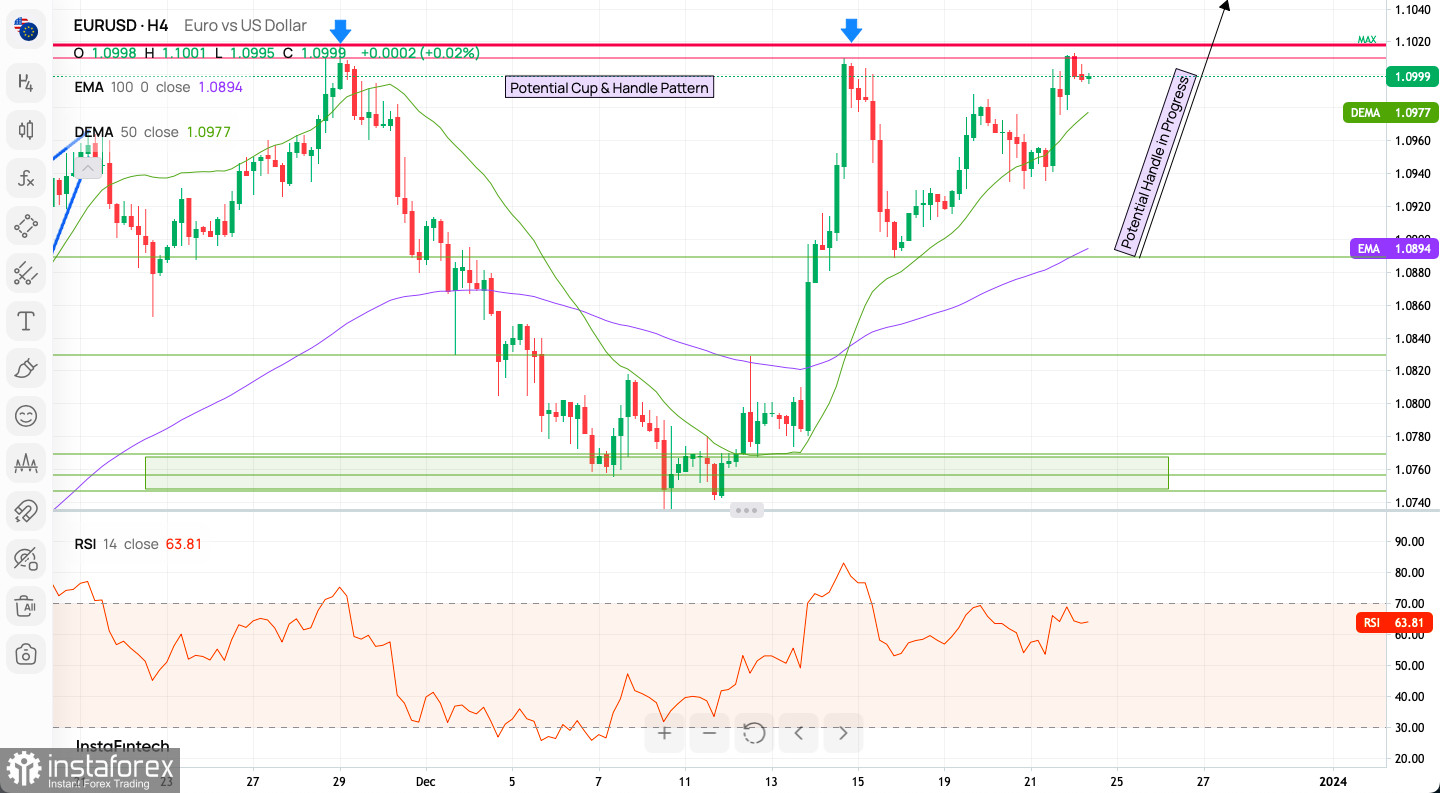

EUR/USD Aims for Breakout: Bulls Revisiting Swing Highs

The EUR/USD currency pair has shown resilience, recovering from a low of 1.0889 to approach a significant previous high at 1.1018. Observing the H4 chart reveals a Cup and Handle pattern, suggesting a potential breakout above this high. This pattern usually indicates a continuation in the existing trend. If the breakout occurs, we might see the pair aiming for 1.1310, a rise of approximately 2.66%.

In the short-term view, support is found at 1.0988 and 1.0931, while resistance lies at the recent highs of 1.1018 and 1.1010. The prevailing positive momentum signals that the bullish sentiment may continue for a while.

Weekly Pivot Points: Critical Levels to Watch

Pivot Points are crucial in determining trend reversals and support or resistance zones. For this week, they are as follows:

- Resistance 3 (WR3): 1.1289

- Resistance 2 (WR2): 1.1149

- Resistance 1 (WR1): 1.1022

- Weekly Pivot: 1.0882

- Support 1 (WS1): 1.0755

- Support 2 (WS2): 1.0615

- Support 3 (WS3): 1.0488

Long-Term Outlook: A Potential Shift

On a weekly basis, the EUR/USD pair has reversed direction after a brief venture beyond the 61% Fibonacci retracement level at 1.0963. The emergence of the Cup & Handle pattern on lower timeframes suggests a possible upward breakout. For confirmation, a weekly close above this level is necessary, potentially indicating a long-term trend shift favoring the Euro. The key support to watch is at 1.0666.

Intraday Indicator Analysis

- Buy Signals: 8 out of 22 technical indicators

- Neutral Signals: 6 indicators

- Sell Signals: 8 indicators

- Moving Averages: 11 indicate Buy, 7 indicate Sell

Market Sentiment: Leaning Bullish

The overall market sentiment is bullish, with 58% favoring a rise compared to 42% expecting a fall. This trend is consistent over the past week and the last few days.

Strategic Trading Insights

Traders should consider a long position if the Cup & Handle pattern breaks above the resistance. However, keep an eye on the RSI for signs of overbuying. Monitor for a breakout above 1.1018 to confirm the pattern's validity. Use other indicators and sentiment analysis for further confirmation. Target the 1.1310 level for long positions, but remain vigilant of market changes.

Useful Links

Important Reminder

The begginers in forex trading need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp market fluctuations due to increased volatility. If you decide to trade during the news release, then always place stop orders to minimize losses.

Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes. For successful trading, you need to have a clear trading plan and stay focues and disciplined. Spontaneous trading decision based on the current market situation is an inherently losing strategy for a scalper or daytrader.