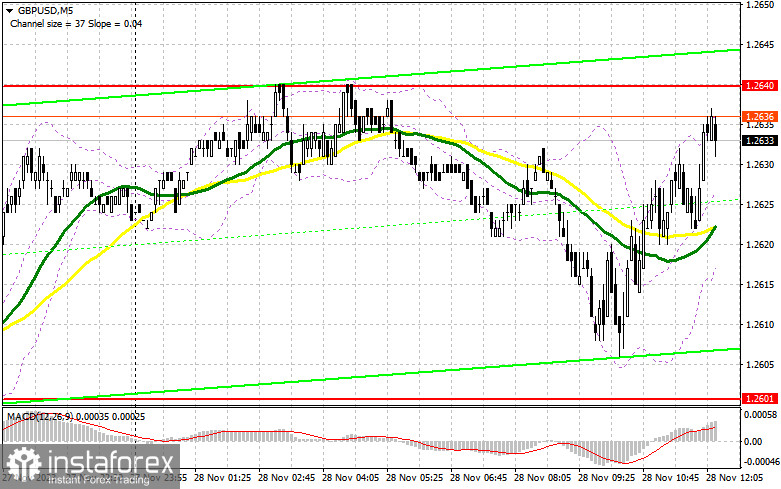

In my morning forecast, I drew attention to the level of 1.2601 and recommended making trading decisions based on it. Let's look at the 5-minute chart and analyze what happened there. A decline towards 1.2601 occurred similarly to yesterday. However, due to low volatility and the absence of fundamental statistics, we couldn't achieve a test and the formation of a false breakout there. For this reason, the technical picture remained unchanged for the second half of the day.

To open long positions on GBP/USD, the following is required:

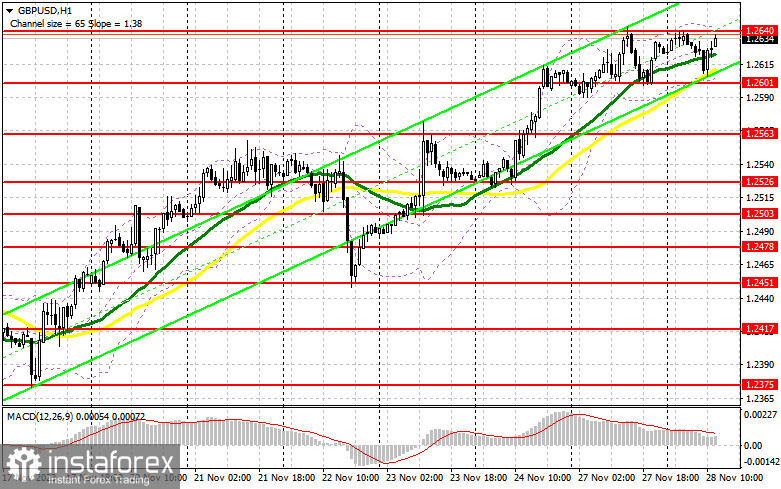

Buyers continue to focus on resistance at 1.2640 and will likely act more actively in this range in the second half of the day. A breakthrough of this level can also be expected in the case of weak US consumer confidence indicator data and dovish statements from FOMC members Austan D. Goolsbee and Michelle Bowman. Their soft stance, which they held last week, will likely further weaken the dollar's positions. If we see a bearish reaction to the statistics, I expect the first appearance of buyers around the same support at 1.2601, which we did not reach in the first half of the day. Forming a false breakout will provide an entry point for long positions to develop the uptrend further and update the resistance at 1.2640, where the pair is currently heading. A breakout and consolidation above this range will lead to a new signal to open long positions with an exit at 1.2675. The ultimate target will be the area at 1.2709, where I will take profit. In the scenario of a decline in the pair and the absence of activity from buyers at 1.2601 in the second half of the day, pressure on the pair will undoubtedly increase, leading to a more significant downward correction, which has been looming for quite some time. In this case, only a false breakout around the next support at 1.2563 will signal the opening of long positions. I plan to buy GBP/USD immediately on the rebound only from 1.2526, with the target of a correction of 30-35 points within the day.

To open short positions on GBP/USD, the following is required:

It can be said that sellers have started to act in the market only after bears defend the level of 1.2640. Good US statistics and an increase in consumer confidence contrary to economists' forecasts will allow the formation of a false breakout at 1.2640, signaling a sale and a chance for a larger downward movement towards the support at 1.2601. A breakthrough and a reverse test from the bottom to the top of this range will deal a more serious blow to buyer positions, removing stop orders and opening the way to 1.2563. A more distant target will be the area at 1.2526, where I will take profit, but we will only reach this level if the representatives of the Fed take a tough position. With the GBP/USD rising and the absence of activity at 1.2640 in the second half of the day, bears will once again lose control of the market, continuing the upward trend. In this case, I will postpone sales until a false breakout at 1.2675. If there is no downward movement, I will sell GBP/USD immediately on the rebound from 1.2709, but I am only counting on a pair correction down by 30-35 points within the day.

Indicator Signals:

Moving Averages

Trading is slightly above the 30 and 50-day moving averages, indicating further pair growth.

Note: The author considers the period and prices of moving averages on the hourly chart (H1) and differs from the general definition of classic daily moving averages on the daily chart (D1).

Bollinger Bands

In case of a decline, the lower boundary of the indicator, around 1.2601, will act as support.

Indicator Descriptions:

- Moving Average (smoothens current trends by averaging volatility and noise). Period 50. Marked on the chart in yellow.

- Moving Average (smoothens current trends by averaging volatility and noise). Period 30. Marked on the chart in green.

- MACD Indicator (Moving Average Convergence/Divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands. Period 20.

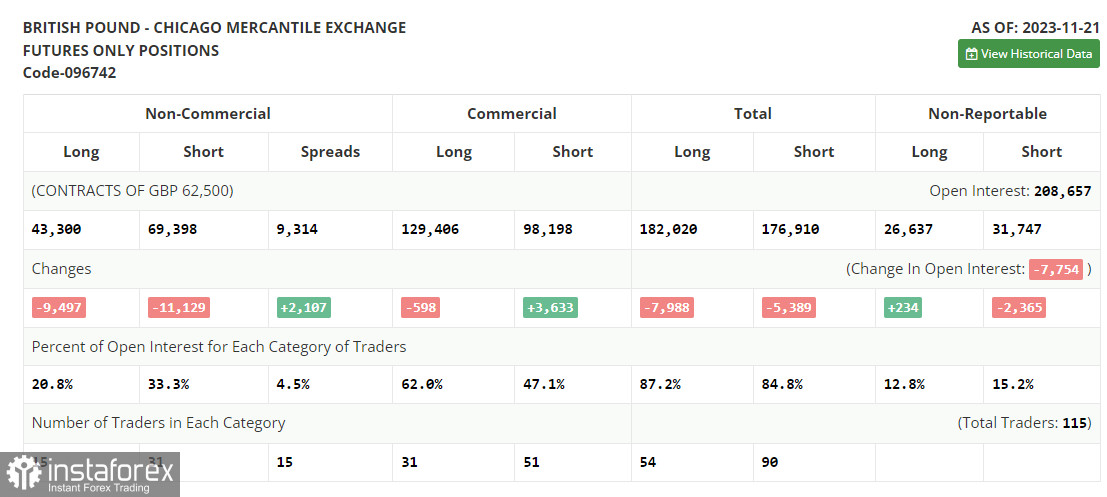

- Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and meet certain requirements.

- Non-commercial long positions represent the total long open position of non-commercial traders.

- Non-commercial short positions represent the total short open positions of non-commercial traders.

- The total non-commercial net position is the difference between non-commercial short and long positions.