Analysis of Monday's transactions:

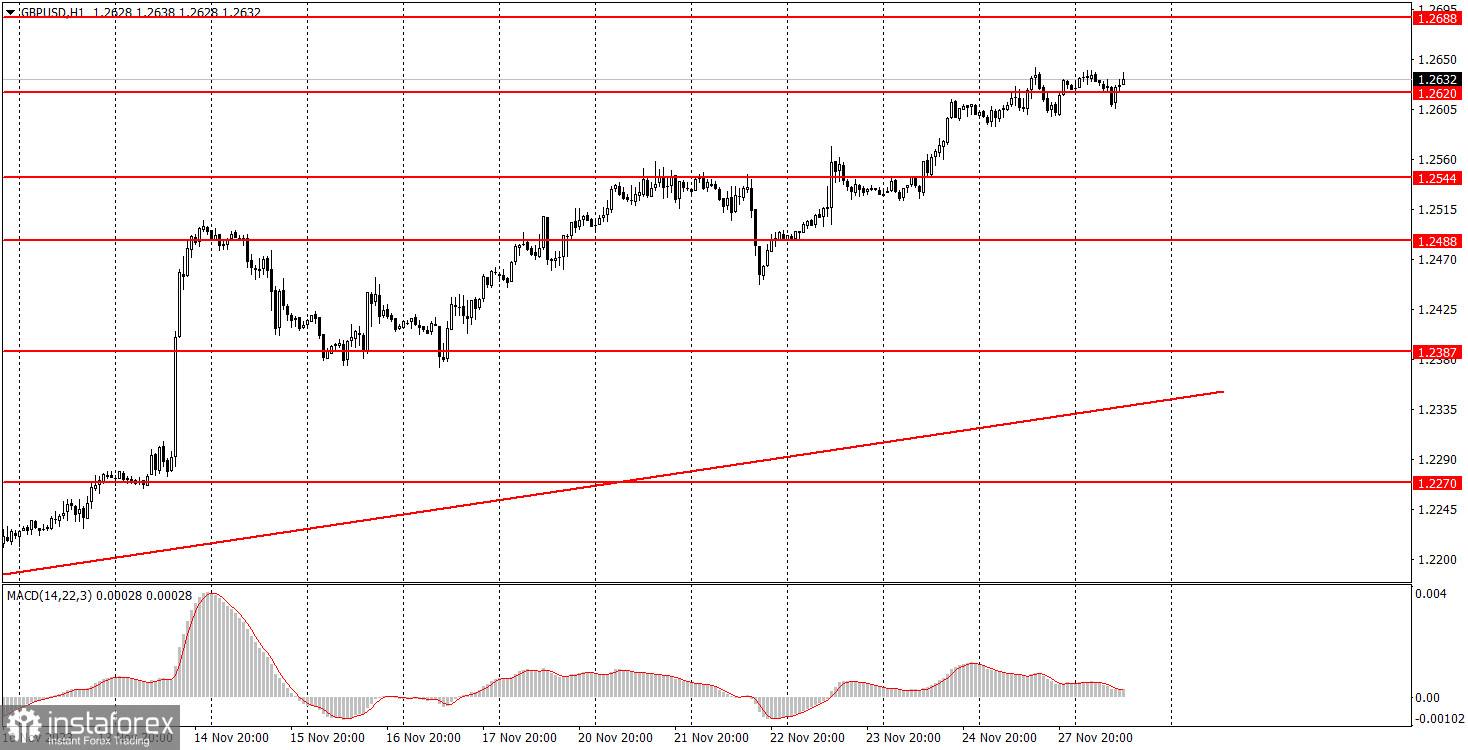

1-hour chart of the GBP/USD pair.

The GBP/USD pair, at the end of the first trading day of the week, remained in the same place where it started the week. Volatility on Monday was very weak, as we warned over the weekend. However, this is not surprising since no significant events existed in the UK or the US. Despite lacking informational support in half of the cases, the British pound continues to grow confidently. And on days when it doesn't grow, it doesn't fall either. Look at how far the ascending trend line is and how weak the recent corrections are. The entire movement is reminiscent of inertia or speculation when the currency appreciates because it is being bought. And it is bought because it appreciates.

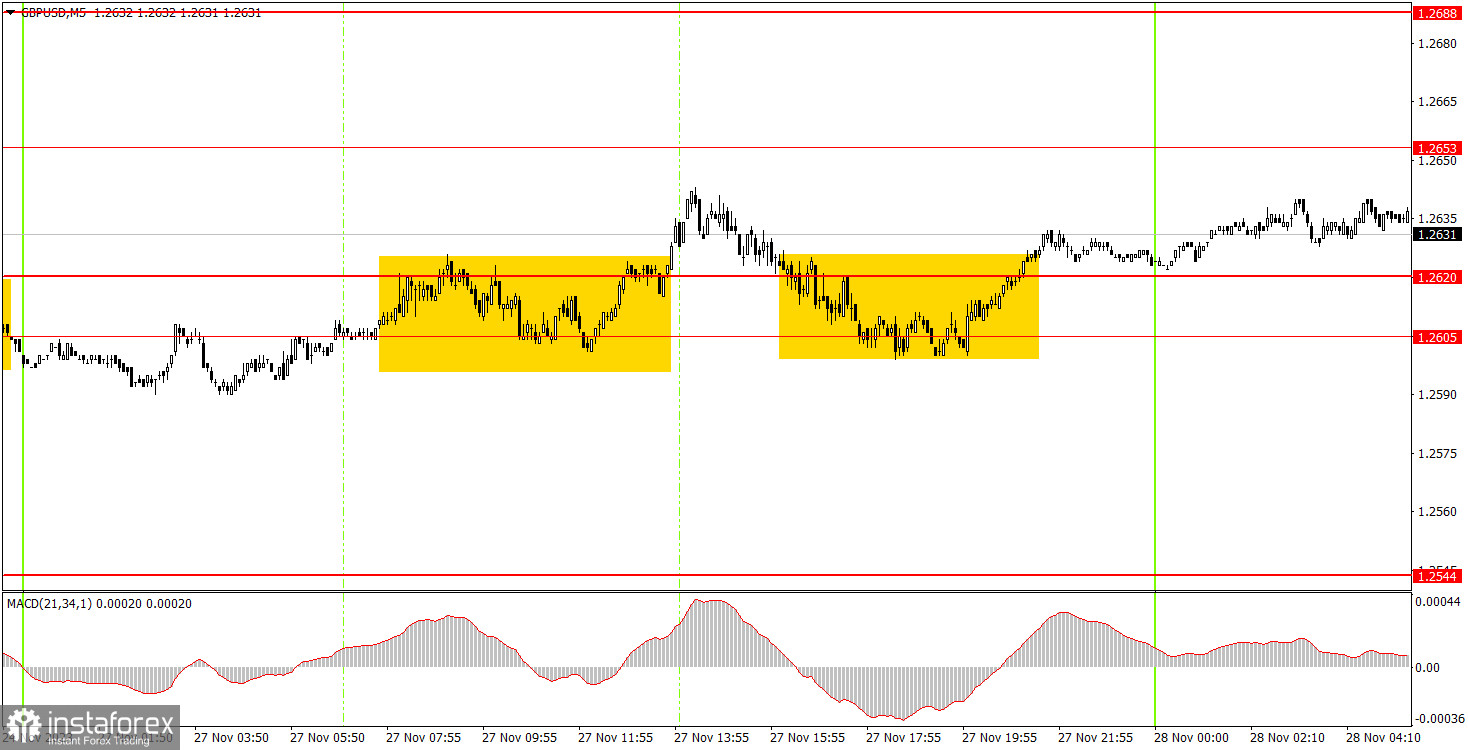

5-minute chart of the GBP/USD pair.

On Monday, exactly two trading signals were formed in the 5-minute timeframe. The price was at 1.2605-1.2620 during the European trading session and barely left it in 5 or 6 hours. However, after forming this buy signal, it could not move even 20 points in the right direction. Later, the pair returned to the range of 1.2605-1.2620 but left it for the second time practically overnight. Therefore, the question was only where to close the first buy deal. And it could be closed almost anywhere since no sell signals were formed. It was extremely difficult to profit from it, but there could be no significant loss either.

How to trade on Monday:

On the hourly timeframe, the GBP/USD pair continues to be ascending, but we still believe it will end soon. Now, we have an ascending trend line, the overcoming of which will determine the end of the upward trend. However, it is located quite far from the price. There are no significant reasons for the pound to continue to rise, but the market keeps it at its highest position in months. On the 5-minute timeframe, tomorrow you can trade at levels 1.2164-1.2179, 1.2235, 1.2270, 1.2310, 1.2372-1.2387, 1.2457-1.2488, 1.2544, 1.2605-1.2620, 1.2653, 1.2688, 1.2748. After the price moves in the right direction by 20 points after opening a trade, you can set the Stop Loss at breakeven. On Tuesday, no important publications are planned in the UK or the US. Therefore, today's volatility is very weak, and we observe almost the same movements as yesterday.

Basic rules of the trading system:

- The strength of the signal is determined by the time it takes to form the signal (rebound or overcome the level). The less time it took, the stronger the signal.

- If two or more trades on false signals were opened near any level, all subsequent signals from that level should be ignored.

- In a flat, any pair can generate many false signals or not generate them at all. But in any case, it is better to stop trading at the first signs of a flat.

- Trades are opened between the start of the European session and the middle of the American session when all trades must be closed manually.

- On the 30-minute timeframe, trades based on signals from the MACD indicator can only be made in the presence of good volatility and a trend confirmed by the trend line or channel.

- If two levels are located too close to each other (from 5 to 15 points), they should be considered as a support or resistance area.

What is on the chart:

Support and resistance levels - levels that are targets when opening buy or sell positions. Take Profit levels can be placed near them.

Red lines - channels or trend lines that reflect the current trend and show in which direction it is preferable to trade now.

MACD indicator (14, 22, 3) - histogram and signal line - an auxiliary indicator that can also be used as a source of signals.

Important speeches and reports (always included in the news calendar) can greatly affect the currency pair's movement. Therefore, during their release, it is recommended to trade as cautiously as possible or exit the market to avoid a sharp reversal of the price against the previous movement.

For beginners trading in the forex market, it is important to remember that only some trades can be profitable. Developing a clear strategy and money management are the keys to success in trading over the long term.