The S&P 500 and Nasdaq Composite ended Thursday with small losses ahead of a major jobs report, retreating from record highs hit the day before. The Dow, however, edged up slightly.

The S&P 500 and Nasdaq started the day higher and hit intraday records, but then retreated as tech stocks slid.

Utilities and industrials also contributed to the S&P 500's decline, with consumer discretionary and energy leading the gains.

Nvidia shares fell 1.1%, falling to third place in the world's most valuable companies, behind Apple, which regained the second spot.

Investors are eyeing a key U.S. nonfarm payrolls report on Friday. The latest weekly jobless claims report points to a softening labor market that could allow the Federal Reserve to begin cutting interest rates. The European Central Bank cut its interest rate for the first time since 2019.

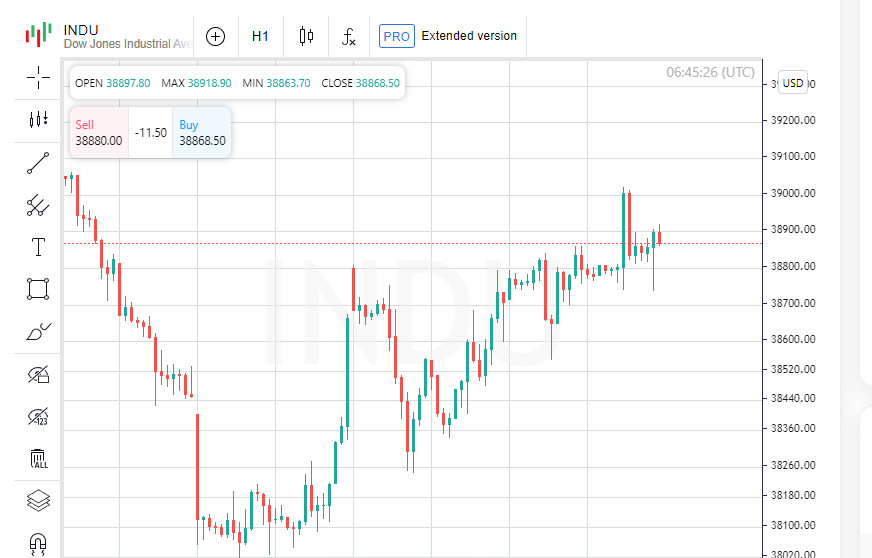

The Dow Jones Industrial Average gained 78.84 points, or 0.20%, to 38,886.17. The S&P 500 lost 1.07 points, or 0.02%, to 5,352.96, while the Nasdaq Composite fell 14.78 points, or 0.09%, to 17,173.12.

Among the Dow Jones components, Salesforce Inc. was the top gainer, up 6.23 points (2.63%) to close at 242.76. Amazon.com Inc. was up 3.72 points (2.05%) to close at 185.00.

Nike Inc. was up 1.40 points (1.48%) to close at 95.72.

Intel Corporation was the top loser, down 0.36 points (1.17%) to 30.42. 3M Company shares added 0.84 points (0.85%) to close at 98.22, while Goldman Sachs Group Inc shares fell 3.58 points (0.78%) to end at 458.10.

Among the S&P 500 index's top gainers were Illumina Inc shares, which rose 7.42% to close at 114.72. PayPal Holdings Inc shares rose 5.49% to close at 67.02, while MarketAxess Holdings Inc shares increased 4.86% to end at 205.97.

NRG Energy Inc shares showed the biggest decline, losing 4.56% to close at 77.83. Hubbell Inc shares fell 4.11% to end at 365.94. Eaton Corporation PLC fell 4.02% to 313.46.

The biggest gainers on the NASDAQ Composite were Virax Biolabs Group Ltd, up 85.85% to 1.97. SilverSun Technologies Inc rose 68.61% to close at 220.00, while Fibrobiologics Inc rose 53.88% to 10.31.

Cue Health Inc was the worst performer, down 79.95% to 0.01. Plutonian Acquisition Corp fell 58.10% to close at 2.43. Actelis Networks Inc fell 47.04% to 1.97.

The rise of Nvidia and other AI-related stocks has been a key factor in supporting Wall Street's rally this year. The chipmaker has contributed significantly to the S&P 500's gain of more than 12% for the year.

Traders are pricing in a 68% chance of a rate cut in September, according to CME's FedWatch tool, and are pricing in two rate cuts this year, according to LSEG data. Forecasters polled by Reuters also expect two rate cuts.

"We're in a period of uncertainty between now and tomorrow," said Thomas Hayes, chairman of Great Hill Capital in New York. "But overall, we're seeing the beginning of a global, coordinated easing policy from central banks in the West, with the exception of Japan, which is tightening," he added.

GameStop shares jumped 47% after a popular online influencer known as "Roaring Kitty" announced on YouTube that she would be livestreaming on Friday.

Lululemon Athletica shares rose 4.8% after the company beat first-quarter earnings and revenue estimates.

U.S.-listed shares of Chinese electric vehicle maker NIO (9866.HK) fell 6.8% after reporting a quarterly net loss.

Five Below shares fell 10.6% after the discount store operator lowered its full-year net sales forecast.

Advancing stocks outnumbered declining stocks on the NYSE by a 1.05-to-1 ratio. On the Nasdaq, 1,729 stocks ended higher and 2,445 ended lower, for a 1.41-to-1 ratio in favor of decliners.

The S&P 500 posted 25 new 52-week highs and five new lows, while the Nasdaq Composite posted 57 new highs and 110 new lows. Total equity trading volume on U.S. exchanges was about 10.4 billion, below the 20-day average of 12.7 billion.

August gold futures rose 0.69%, or 16.50, to $2.00 a troy ounce. WTI crude oil futures for July delivery rose 2.01%, or 1.49, to $75.56 a barrel. Brent crude futures for August delivery rose 1.87%, or 1.47, to $79.88 a barrel.