The GBP/USD currency pair also traded higher on Thursday. The growth of the British currency this time was not strong, but we can say the same thing as in the article on EUR/USD: what difference does the strength of growth make in the context of a single day if, overall, the pound is practically constantly rising? What were, for example, the reasons for the pound's growth yesterday? The US GDP report? Let's take a closer look at it.

As it turned out, economic growth of 4.9% for the quarter is a disappointing value for the market. Let's look at the GDP value for the UK in the third quarter – 0%. In the European Union? -0.1%. Values of 0% and -0.1% did not cause a strong desire for the market to sell the pound and the euro. And did the value of +4.9% in the US cause the dollar to fall? Where is the logic here? Let's try to look at the problem from a different angle. The forecasts for the first and second estimates of the US GDP report were 4.9-5.0%. Both times, they were exceeded, which did not trigger a strengthening of the dollar. However, the market considered this value weak when the third estimate came out, which coincided with the forecast given at the beginning. We are not even discussing that yesterday's dollar decline began slightly before the report was published. But that's a detail.

Thus, no matter how you look at it, explaining why the pound is rising is still very difficult. Let's turn to monetary policy. Here, everything is the same as between the ECB and the Fed. For some reason, the market believes in an earlier transition to a "dovish" policy by the Fed than by the Bank of England. Yes, Andrew Bailey said last week that he allows for another tightening. Meanwhile, the Fed, at the same time, rejected further rate hikes. But this week, a new report on British inflation was released, showing a slowdown to 3.9%. Bailey's words are no longer relevant.

Inflation in the UK is slightly higher than inflation in the US, falling faster than in the US. Thus, in March, the Bank of England may start lowering the rate independently, as it needs to remember its economy, which is already on the verge of recession. Economic growth in the UK has been absent for six quarters, so the Bank of England needs to save its own economy and lower the rate before it is too late. However, the market is not waiting for the BOE to ease but for the Fed.

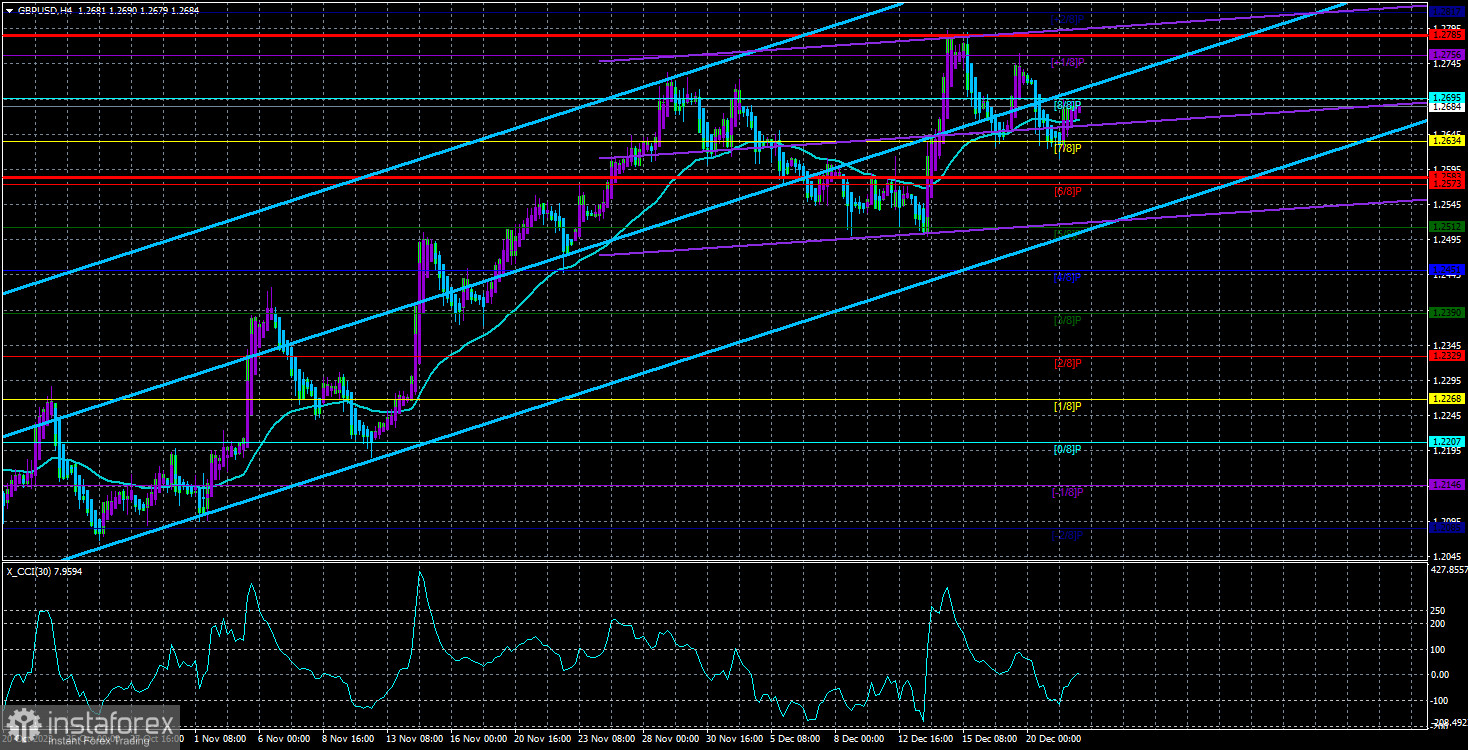

As we have said many times before, from a technical point of view, only the CCI indicator indicates the completion of the upward trend, which we still consider a simple correction. All other indicators continue to "look" up. Thus, the best decision will be to trade on the rise following the current trend. But at the same time, it should be remembered that there are practically no fundamental and macroeconomic reasons for the pound. The British currency should thank the market for its favorable attitude towards it.

Also, look at the price behavior below the moving average line. In the illustration above, which does not cover all the upward movement over the past months, we counted four consolidations below the moving average. And in each case, the pair could not go down even 100 points. That is, each new overcoming of the moving average line means nothing. The price continues to move north. Sometimes, it pauses, but then the movement resumes regardless of whether there is a reason for it or not.

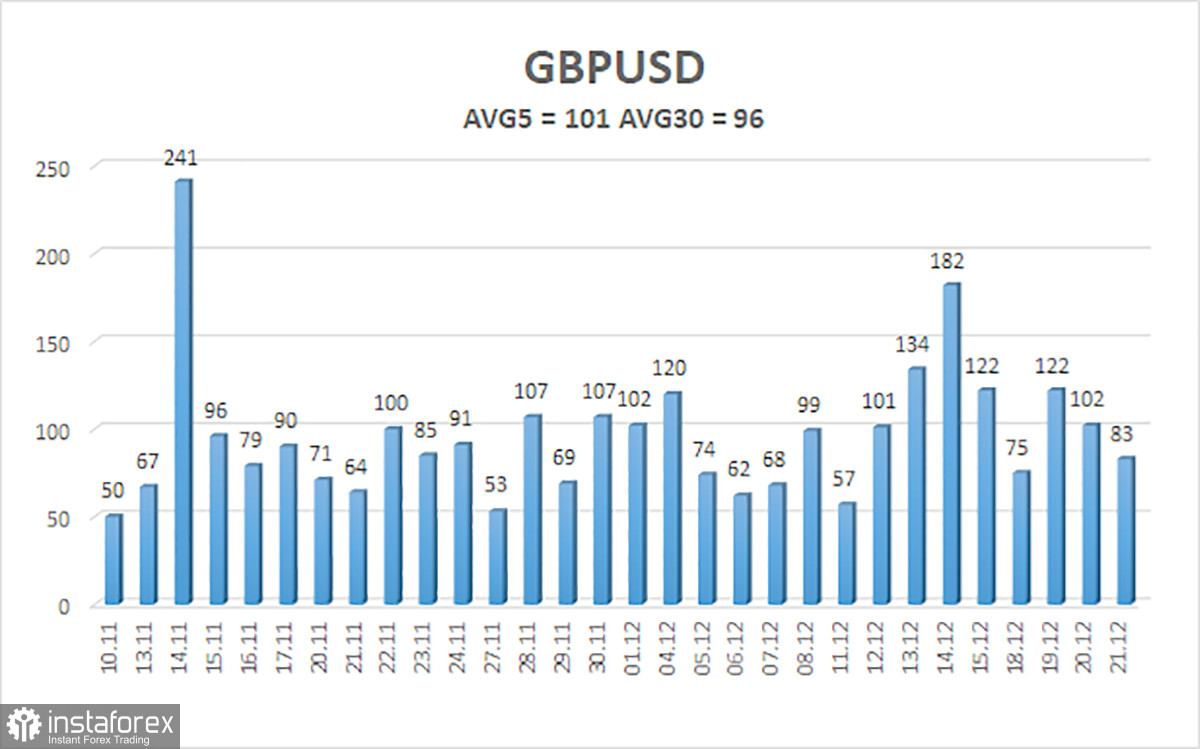

The average GBP/USD pair volatility for the last five trading days is 101 points. For the pound/dollar pair, this value is considered "high." Therefore, on Friday, December 22, we expect movements within the range limited by the levels of 1.2583 and 1.2785. A downward reversal of the Heiken Ashi indicator will indicate a new twist in the corrective movement.

Nearest support levels:

S1 – 1.2634

S2 – 1.2573

S3 – 1.2512

Nearest resistance levels:

R1 – 1.2695

R2 – 1.2756

R3 – 1.2817

Trading recommendations:

The GBP/USD pair continues to stay above the moving average line, but its growth raises many questions. For now, traders can consider long positions, but we all understand that two ultra-important events fueled last week's growth. Now, there are no growth factors for the pound. However, long positions can be maintained with targets of 1.2756 and 1.2785 until a new consolidation of the price below the moving average. Short positions will become relevant if the price consolidates below the moving average with targets at 1.2573 and 1.2512. We still believe that a decline is more likely (fourfold overbought CCI).

Explanations for the illustrations:

Linear regression channels help determine the current trend. If both are directed in the same direction, the trend is strong.

The moving average line (settings 20,0, smoothed) determines the short-term trend and direction for trading.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the probable price channel for the pair to spend the next day, based on current volatility indicators.

CCI indicator – its entry into the oversold zone (below -250) or overbought zone (above +250) indicates that a trend reversal is approaching in the opposite direction.