Analysis of macroeconomic reports:

There are a sufficient number of macroeconomic events scheduled for Friday, among which some are very important. Of course, we should start with the US publications as they have priority for the market. Today, the unemployment rate for May, the number of new jobs created in the non-farm sector (Nonfarm Payrolls), and changes in the average wage level will be released. The US dollar requires very strong data to show growth, as the market currently interprets almost all news unfavorably for it. If the US data turns out to be weak, there is no doubt that the US currency will again plummet.

In Germany, a secondary report on industrial production will be published today, while in the European Union, the GDP report for the first quarter in the third estimate will be released. The UK has an empty event calendar.

Fundamental Events Analysis:

From Thursday's fundamental events, we highlight Christine Lagarde's speech. In fact, we should not expect any major statements from the ECB President today. The European regulator's latest meeting just concluded yesterday, and Christine Lagarde spoke at a press conference. Her speech contained little specifics and important information, and the market barely reacted. Therefore, it is unlikely that Ms. Lagarde will make any significant statements today.

General Conclusions:

During the last trading day, focus on the US labor market and unemployment statistics. In reality, the market reaction might be as weak as it was to the ECB meeting yesterday. Only very strong data can help the dollar. If the reports are mediocre or worse than forecasts, there is no doubt that both currency pairs will rise again, indicating another fall for the US dollar.

Main Rules of the Trading System:

- The strength of a signal is determined by the time it takes to form (bounce or break through a level). The less time it takes, the stronger the signal.

- If two or more trades near a level are based on false signals, all subsequent signals from that level should be ignored.

- In a flat market, any pair can generate many false signals or none at all. In any case, it's better to stop trading at the first signs of a flat.

- Trades should be opened between the start of the European session and the middle of the American session, after which all trades should be closed manually.

- On the hourly timeframe, trade based on MACD indicator signals if there is good volatility and a trend confirmed by a trend line or channel.

- If two levels are too close together (5 to 20 points), they should be considered a support or resistance area.

- After moving 15-20 points in the right direction, set a Stop Loss to break even.

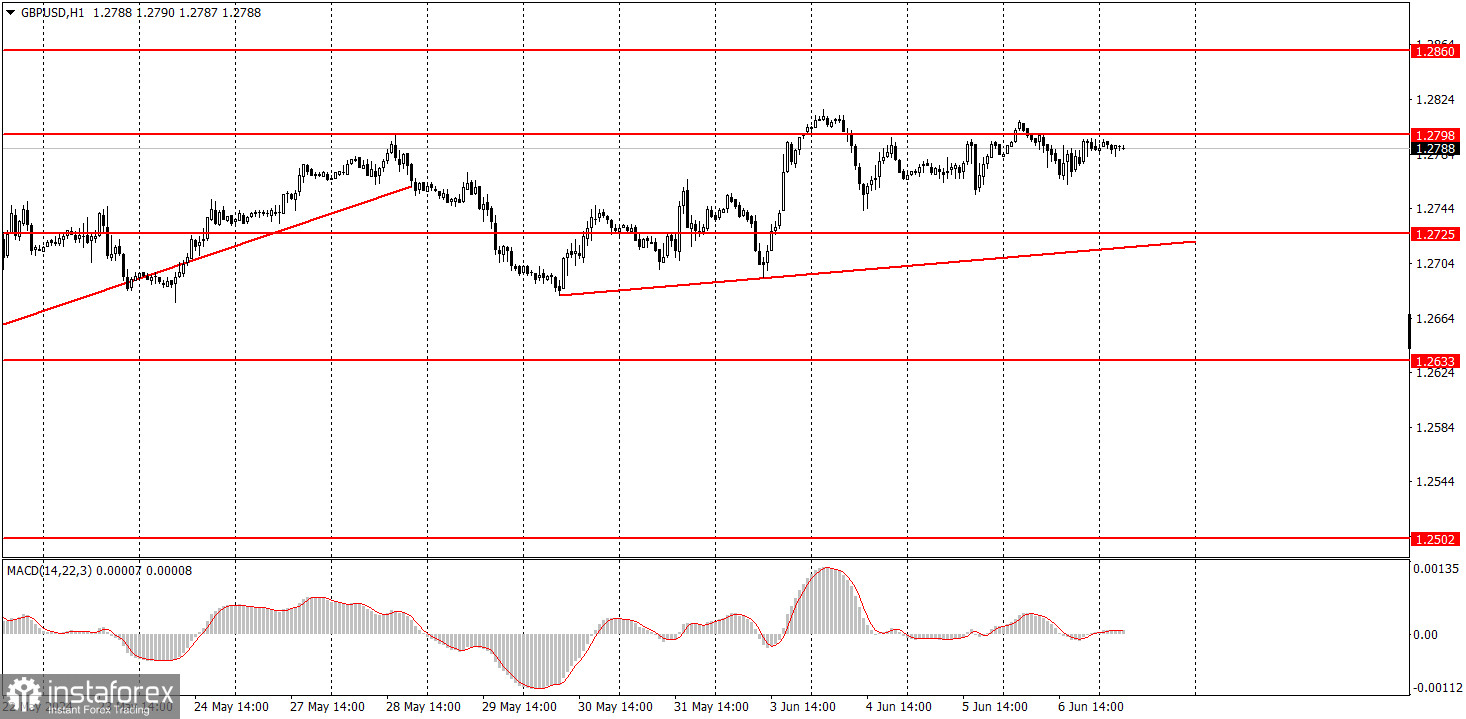

Explanation of the Charts:

- Support and resistance levels: Levels that are targets for opening buy or sell trades. Near them, Take Profit levels can be placed.

- Red lines: Channels or trend lines that show the current trend and indicate the preferred trading direction.

- MACD indicator (14,22,3): Histogram and signal line – an auxiliary indicator that can also be used as a source of signals.

Important speeches and reports (always listed in the news calendar) can significantly influence the movement of the currency pair. Therefore, during their release, it is recommended to trade with maximum caution or exit the market to avoid a sharp price reversal against the preceding movement.

Beginners trading on the forex market should remember that only some trades can be profitable. Developing a clear strategy and money management are key to success in trading over the long term.