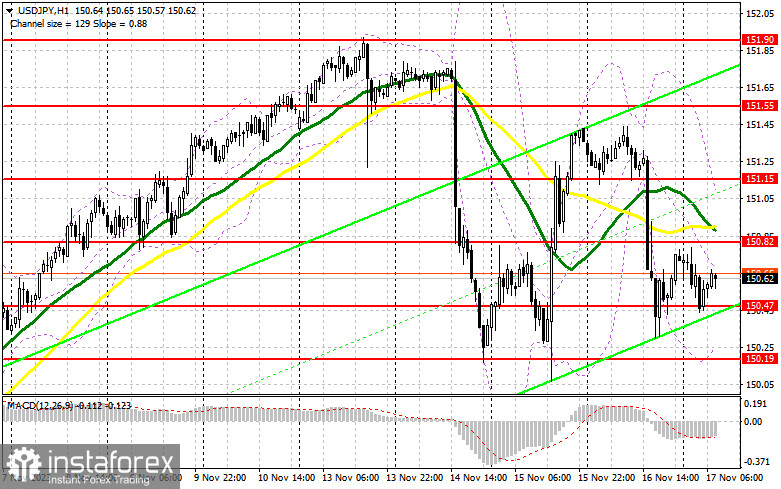

The incoming data from the US continues to disappoint traders, suggesting that the American economy is finally buckling under the pressure of high interest rates. With no significant statistics from Japan today, the instrument is likely to remain under pressure. Markets are waiting for the US data on building permits and new housing starts. Weak figures will likely lead to another sell-off in the pair, and buyers will have to oppose this trend. Bulls are likely to show their presence after a false breakout near the nearest support of 150.47, providing an entry point for long positions with the aim to retest the resistance at 150.82, just above which the moving averages favor the sellers. A breakout and consolidation above this range will allow buyers to strengthen their market position, generating a buy signal with the target at 151.15. The ultimate target lies in the 151.55 area, where I plan to take profit. If the pair declines and bulls show no activity at 150.47, bears will quickly regain market control. Hence, I recommend delaying purchases until the price tests the low of 150.19 where the dollar bulls have stepped in already twice this week. Therefore, only a false breakout at this level will give a signal to open long positions. I plan to buy USD/JPY immediately on a rebound from 149.94, aiming for an intraday correction of 30-35 pips.

For short positions on USD/JPY

Sellers have once again got a chance to build a stronger downward correction, but much will depend on US data. Today, I expect to see the first entry point for short positions only after a false breakout at the nearest resistance of 150.82, where a surge could occur in the first half of the day. This will return pressure on the pair and help develop a correction down to the support at 150.47. A breakout and a bottom-up retest of this range will deal a more serious blow to the buyers' positions, leading to triggered stop orders and opening a path to the weekly lows around 150.19. The ultimate target is the 149.94 area, where I plan to take profit. If USD/JPY rises, which is more likely to happen, and bears show no activity at 150.82, buyers will regain the initiative, maintaining the chances of building a new bullish market. In this case, I will delay sales until a false breakout at 151.15. If there is no downward movement there, I will sell USD/JPY immediately on a rebound from 151.55, considering an intraday correction of 30-35 pips.

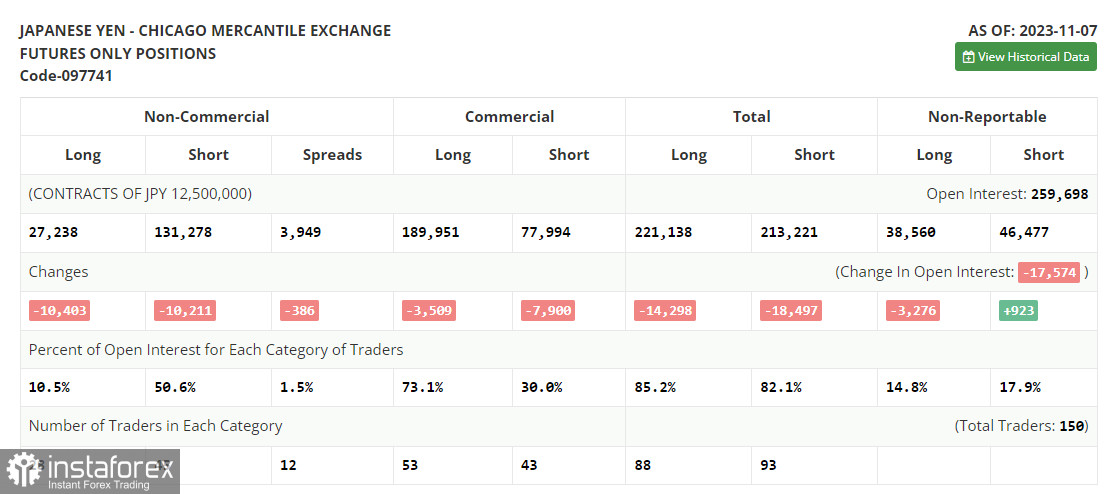

COT report

The Commitments of Traders report for November 7 indicated a decrease in both long and short positions. However, this did not significantly change the balance of power, as the reduction was almost equal. The fact that buyers took the psychological mark of 151 yen per dollar indicates a strong difference in demand and supply. This is mainly because the policies of central banks are quite different, making the dollar a more attractive asset. It is crucial to see how the yen reacts to the important upcoming US data, which could set the direction for the pair in the near term. However, the yen is unlikely to recover strongly without significant changes in the monetary policy of the Bank of Japan. The latest COT report shows that non-commercial long positions decreased by 10,403 to 27,238, while non-commercial short positions fell by 10,211 to 131,278. This suggests continued pressure on the yen and an overall trend towards the strengthening of the US dollar. Consequently, the spread between long and short positions narrowed by 386. The weekly closing price rose to 0.6690 from 0.6647.

Indicator signals:

Moving Averages

Trading below the 30- and 50-day moving averages indicates a possible decline in the dollar.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If the pair declines, the lower band of the indicator at 150.25 will act as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.