Analysis of GBP/USD 5M

GBP/USD managed to slightly correct higher on Monday. We have noticed before that the British pound is reluctant to fall, despite having all the necessary reasons for doing so. It found a reason to edge up on Monday, even though the euro stood still all day, and there were no fundamental or macroeconomic developments. In general, we believe that the British pound is unreasonably expensive, overbought, and has no grounds for reviving the uptrend. Unfortunately, the market currently holds a different opinion. Take note that the market can trade without paying any attention to fundamental and macroeconomic events. It is difficult to trade during such periods, as prices simply do not move in the expected direction.

The pair has yet to breach the level of 1.2520, and this week there will be a significant number of important events and reports that can push the pair in either direction. While no one expects any changes in monetary policy from the Bank of England and the Federal Reserve, we should still consider the possibility that surprises can happen at any time. At the moment, we cannot predict how the market will react to them. Therefore, be prepared for strong movements and sharp reversals.

Yesterday, the price even managed to form a good sell signal. At a certain point, the pair reached the area of the Kijun-sen and Senkou Span B lines, from which it rebounded quite accurately and confidently. After this sell signal, the price fell by about 25 pips. The pair did not reach the target level, so the short position could be closed anywhere.

COT report:

COT reports on the British pound also align perfectly with what's happening in the market. According to the latest report on GBP/USD, the non-commercial group opened 5,000 long positions and closed 14,500 short ones. Thus, the net position of non-commercial traders increased by another 19,500 contracts in a week. The net position indicator has been steadily rising over the past 12 months, but it has been firmly decreasing since August. In recent weeks, the pound has traded higher, and large players are gradually increasing their long positions. However, we still believe that the pound will no longer rally.

The "non-commercial" group currently has a total of 66,300 long positions and 54,600 short ones. In general, the bulls and the bears have reached a balance. Since the COT reports cannot make an accurate forecast of the market's behavior at the moment, and the fundamentals are practically the same for both currencies, we can only consider the technical picture and economic reports. The technical analysis allows us to expect a strong downtrend, and the economic reports have been significantly stronger in the United States than in the United Kingdom. There are many factors influencing the pair's movement right now, and not all of them can answer the question of what to expect next.

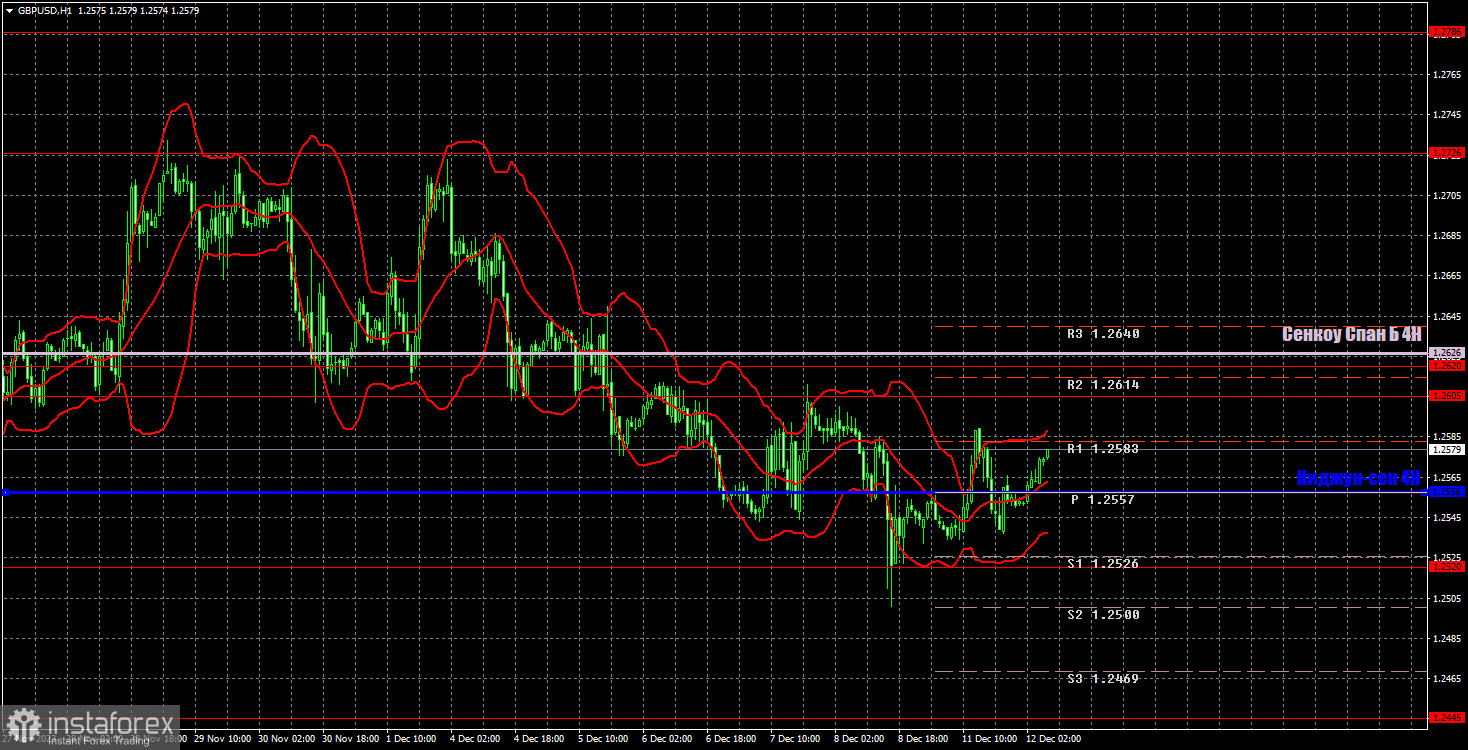

Analysis of GBP/USD 1H

On the 1H chart, a rather weak downtrend persists. We still expect the pound to fall and consider it excessive and illogical for the pair to continue its upward movement. The pair remains overbought, but the market is not in a rush to sell at the moment. A correction to the Senkou Span B line is possible.

Today, the pair may continue its upward movement, as we can't confirm that the US dollar will receive support from the inflation data. Even if inflation accelerates slightly, it does not necessarily mean that the Federal Reserve will raise interest rates again.

As of December 12, we highlight the following important levels: 1.1927-1.1965, 1.2052, 1.2109, 1.2215, 1.2269, 1.2349, 1.2429-1.2445, 1.2520, 1.2605-1.2620, 1.2726, 1.2786, 1.2863. The Senkou Span B (1.2626) and Kijun-sen (1.2558) lines can also be sources of signals. Signals can be "bounces" and "breakouts" of these levels and lines. It is recommended to set the Stop Loss level to break-even when the price moves in the right direction by 20 pips. The Ichimoku indicator lines can move during the day, which should be taken into account when determining trading signals. The illustration also includes support and resistance levels that can be used to lock in profits from trades.

On Tuesday, the UK will release interesting reports on unemployment and wages. Market participants will keep an eye on the US inflation report. The UK reports may only cause a minor reaction, but the US inflation data can significantly impact the pair's movement.

Description of the chart:

Support and resistance levels are thick red lines near which the trend may end. They do not provide trading signals;

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, plotted to the 1H timeframe from the 4H one. They provide trading signals;

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals;

Yellow lines are trend lines, trend channels, and any other technical patterns;

Indicator 1 on the COT charts is the net position size for each category of traders;

Indicator 2 on the COT charts is the net position size for the Non-commercial group.