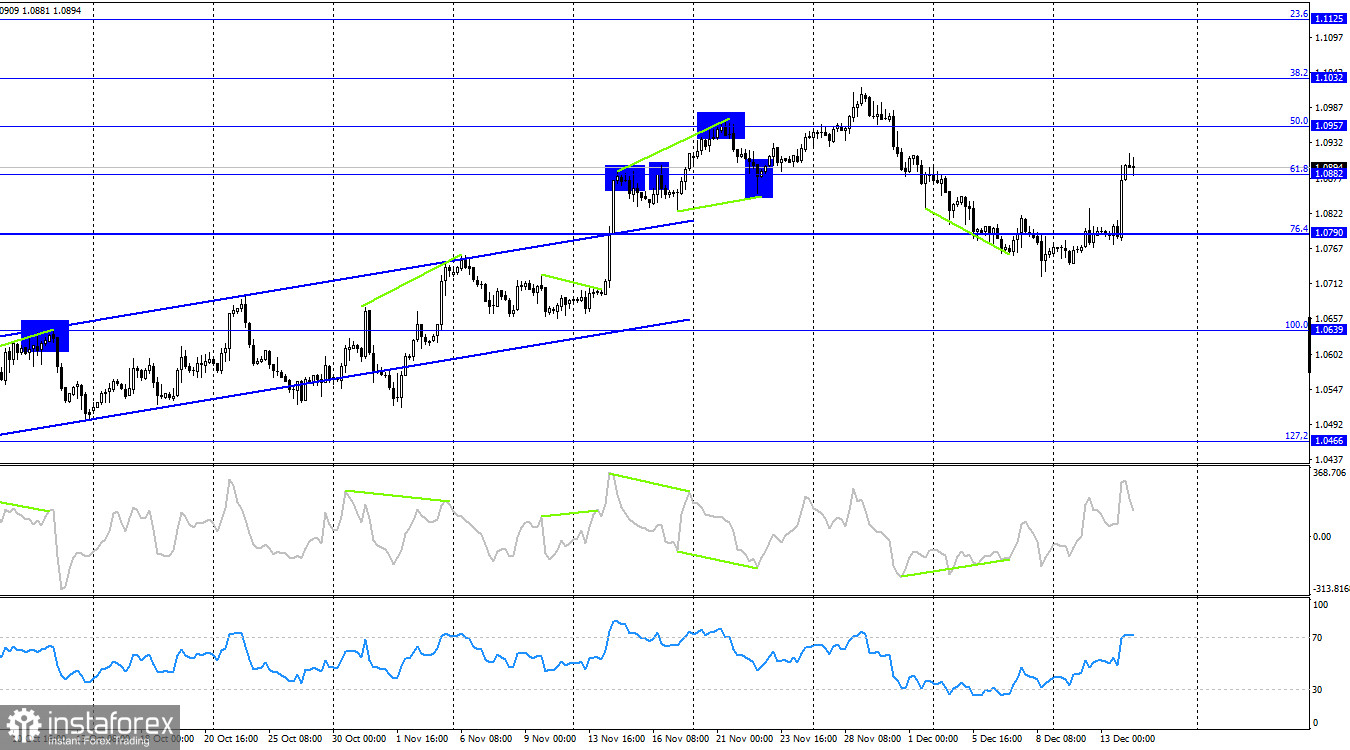

The EUR/USD pair executed a turnaround in favor of the European currency on Wednesday, demonstrating an impressive rise and consolidating above the corrective level of 50.0% (1.0862). Thus, the upward momentum may now continue toward the next Fibonacci level at 61.8% (1.0960). The reasons for such growth are not evident from an informational perspective, but there is a possibility. If the pair consolidates below the level of 1.0862, it would favor the US currency, leading to a resumption of declines towards the levels of 1.0818 and 1.0765.

The wave situation has become somewhat more complicated over the past day. The last upward wave surpassed the peak of the previous wave, thus providing the first sign of a trend change to a "bullish" one. However, yesterday's growth was triggered by an important event (the FOMC meeting), which occurs only once every one and a half months. In a way, it can be considered a singular event. Therefore, I am not yet convinced that the "bullish" trend will continue for a long time. However, most graphic indicators do support the bulls at the moment.

The key event of yesterday was the FOMC meeting. Following its results, the rate remained unchanged for the third time in a row, but Fed Chair Jerome Powell announced at the press conference a softening of the dot plot for the next year and ruled out further rate hikes. The tone of the Fed chair abruptly shifted to a "dovish" one. While Powell previously regularly spoke about the Fed's readiness to raise rates even more if necessary, this option is no longer a priority. The market reacted predictably, but, as I have already mentioned, this is just one event. For the euro to continue its rise, it will need additional background support. For example, the results of the ECB meeting will be known in a few hours, and Christine Lagarde will speak in one and a half hours. These events can trigger a decline in the euro.

On the 4-hour chart, the pair executed a turnaround in favor of the European currency, consolidating above the Fibonacci level of 61.8% (1.0882). This consolidation allows for expectations of continued growth towards the next corrective level of 50.0% (1.0957). No impending divergences are observed today from any indicators, and the ECB meeting and Christine Lagarde's speech may cause a decline in the European currency. Today, everything will depend on the information background rather than the graphic and wave picture.

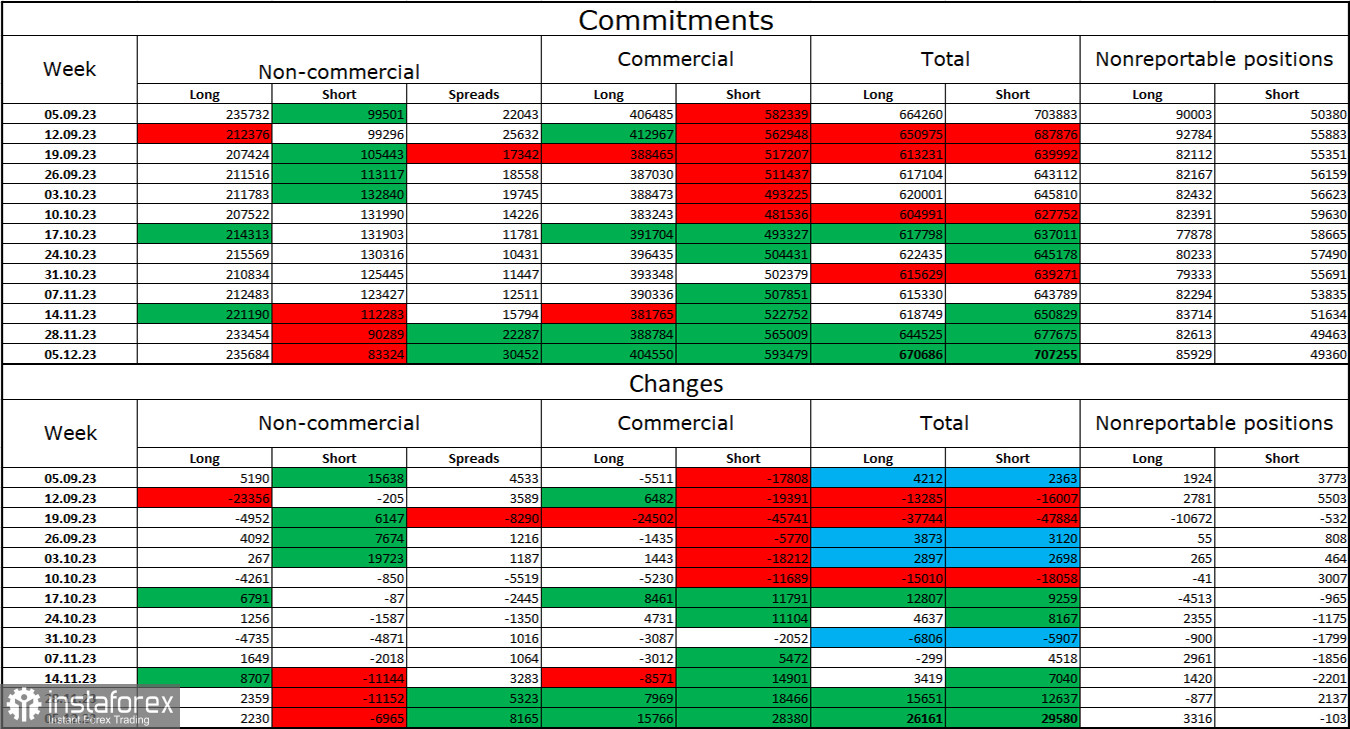

Commitments of Traders (COT) report:

During the last reporting week, speculators opened 2230 long contracts and closed 6965 short contracts. The mood of major traders remains "bullish" and is beginning to strengthen again. The total number of long contracts held by speculators is now 235 thousand, with only 83 thousand short contracts. The difference is again threefold. However, I still believe that the situation will continue to change in favor of the bears. Bulls have dominated the market for too long, and now they need a strong information background to maintain the "bullish" trend. I don't see such a background at the moment, although the situation may change after the Fed and ECB meetings. Professional traders may resume closing long positions soon. I believe that the current figures allow for a resumption of the decline in the euro in the coming months.

Economic Calendar for the United States and the European Union:

European Union - ECB Rate Decision (13:15 UTC).

United States - Retail Sales Change (13:30 UTC).

United States - Initial Jobless Claims (13:30 UTC).

European Union - ECB Press Conference (13:45 UTC).

European Union - Christine Lagarde's Speech (15:15 UTC).

On December 14, the economic events calendar contains important entries. The impact of the information background on traders' sentiment today can again be quite strong.

EUR/USD Forecast and Trader Tips:

I recommended buying the pair upon the consolidation of quotes on the hourly chart above the descending corridor with targets at 1.0818 and 1.0862. All targets have been worked out. Buy positions can be left open with a target at 1.0960, but it is essential to set a Stop Loss below 1.0862. Sales are possible today upon consolidation below 1.0862 with targets at 1.0818 and 1.0765.