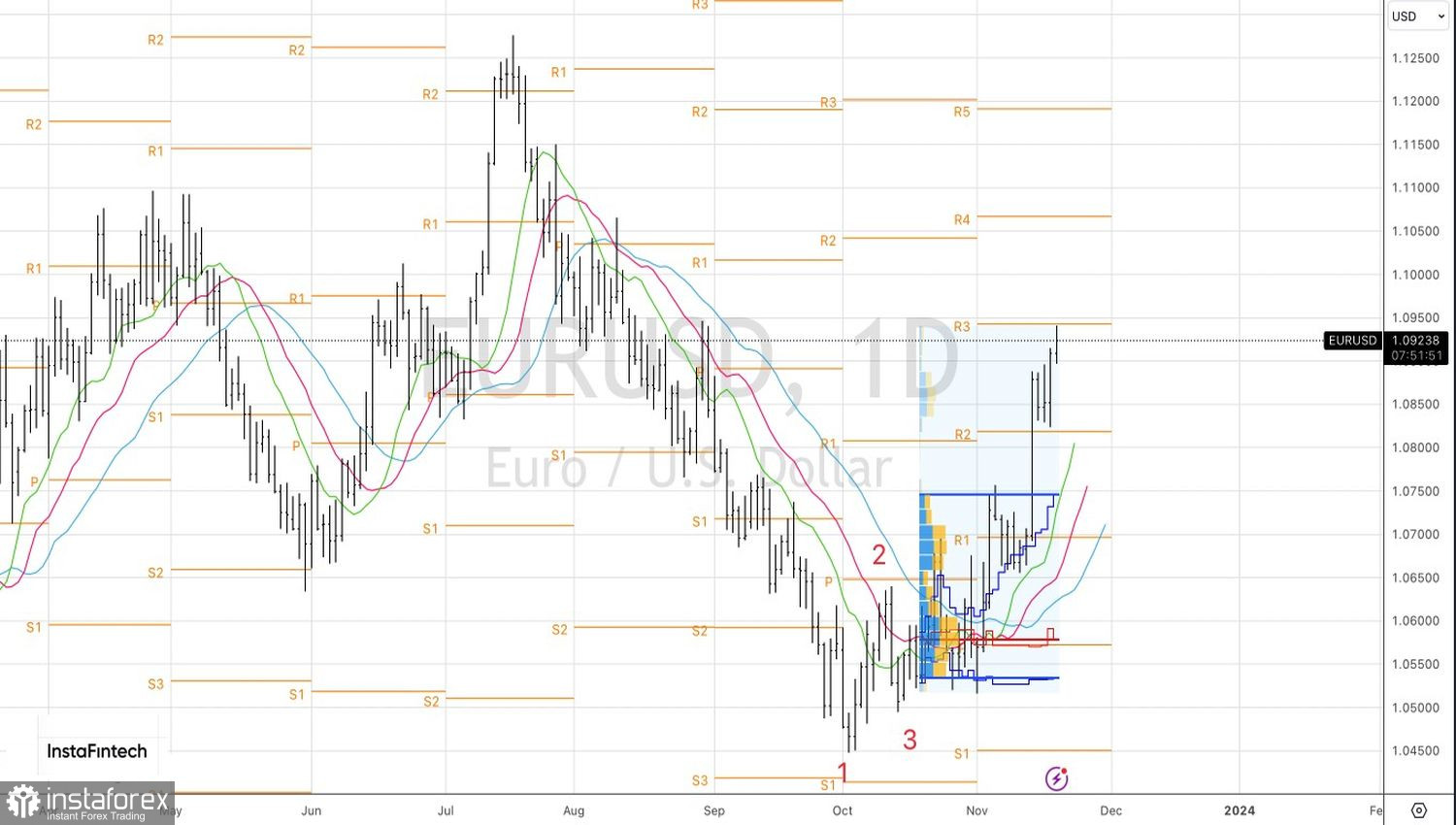

Expectations of improved business activity in the eurozone and the upgrade of Italy's credit rating forecast to a stable level by Moody's Investors Service became catalysts for the EUR/USD rally towards August highs. However, the advancement of the main currency pair upward is not as rapid as the bulls would prefer. Markets are reassessing the prospects of interest rates from the world's leading central banks. It is entirely possible that investors have mistaken their desires for reality.

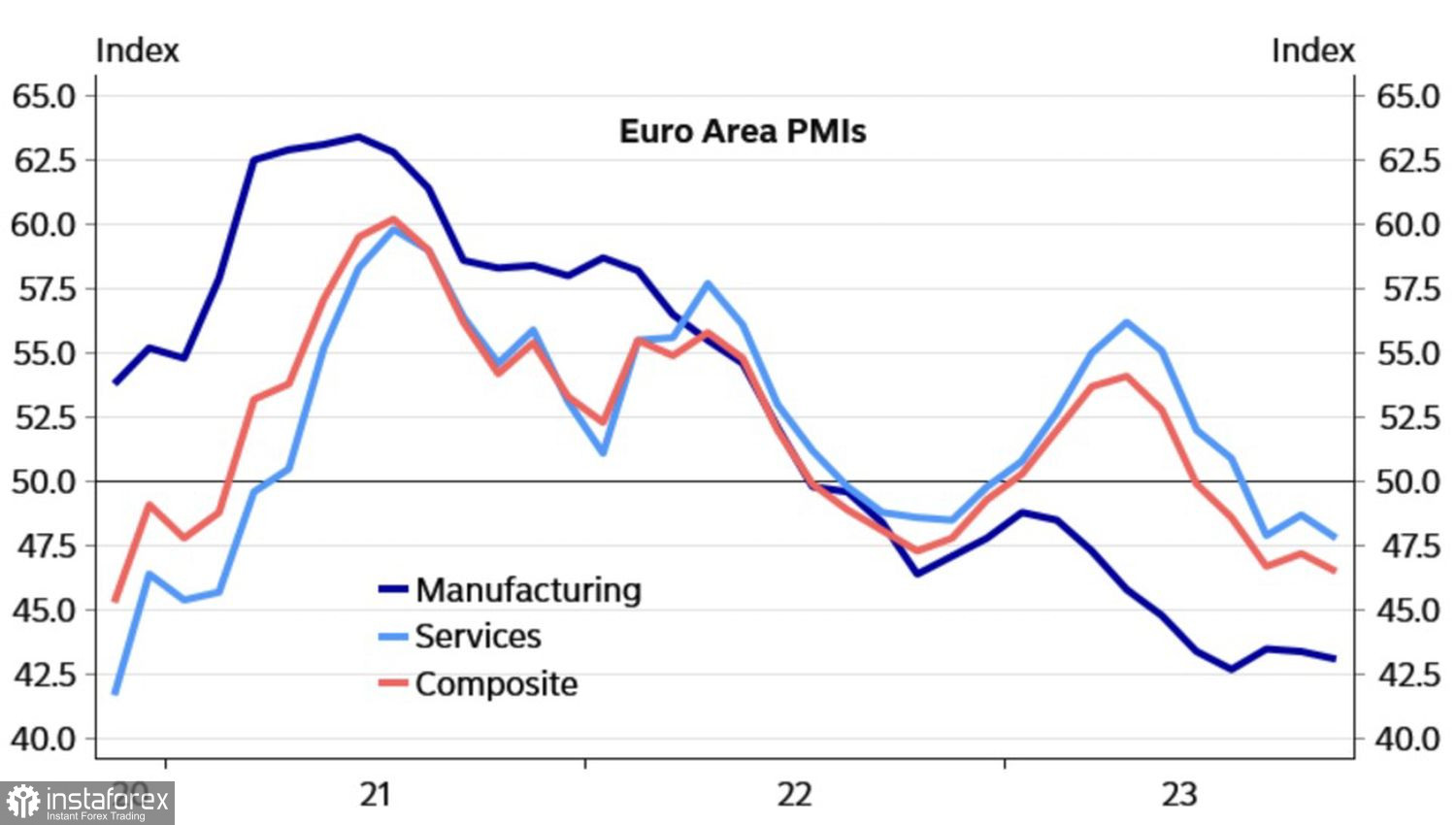

Business Activity Dynamics in the Eurozone

Fear has big eyes. So does greed. The desire to jump on the upside bound EUR/USD train was so great that traders were buying euros without looking back. Yes, the eurozone economy looks decidedly weaker than the American one, and the capture of ships in the Red Sea by Iran-backed Houthis led to a surge in gas prices and rumors of a return to an energy crisis. But can this compare to the dovish pivot of the Federal Reserve?

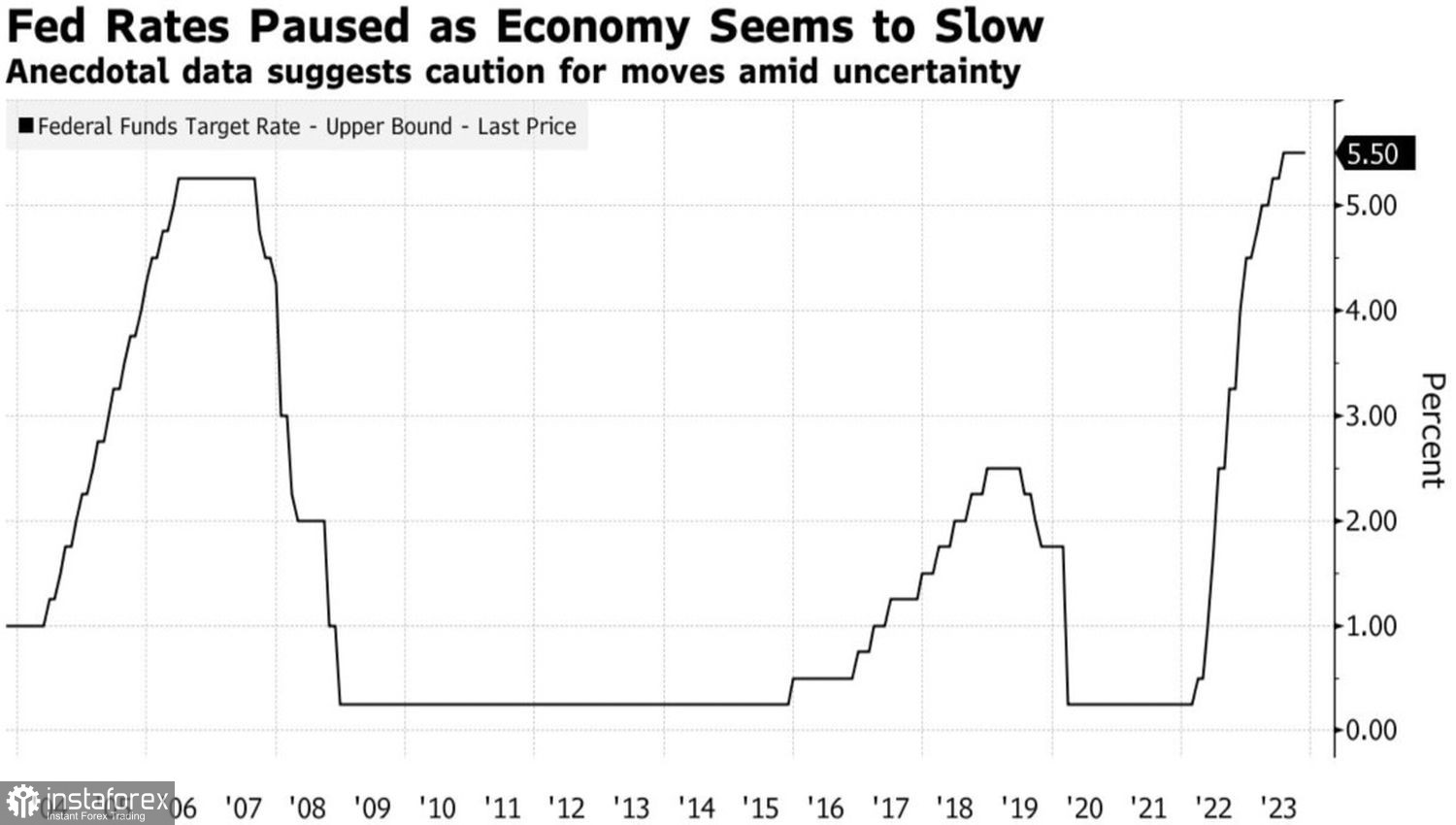

Since the start of the tightening cycle of the Federal Reserve's monetary policy, the cost of borrowing has increased by 525 basis points. Meanwhile, rapid inflation decline makes one wonder if such high rates are needed for the economy. The futures market expects a 100 basis point reduction in 2024. However, is the presumed cut too significant?

Federal Funds Rate Dynamics

At a meeting with businessmen, Richmond Fed President Thomas Barkin asked those who believe that inflation in the U.S. will be higher than before the pandemic to raise their hands. Two-thirds of the audience did so. Goldman Sachs predicts that the Fed will only cut the federal funds rate in the fourth quarter of 2024 by just 25 basis points. This contradicts the indications of the futures market. If this happens, the U.S. dollar will rise from the ashes.

Essentially, investors expect inflation in the U.S. and Europe to continue to decline as rapidly as before. The elimination of supply chain disruptions and the exhaustion of fiscal stimulus will return us to the previous era of low borrowing costs. In reality, high prices could easily return, as they did in the 1970s. Both the Fed and the markets must consider such a risk.

Their current expectations of a 100 basis point reduction in the federal funds rate by the end of 2024 and a 25 basis point reduction in March, with a 30% probability, are clearly exaggerated. If the odds start to decrease, stock indices will fall, and global risk appetite will decrease. This will strengthen the U.S. dollar against major world currencies. However, for this scheme to start unfolding, there needs to be some improvement in macroeconomic statistics in the United States. For now, everything is happening in the opposite direction.

Technically, the further dynamics of EUR/USD will depend on the ability of the currency pair to overcome the pivot level of 1.094. If successful, one should expect a continuation of the rally towards 1.103, providing a basis to increase long positions. On the contrary, the failure of the bulls to storm the crucial resistance will increase the risks of euro consolidation in the range of $1.084–$1.094 and allow for short-term selling against the U.S. dollar.