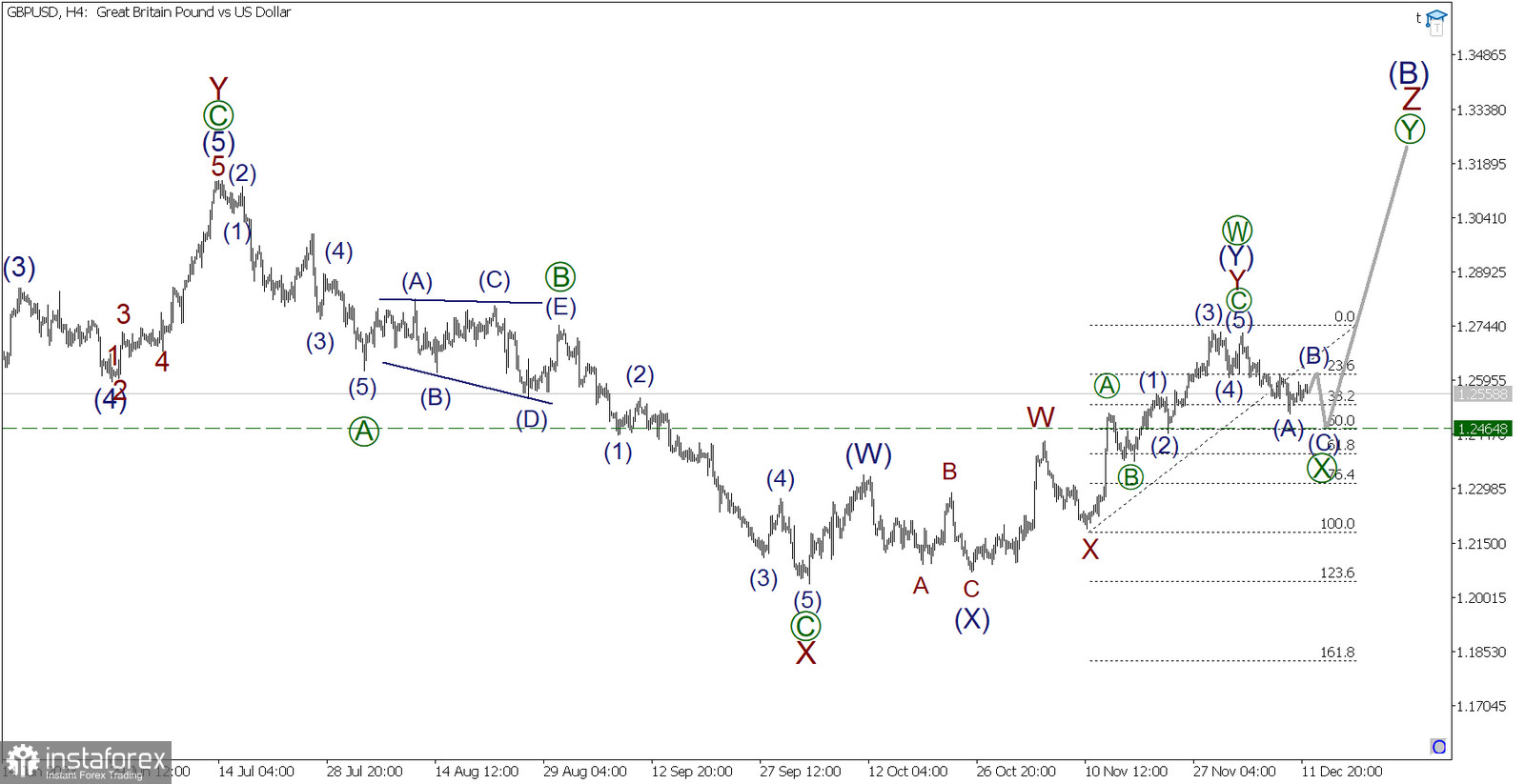

Today, let's talk about the currency pair GBP/USD. As I previously anticipated, the pair may be forming a corrective wave [X] within the ongoing bullish wave Z. Most likely, the entire wave Z will take the form of a double zigzag [W]-[X]-[Y]. So, the wave [X], judging by its internal structure, is expected to be a standard three-wave zigzag (A)-(B)-(C).

There is a high probability that the bears have already completed the construction of the impulse wave (A), so we may currently observe a price rise within the bullish corrective wave (B). The correction (B) is expected to be small in magnitude, so the downward trend may resume shortly.

The end of the entire wave [X] can be anticipated around the level of 1.2464. It is determined using Fibonacci lines. At this mark, the magnitude of [X] will be 50% of the previous active wave [W]. The probability of reaching the specified coefficient is high.

The key events in the United States and the United Kingdom this week, which are at the center of attention and may cause market volatility are: 1) the decision on the Federal Open Market Committee's interest rate on Wednesday, 2) the decision on the Bank of England's interest rate on Thursday.

Trading recommendations: Sell at 1.2577, take profit at 1.2464.