After yesterday's inflation data in the US, the Federal Reserve has a great opportunity to maintain its hawkish stance without considering market expectations. It is very likely that the committee will continue to keep interest rates high, maintaining the cost of borrowing unchanged for the third meeting in a row.

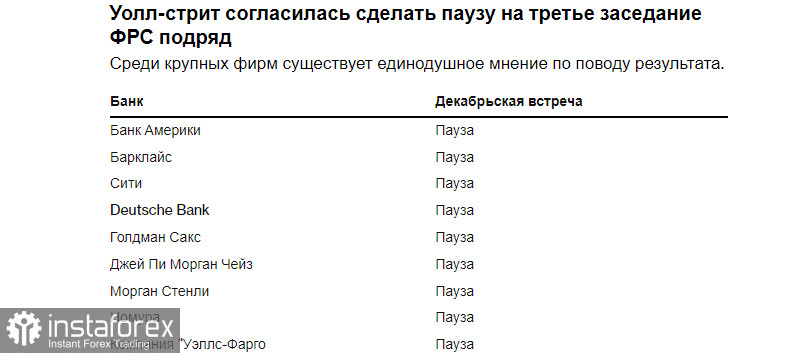

Today, the Federal Open Market Committee is expected to keep rates between 5.25% and 5.5% following its two-day policy meeting. The rate decision and accompanying statements will be released after a speech by Chairman Jerome Powell.

Recently, Powell stated that it was too early to discuss when the central bank would start lowering interest rates. Instead, the policymaker emphasized a desire to pause and assess the impact of higher borrowing costs on the economy. Interestingly, such statements have been made since this autumn. That is why the situation will hardly change today, especially amid the recent inflation figures.

Although the Federal Reserve has made progress, there is still a bit more to do to reach the target level of around 2.0%. For this reason, Wall Street will focus on the Fed officials' interest rate forecasts—the so-called dot plot—which will indicate when the committee expects to lower interest rates in 2024 and 2025. Economists predict two rate cuts next year and another five in 2025, but there is also a high degree of uncertainty. Some Fed watchers believe the FOMC plans a full percentage point cut in 2024, while others see no cuts at all.

Another important aspect is whether the committee will adjust its inflation forecasts. Economists expect the average inflation forecast for 2023 to drop to 3.1% from 3.3% in September and the preferred Federal Reserve measure of inflation (the personal consumption expenditures index) to fall to 3.5% from 3.7%.

Yesterday's US CPI report showed a rise in prices in November compared to October, driven by increased housing costs and service sector prices. These figures highlight the unstable nature of returning to the target level, as Fed Chairman Jerome Powell recently mentioned.

Economists also expect the FOMC to raise its economic growth outlook for 2023 after a very strong third quarter, with minor changes to its 2024 outlook.

Regarding FOMC statements, the Federal Reserve is likely to maintain its current interest rate recommendations, leaving the possibility of further hikes. This will be a clear bearish signal for risk assets, especially the single currency, as the European regulator is expected to adopt a softer stance, which we will learn about tomorrow.

At the press conference, Powell is likely to reiterate his view that it is premature to discuss easing monetary policy. He will probably be asked if he agrees with Fed Governor Christopher Waller, who acknowledged that the central bank would be ready to consider rate cuts if inflation continues to decrease. He will also be questioned about his views on financial conditions, including the recent drop in US Treasury yields. The Fed Chairman's responses will influence the short-term direction of the US dollar.

How risky assets will react to all this is a difficult question. A softer policy will likely lead to growth, while a tougher approach will maintain pressure on trading instruments.

Regarding the technical analysis of EUR/USD, buyers should now consider how to regain control over 1.0790. If bulls intend to take back the market, they need to reach 1.0830. From this level, reaching 1.0860 is possible, but doing so without support from major traders will be quite challenging. The final target is the peak at 1.0890. In case of a decrease, buyers will become active only around 1.0760. Otherwise, it would be wise to wait for a renewal of the 1.0725 low or to open long positions at 1.0670.

As for the prospects of the GBP/USD pair, the situation remains quite complicated in the bullish market. Only a consolidation above 1.2570 will revive the chance for a correction to 1.2610, keeping hope alive for an update of the 1.2640 high. After that, we may see a more significant surge towards 1.2690. If the pair falls, bears will try to take control over 1.2530. If they succeed, breaking this range will hit bulls' positions and push GBP/USD down to a low of 1.2500 with the potential to slide to 1.2450.