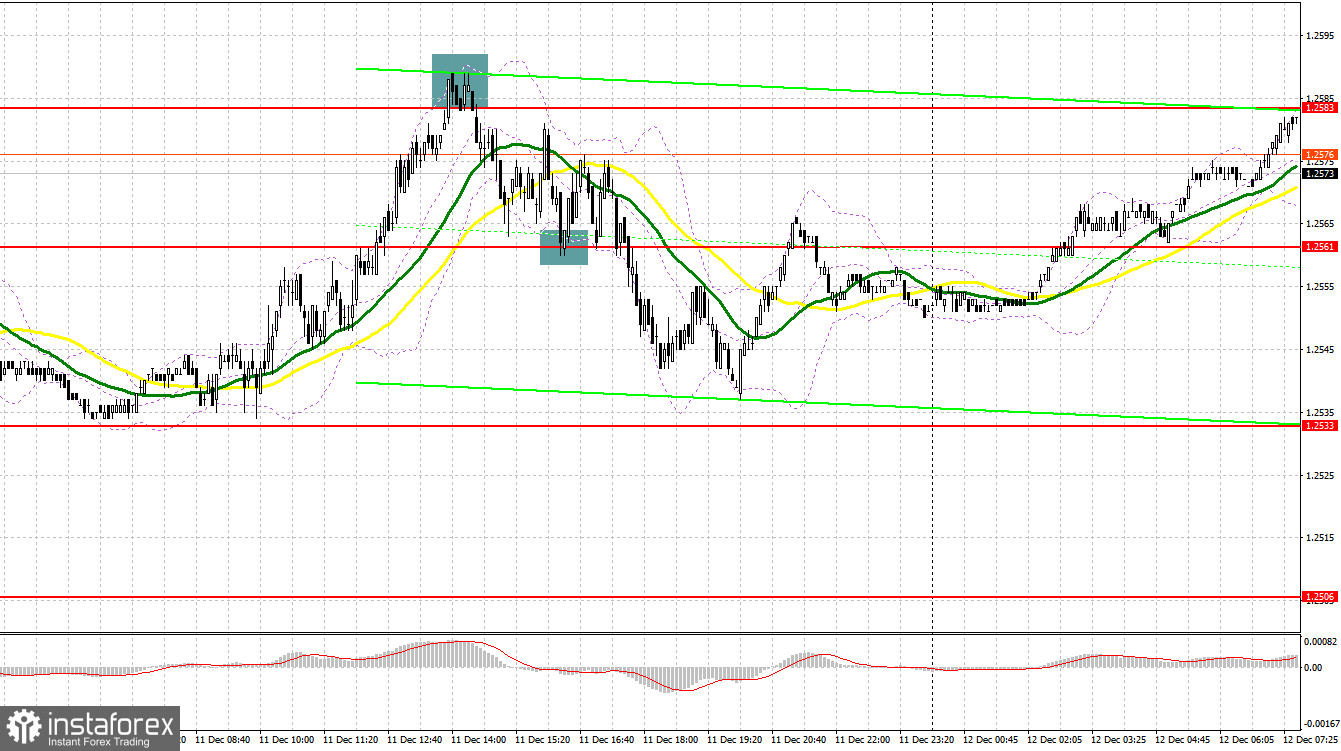

Yesterday, the pair formed some great entry signals. Let's have a look at what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.2533 as a possible entry point. The pair fell, but the 1.2533 level was not tested, so I did not wait for market entry signals. In the afternoon, after rising to 1.2583, the bears emerged. After a false breakout and a sell signal, the pair fell by about 25 pips. Safeguarding the support at 1.2561 in continuation of the uptrend led to an attempt to push the pair to rise during the US session, but the pair did not actively rise.

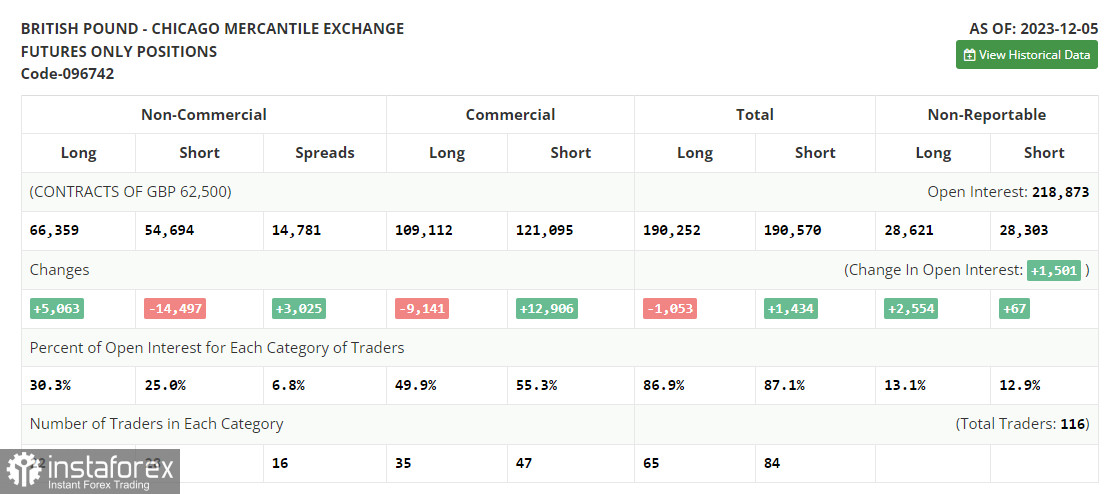

COT report:

Before analyzing the technical picture of the pound, let's see what happened in the futures market. The Commitments of Traders (COT) report for December 5 showed a sharp increase in long positions and a decline in short ones. The pound is still in demand, as Bank of England Governor Andrew Bailey and other BoE policymakers mentioned that the interest rates will need to be kept at the current level, if not raise them. This led traders to believe that they can buy the pair on every good downward move. The Federal Reserve and the BoE meetings will be held this week, which will be decisive. The soft tone of the US central bank will weaken the dollar's positions. If the situation is reversed, and the Fed says it needs to wait longer to decide when to cut interest rates, and the Bank of England starts worrying about the prospects for economic growth, then it is inevitable that the pound will fall. The latest COT report indicates that non-commercial long positions rose by 5,063 to 66,359, while non-commercial short positions were down by 14,497 to 54,694. As a result, the spread between long and short positions increased by 3,025.

For long positions on GBP/USD:

Today everything will be tied to the UK data on unemployment claims, the jobless rate and the average earnings. Weak labor market data will exert pressure on the pound, which I plan to take advantage of. A decline in average earnings will also have a positive impact on inflationary pressures, which plays against the pound in these conditions. If the data disappoints, the pair may likely fall to the important support level at 1.2538 and the bears will make an attempt at this level. A false breakout on this mark, similar to what I discussed above, will provide an entry point for long positions aimed at the resistance at 1.2574, where the pair is currently trading. Only a breakthrough and an upward test of this range will strengthen recovery chances, creating a buy signal to reach 1.2609. A move above this range will indicate a surge towards 1.2646 - a new local high, a test of which will lead to forming an uptrend. If the pair falls and there is no buying activity at 1.2538, sellers will get a chance to regain market control and build a bearish trend. In that case, I'll postpone opening long positions until the price tests the support at 1.2506. Buying is also possible there but only on a false breakout. Long positions on GBP/USD can be opened immediately on a rebound from 1.2478, aiming for a correction of 30-35 pips within the day.

For short positions on GBP/USD:

Yesterday, the bears emerged, but so far the market remains in balance. In case of strong data, sellers will have to defend the area around 1.2608, where forming a false breakout will create a sell signal with the expectation of the pair's decline and a test of the nearest support at 1.2574. A breakout and a retest from below will increase pressure on the pair, giving bears an advantage and a sell entry point with 1.2538 as the target, where I anticipate more active buyers. The next target would be the 1.2506 area, where I will take profits. If GBP/USD rises and there is no activity at 1.2609, the bulls will regain the advantage, leading to an upward movement towards the next resistance at 1.2609. I would also advise selling there only on a false breakout. If there is no activity there either, I recommend opening short positions on GBP/USD from 1.2646, anticipating a 30-35 pip downward rebound within the day.

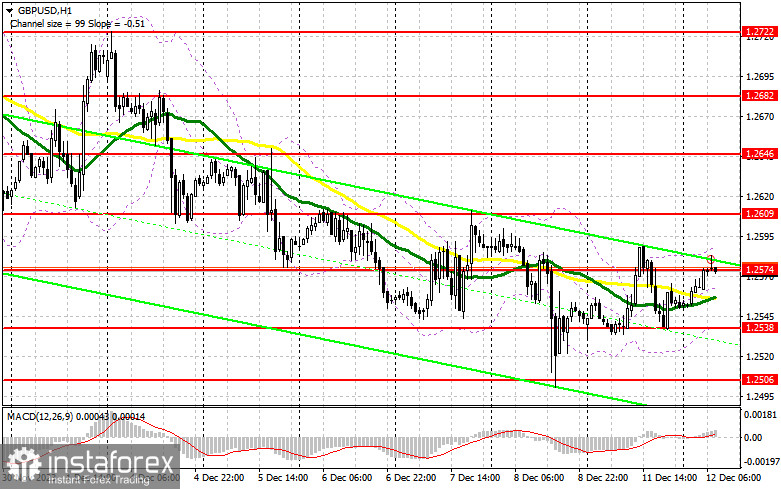

Indicator signals:

Moving Averages

The instrument is trading above the 30 and 50-day moving averages. It indicates that GBP/USD is likely to rise further.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If GBP/USD grows, the indicator's upper border near 1.2580 will serve as resistance. If the pair declines, the indicator's lower border near 1.2538 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.