No one expected significant changes in the number of initial jobless claims in the United States, and although the data differed slightly from forecasts, overall, it matched expectations. In particular, the number of initial claims, instead of increasing by 7,000, rose by 2,000. And as expected, the number of continued claims decreased by 1,000. Such results could not have pushed the euro to show solid growth. The truth is, the surprise came from the data that no one was expecting anything from, namely the US Q3 GDP data, which accelerated from 2.4% to 2.9%. However, all the preliminary estimates showed growth at 3.0%. So the market had already priced in that result. Yesterday, there was a minor adjustment in positions, precisely under the influence of new data on economic growth rates.

Today, we don't expect significant data from the EU and the US. So there shouldn't be any surprises. Therefore, the market will likely try to consolidate at the levels it reached yesterday.

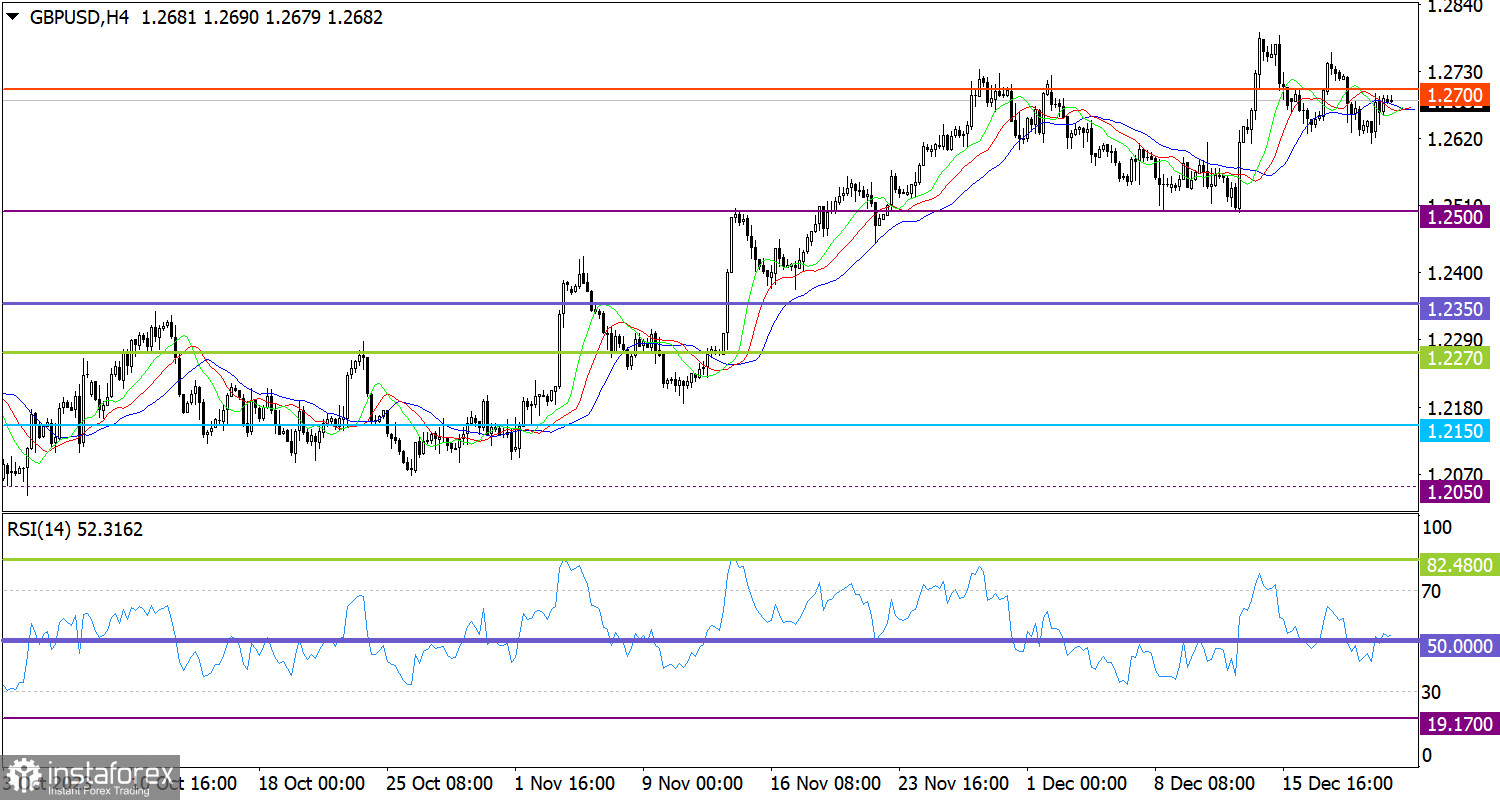

The progress of the corrective phase slowed down around the level of 1.2600. As a result, the volume of short positions decreased, providing the opportunity to bring back the quote to the level of 1.2700.

On the four-hour chart, the RSI upwardly crossed the 50 middle line, indicating an increase in the volume of long positions.

Meanwhile, the Alligator's MAs are intertwined on the 4-hour chart. This technical factor indicates a standstill in the medium-term growth cycle. In this case, the corrective phase became stagnant.

Outlook

Keeping the price above the level of 1.2700 suggests that the pound could rise towards the level of 1.2800. This will lead to extending the upward cycle.

The bearish scenario will come into play if the price stays below the level of 1.2600 with confirmation on the daily timeframe. In this case, the volume of short positions could increase when the pair moves towards 1.2500.

The comprehensive indicator analysis in the short-term period indicates the recovery process of the pound. In the intraday period, indicators signal that the downtrend will persist due to the current corrective phase.