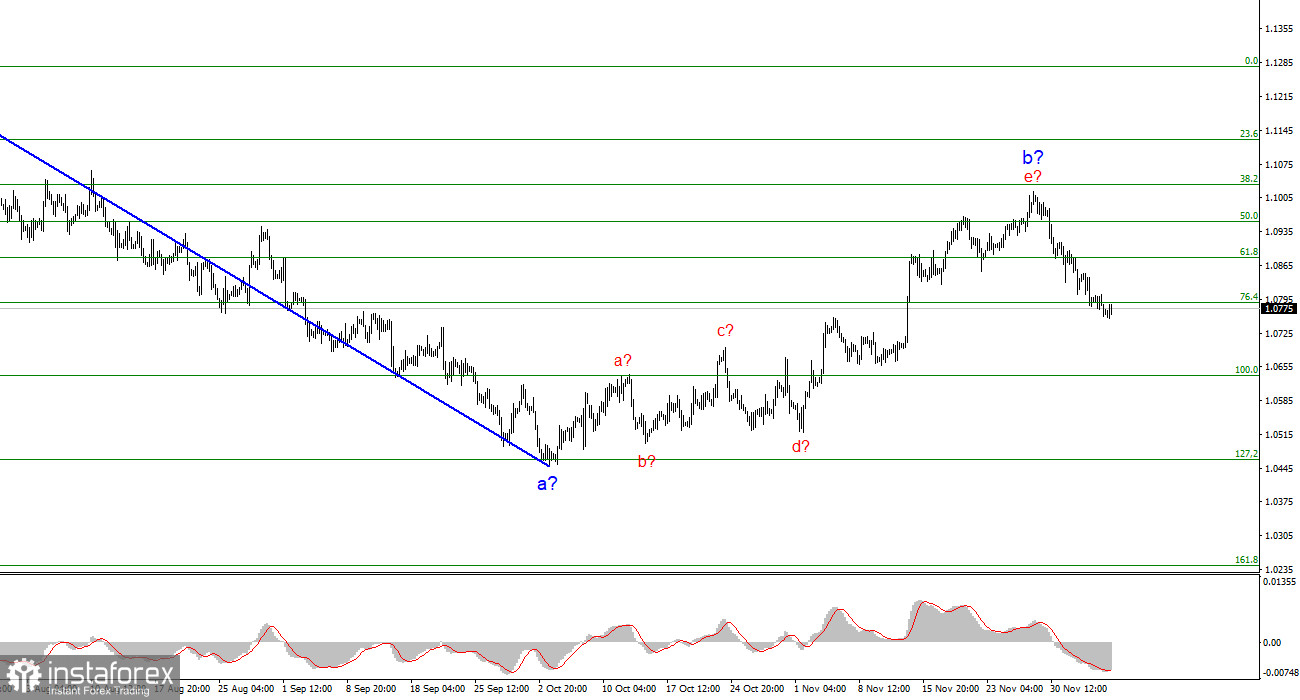

In the last six working days, European currency demand has steadily declined. This is a legitimate movement, as the current wave analysis and news background predict a fall in the euro. I want to remind you that the recent rise in the pair was a corrective wave, the size of which currently stands at 61.8%. 61.8%, according to Fibonacci, is an excellent level for completing a corrective wave. Undoubtedly, wave 2 or b can take a much more extended and complex form. This often happens when the news background contradicts the wave analysis. But currently, the news background does not support the euro, and here's why.

First, economic reports from the European Union are worse than those from the United States. If reports in America for the last month were below market expectations, then reports in the European Union usually come out below zero. A vivid confirmation of this is the GDP reports in the EU and industrial production in Germany, released today. This factor alone tells us there is no reason for increased demand for the euro.

In addition, an increasing number of members of the ECB Executive Board are talking about lowering interest rates in 2024. I remind you that inflation in the EU has already dropped to 2.4%, so the regulator no longer needs to consider new tightening. Even if the consumer price index rises slightly, this will not be a reason for new tightening.

One of the ECB Board members, Isabel Schnabel, said yesterday that she would prefer to wait to make forecasts for monetary policy for six months or a year ahead, as there have been surprises in the past that could not be predicted in advance. She stated that the ECB still relies on economic statistics when making decisions, but the latest inflation data make further tightening unlikely. Schnabel also noted that core inflation is decreasing faster than she assumed, but Europe's price growth may accelerate in the coming months. According to Schnabel, rates have yet to be raised but will not be considered until statistical data allow for tightening expectations.

Based on the analysis, I conclude that constructing a descending wave set continues. Targets around the 1.0463 mark have been perfectly worked out, and the unsuccessful attempt to break through this mark indicated a transition to the construction of a corrective wave. Wave 2 or b has taken a completed form, so in the near future, I expect the construction of an impulsive descending wave 3 or c with a significant decline in the pair. I still recommend selling with targets below the low of wave 1 or a. At this time, wave 2 or b can be considered complete.

At this time, I recommend selling the pair with targets below the 1.2068 mark because wave 2 or b must eventually be complete, and it can end at any moment. The longer it takes, the stronger the pound's decline will be. The contracting triangle is a precursor to the completion of the movement.